January diesel engine has a great start! Weichai Double First Cloud Soars 143%, Dongkang Enters Sixth Place for the First Time

In January 2024, the diesel engine market welcomes a "good start"! A significant increase of 54%.

In January 2024, unlike previous years when the same period was affected by the Spring Festival, the diesel engine market welcomed a significant increase at the beginning of the year. Both year-on-year and month on month growth trends have been observed, marking the sixth consecutive increase in the diesel engine market since July 2023, providing a reassurance for the diesel engine market in 2024.

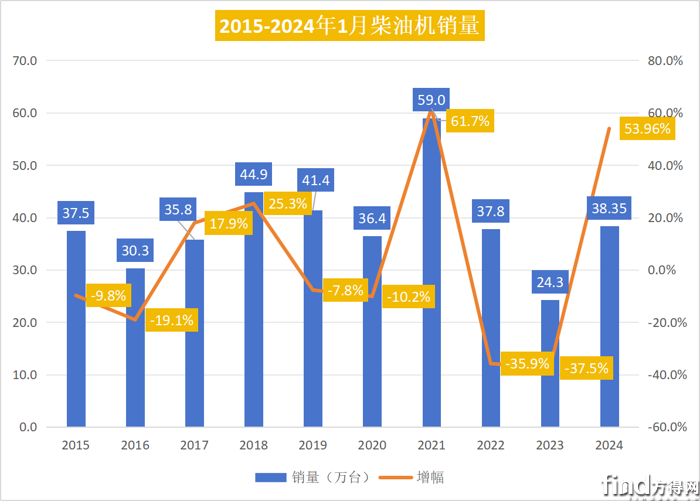

According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in January 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) reached 383500 units, a year-on-year increase of 53.96% and a month on month increase of 12.6%.

How will companies perform at the beginning of 2024? What changes have occurred in the ranking of enterprises?

01

Annual sales of 383500 units in January 2024

Ranked second in five years

In January 2024, the diesel engine market started the year with a "booming" trend, with sales increasing by 12.6% month on month and 54% year-on-year, continuing to expand.

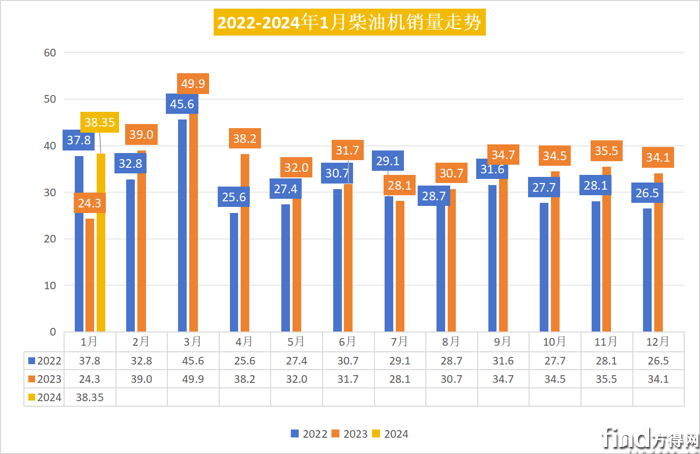

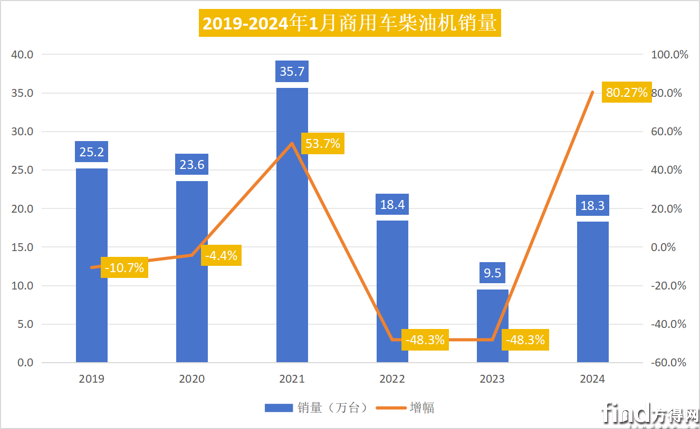

In 2024, diesel engines entered a growth mode from January, with monthly sales ranking second in the past five years. From the monthly sales trend chart of 2022-2023 in the table below, it can be seen that the monthly sales in January 2024 are also quite high in the past two years.

