2023 Heavy Truck Sales Increase by 35%, Stock Market Competition Becomes Key

In 2023, the heavy truck industry entered a period of recovery and ultimately achieved a growth rate of 35.6%, which can be considered as a high growth rate achieved through the joint efforts of the entire industry. From data analysis, although the growth rate is not low, we can clearly see that this is partly due to the low sales base of the same period last year, and it is an undeniable fact that market demand has not been fully released. The direction of the heavy-duty truck market in 2024 will continue to be based on sustained recovery, and the competition for stock and increment will become more intense. Enterprises need to deeply understand the significance of high-quality development, abandon price oriented thinking, bring higher quality products to users, promote healthy and sustainable development of the industry, and lay a solid foundation for their own sustainable development.

The production and sales data released by the China Association of Automobile Manufacturers shows that in December 2023, the sales of heavy-duty trucks reached 52000 units, a month on month decrease of 26.7% and a year-on-year decrease of 3.5%. In 2023, a total of 911000 heavy-duty trucks were sold, representing a cumulative growth of 35.6%.

Existing markets and new energy heavy-duty trucks may become new hotspots

The fact that the sales volume of heavy trucks in December decreased both year-on-year and month on month indicates that the heavy truck market in 2023 has not experienced a "year-end tail up" situation. On the one hand, some dealers have already focused their efforts on achieving a "good start" in 2024, intending to "moderately and reasonably" lower sales in the last month of 2023, in order to achieve a better start in January 2024. On the other hand, it does indicate that market demand is slowly recovering, and transportation and vehicle demand have not been fully released. In addition, the proportion of new cars in the market has been relatively high before, and there has not been a cyclical peak in car replacement. Therefore, at the end of the year, there was a wait-and-see mentality among car buyers, leading to sluggish sales.

Throughout the year, the heavy-duty truck market has experienced a slow upward trend, with sales starting to slowly increase in the second quarter. Ultimately, a growth rate of 35.6% was achieved throughout the year, which can be considered as a significant achievement in the industry's joint efforts. From data analysis, this is mainly due to the low sales base in the same period last year, and it is an undeniable fact that market demand has not been fully released.

The reporter from China Commercial Vehicle Network contacted dealers in Henan, Anhui, Hebei, Guangdong and other places. Many dealers have expressed that the current market demand for incremental growth is not strong, and the demand for replacement vehicles in the existing market is not obvious, so the overall market growth rate is not strong. Many medium-sized transportation companies have a strong wait-and-see attitude, "said dealers in Henan." It is currently unlikely to change vehicles, and adding more vehicles is not considered

The popularity of natural gas trucks this year has to some extent boosted sales in the heavy truck market, "said dealers in Hebei province." As natural gas remains relatively stable for a period of time, although this driving effect may weaken, this niche area will remain hot

Regarding the market feedback on new energy heavy-duty trucks, dealers in Guangdong believe that with the increasing promotion of infrastructure construction and the increase of specific usage scenarios, pure electric or battery swapping heavy-duty trucks will also become a new growth point.

Heavy Duty Truck Cicada Joint Sales Crown Foton has a significant growth rate

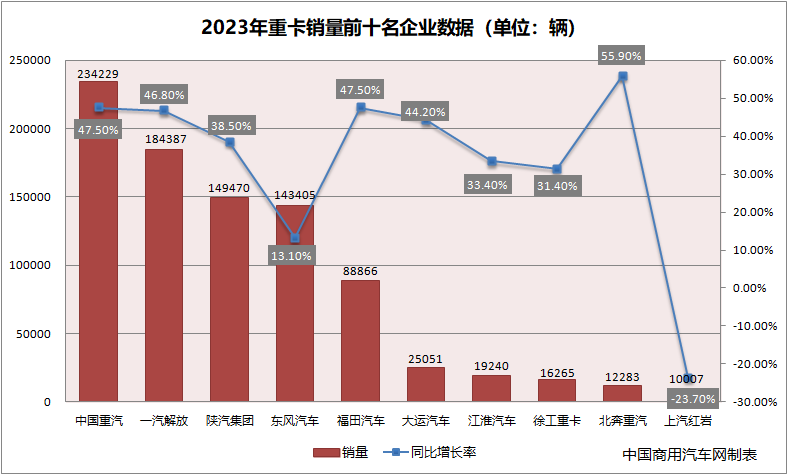

In 2023, China National Heavy Duty Truck Group sold 234229 heavy-duty trucks, a year-on-year increase of 47.5%, ranking first in the industry in terms of sales volume and winning the championship in the heavy-duty truck industry. China National Heavy Duty Truck Group (Sinotruk) adheres to the construction of product strength and marketing strength, achieving the consecutive sales champion. It is worth noting that China National Heavy Duty Truck Group not only achieved a significant sales lead, but also a leading sales growth rate, ranking second in the industry with a growth rate of 47.5%, becoming a highly valuable sales champion.