In January 2024, the diesel engine market continued its growth momentum from the second half of 2023. According to Fangde.com analysis, the sales growth of diesel engines in January 2024 can be attributed to the following reasons: firstly, the base for January 2023 was relatively low, and its monthly sales were the lowest point of the year. In January 2024, the diesel engine market was driven by factors such as pre holiday promotions by many businesses and year-end sales surges.

Secondly, in 2024, both the commercial vehicle and truck markets will grow without exception, and it is reasonable for the diesel engine market to be affected and grow. From the overall market perspective, in the three major truck segments of heavy, medium, and light commercial vehicles in January 2024, heavy trucks saw a year-on-year increase of 98%, light trucks saw a year-on-year growth of 82%, and the overall commercial vehicle market also grew by over 80%.

Looking at the sales and growth trend chart of diesel engines in January of the past 10 years, it can be seen that the average monthly sales in January were around 370000 units, with the highest sales in 2021 at 590000 units and 383500 units in January 2024, ranking second in the past five years but lower than the pre pandemic period of 2018-2019.

From the perspective of various segmented markets, the demand for end markets such as construction machinery and agricultural machinery is growing. In January, the sales volume of multi cylinder diesel engines for construction machinery was 79700 units, an increase of 15.71% month on month and 40.28% year-on-year. The top ten sellers are New Diesel, Weichai, Quanchai, Yunnei, Yuchai, Dongkang, Caterpillar, Jiefang Power, Guangkang, and Shangchai, accounting for 96.55% of their total sales.

The growth in January 2024 is actually expected, and many diesel engine companies have made predictions about the market situation in 2024 at their annual meetings. In 2024, many companies in the industry predict that the commercial vehicle market will continue to recover, with heavy trucks growing by 10% and medium and light trucks growing by 5% -7%. The diesel engine market, which is closely related to this trend, will also follow this trend.

In 2024, the diesel engine market will face both opportunities and challenges, with a clear overall recovery trend. It will still take time to return to pre pandemic levels.

02

Weichai Cliff Leads, Yuchai Increases by 68.7%

The Liberation Leap Forward, led by two Eastern Kangs, entered the sixth place

In January 2024, there was a significant change in the ranking of the top five.

The top five diesel engine companies in January 2023 are Weichai, Yuchai, Yunnei, Quanchai, and Jiangling.

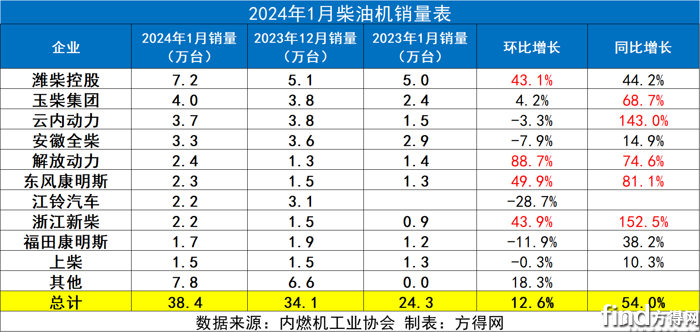

In January 2024, Weichai ranked among the top five diesel engines, leading the way with sales of 72000 units.

Due to the highest growth rate of heavy-duty and light-duty trucks in commercial vehicles, diesel engine companies that mainly assemble these models have been significantly affected.

Yuchai ranks second in the industry with a sales volume of 40000 units, a year-on-year increase of 68%. In terms of sales volume, in January 2024, five of the top ten companies in the diesel engine market saw month on month growth. Among them, Weichai, Jiefang, Dongfeng Cummins, and Xinchai had higher growth rates than the industry, outperforming the overall market.

Compared to the same period last year, all ten companies achieved positive growth, among which Yunnei Power saw a year-on-year increase of 143%, making it the company with the highest monthly industry growth rate.

In January 2024, Quanchai ranked fourth in the industry, with a year-on-year growth of 14.9%. Quanchai's Zhiwei H25 engine is a 2.5-liter, four valve engine jointly developed by Quanchai, Ricciardo, Tiannei, and Bosch, with a maximum power of 126kW and a maximum torque potential of 500N. m. It can output 390N. m at low speeds and high torque (1000r/min), and is highly favored by users in urban transportation, greenways, and cold chains, providing support for its success.

Quanchai Zhiwei H25

Among the top five companies, there is also a 'strong player' who has entered, and this company is Liberation Power. In January 2024, Jiefang Power jumped two places and entered the top five in the industry, with a month on month growth of 88.7%, the highest in the industry.

It is worth mentioning that Dongfeng Cummins entered the top six in the industry for the first time in January, with year-on-year and month on month growth rates higher than the overall market.

In January 2024, only Weichai had over 70000 units in the diesel engine industry; There are three companies that have exceeded 30000 units: Yuchai, Yunnei, and Quanchai. More than 20000 units are sold by companies such as Jiefang Power, Dongfeng Cummins, Jiangling Motors, and Xinchai, with a small sales gap. Enterprises with around 15000 units include Shangchai and Foton Cummins.

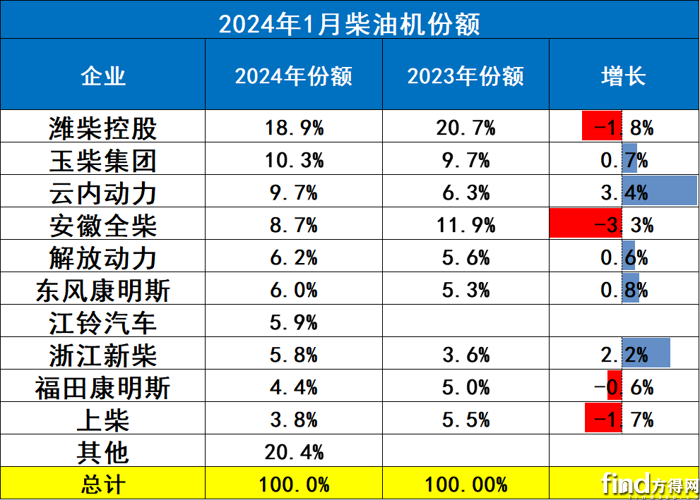

From the perspective of enterprise share proportion, in January 2024, Weichai dominated the industry with a market share of 18.9%, making it the only company in the industry with a market share exceeding 15%. Yuchai is one of the companies with a market share exceeding 10%, among which Yunnei's market share increased by 3.4% year-on-year, with the highest growth rate. Liberation, Dongkang, and others have achieved slight growth in market share.

In 2024, the proportion of the top ten companies in the industry (79.5%) has slightly increased compared to last year. Similarly, the share of the top five diesel engine companies (53.72%) has decreased compared to last year (54.14%), which means that the "cake" of the top five companies has been divided by the bottom, and new forces have entered to seize the original share of the top ten diesel engine companies.

03

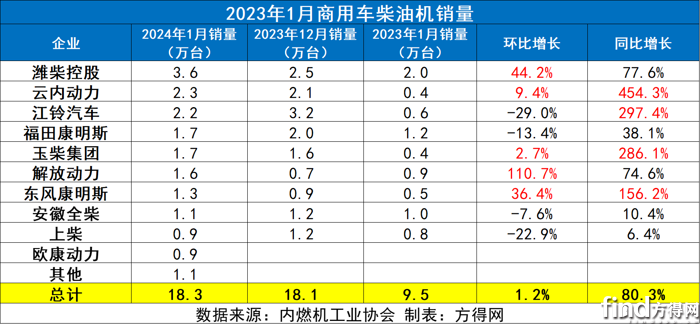

Commercial vehicle diesel engines skyrocket by 80%

Cloud internal increased by 454% year-on-year

In 2024, the growth rate of the commercial vehicle diesel engine market will be even greater, with sales increasing by over 80%.