FAW Jiefang sold 184387 heavy-duty trucks, a year-on-year increase of 46.8%, ranking second in sales and third in growth rate in the industry. FAW Jiefang closely grasps industry trends, adjusts product strategies in a timely manner, and quickly launches products that meet industry demand. After the leadership adjustment, the company's development has entered a new stage, and the future development trend is more worthy of attention.

Shaanxi Automobile Group sold 149470 heavy-duty trucks, a year-on-year increase of 38.5%, ranking third in the industry in terms of sales volume, and its market position has risen accordingly.

Dongfeng Motor sold 143405 heavy-duty trucks, a year-on-year increase of 13.1%. Its annual sales ranked fourth with a gap of 6000 vehicles, and its market position fell out of the top three.

Foton Motor sold 88866 heavy-duty trucks, a rather auspicious figure that brought a year-on-year growth rate of 47.5%, ranking second in the industry with China National Heavy Duty Truck Group. Foton Motor has always been committed to breakthrough innovation in the heavy truck market, and its automatic transmission products have been widely recognized in the industry, thereby driving the industry to achieve high-quality development. At the Ecological Innovation Conference held at the end of 2023, Foton Motor once again amazed the industry, leading the direction for the development and construction of the commercial vehicle industry ecosystem.

The top five companies in the heavy truck industry in terms of sales in 2023 have a cumulative sales volume of around 100000 vehicles throughout the year, and have a significant advantage over the rear enterprises. Their comprehensive market share still remains at a level of over 85%.

Red Rock sales decline, Beiben has the largest growth rate

In 2023, Dayun Automobile sold 25051 heavy-duty trucks, a year-on-year increase of 44.2%, ranking sixth in the industry in terms of sales volume; Jianghuai Automobile will sell 19240 heavy-duty trucks in 2023, a year-on-year increase of 33.4%, ranking seventh in the industry.

XCMG Motors will sell 16265 heavy-duty trucks in 2023, a year-on-year increase of 31.4%, ranking eighth in the industry. While maintaining its market position in traditional products, XCMG has continuously broken through in the field of new energy products, effectively opening up the market situation and creating strong growth points for its own sales.

Beiben Heavy Duty Truck will sell 12283 heavy-duty trucks in 2023, a year-on-year increase of 55.9%, ranking first in the industry in terms of sales growth. However, if Beiben Heavy Duty Truck wants to maintain its current position in the fierce market competition, it still needs to make great efforts in the product side. Otherwise, products with unclear advantages will be difficult to achieve sustained sales growth in future development.

SAIC Hongyan will sell 10007 heavy-duty trucks in 2023, a year-on-year decrease of 23.7%, making it the only company among the top ten to experience a decline in sales. In January 2024, SAIC Hongyan held its annual business meeting and set an annual sales target of 30000 vehicles for 2024. Compared to the achievement of 10000 vehicles in 2023, in order to achieve the sales target, SAIC Hongyan needs to achieve a high-speed growth rate of 200%. This is a very difficult challenge for SAIC Hongyan, which has just overcome inventory pressure and has not yet gained market recognition for its product strength. SAIC Hongyan needs to recognize its own shortcomings, identify problems, and solve them, otherwise the sales target will become empty talk.

The year 2023, which marks the beginning of the recovery period in the heavy-duty truck industry, has passed. The market trend in 2024 will continue to be based on sustained recovery, and the competition for stock and increment will become more intense. Enterprises need to deeply understand the significance of high-quality development, abandon price oriented thinking, bring higher quality products to users, promote the healthy and sustainable development of the industry, and lay a solid foundation for their own sustainable development.

Article source: Reprinted from China Commercial Vehicle Network