With the high growth of the commercial vehicle market and the approaching Spring Festival holiday, the demand for enterprise promotion has been continuously released. In addition, due to factors such as holidays and policy changes in the same period last year, the growth rate of multi cylinder diesel engines in commercial vehicles is even more significant.

In January 2024, all of the top ten companies in the commercial vehicle diesel engine market achieved positive growth, with four companies surpassing industry growth and the largest growth rate reaching 454%.

From a month on month perspective, Weichai, Yunnei, Yuchai, Dongfeng Cummins, and Jiefang Power achieved positive growth, with Jiefang Power increasing by 110% month on month, doubling.

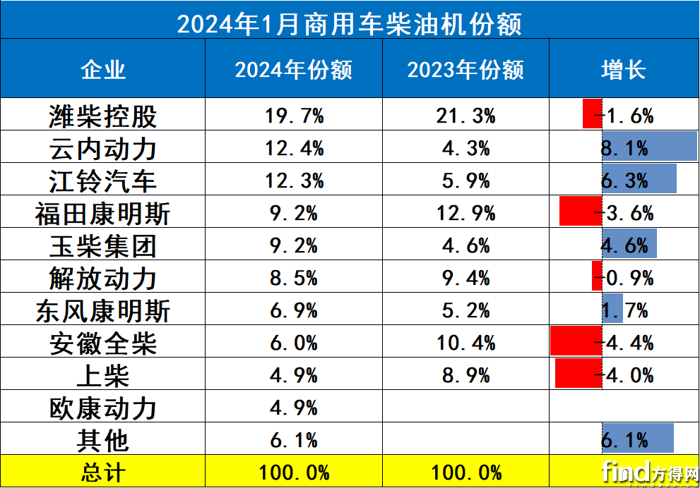

In January 2024, the ranking of the commercial vehicle diesel engine market did not change significantly. In January 2023, the top five commercial vehicle diesel engine companies were Weichai, Fukang, Jiefang, Shangchai, and Jiangling. In January 2024, the top five are Weichai, Yunnei, Jiangling, Fukang, and Yuchai. Within a year, Yunnei ranked second and Jiangling advanced one place.

In January 2024, Weichai was the only company in the commercial vehicle diesel engine market with over 30000 units; Enterprises with over 20000 units include Yunnei and Jiangling, while Fukang, Yuchai, and Jiefang have a very small sales gap and fierce competition.

In terms of market share, the top ten sellers are Weichai, Yunnei, Jiangling, Fukang, Yuchai, Jiefang Power, Dongkang, Quanchai, Shangchai, and Oukang Power, with their top ten sales accounting for 93.94% of the total sales; Weichai holds a leading market share of 19.70% in the commercial vehicle multi cylinder diesel engine market, followed by Yunnei 12.37%, Jiangling 12.26%, Fukang 9.23%, Yuchai 9.20%, Jiefang Power 8.52%, Dongkang 6.93%, Quanchai 5.96%, Shangchai 4.93%, and Oukang Power 4.85%.

Among them, 4 enterprises achieved an increase in market share, with the highest growth rate of 8.1% in cloud market share.

In January 2024, the top five commercial vehicle diesel engine companies had a share of 62.76%, and in January 2023, the top five companies had a share of 62.84%, almost unchanged year-on-year and slightly lower than in 2023, but the ranking of the top five companies shifted significantly. The share of the top ten companies is higher than that of January 2023, indicating an increase in their control over the industry, but the latter companies frequently switch positions.

Overall, the sales figures for January are not indicative, but it can be seen that in 2024, the competition in the diesel engine market will enter a "race for positions" period, and the dominance of a single company will gradually move towards multiple strengths. With the acceleration of the phase out process of National IV diesel vehicles in 2024 and the explosive growth of the natural gas segment market, there are still opportunities in the diesel engine market.

Many diesel engine companies have predicted that the commercial vehicle market and even the diesel engine market will continue to recover in 2024, but the trend of new energy is irreversible.

In 2024, the development of diesel engine enterprises will not only depend on whether the industry is rising, but also on whose "barrel" has fewer shortcomings and a more comprehensive layout. Who can seize the opportunity to seize territory? Worth looking forward to.