Weichai sales crown, Yuchai increased by 22%, Dongkang's growth rate ranks first in the industry! Diesel engines may exceed 1 million units in the first quarter

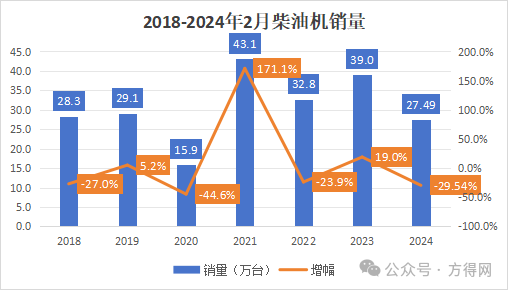

Diesel engines ended their six-month consecutive rise in February, with a year-on-year decrease of 29.5%.

In February 2024, with the year-on-year decline in multiple segments of the commercial vehicle market, the diesel engine market experienced its first year-on-year decline.

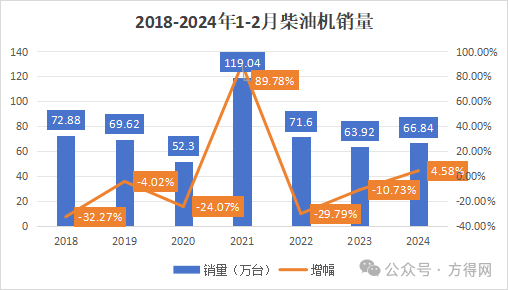

According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in February 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) reached 274900 units, a year-on-year decrease of 29.54% and a month on month decrease of 30.16%. The cumulative sales volume was 668400 units, a slight increase of 4.58% year-on-year.

How did each of the top ten companies perform in this environment? What changes have occurred in the ranking of enterprises?

01

Diesel engines welcome a 'turning point' in February

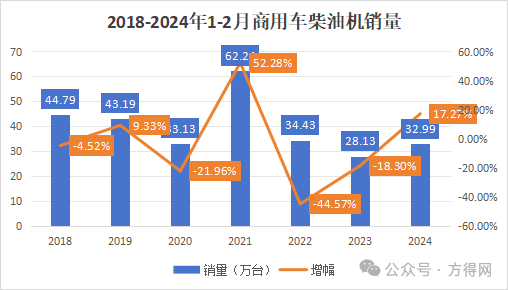

Ranked sixth in sales over the past seven years

In February 2024, the diesel engine market ended its continuous upward trend since August 2023, with a year-on-year decline of 29.54%, which is consistent with the trend of the commercial vehicle market and even the truck market.

As can be seen from the above figure, the overall trend from 2022 to 2023 is characterized by a "high in the beginning and low in the end" trend. The sales volume in the first quarter, especially from February to March, gradually increased, reaching its peak in March, and remained stable in the second three quarters.

The same trend will occur at the beginning of 2024, but the difference is that the high sales in February 2024 are different from previous years.

The year-on-year decline in sales in February 2024 is due to the Chinese New Year and factory holidays in various regions, which have had varying degrees of impact on sales and production capacity.

Due to the holidays in 2023 and 2024 being in different months, it is difficult to compare monthly data and cannot reflect the true situation. The Spring Festival in 2024 falls in February, with fewer effective working days and some demand released before the holiday, resulting in a month on month and year-on-year decline in diesel engine sales in February.

Secondly, in the segmented market, construction machinery continues to decline. According to data from the China Construction Machinery Industry Association, excavator sales in February decreased by about 40% year-on-year. Similarly, according to the latest terminal registration data, the cumulative actual sales of mixer trucks in February 2023 were 1107 units, a decrease of 36% compared to 1729 units in February last year. In addition, the current sluggish real estate market and inadequate investment in some infrastructure projects have affected its diesel engine market sales.

In February, the sales volume of multi cylinder diesel engines for construction machinery was 49800 units, a month on month increase of -37.51% and a year-on-year increase of 42.30%; The cumulative sales volume from January to February was 129500 units, a year-on-year increase of 9.52%. The top ten sellers are New Diesel, Weichai, Quanchai, Yuchai, Yunnei, Dongkang, Caterpillar, Guangkang, Shanghai New Power, and Jiefang Power, accounting for 97.08% of their total sales.

Looking at the sales and growth trend chart of diesel engines in January and February of the past seven years, it can be seen that the average cumulative sales are around 700000 units, with the lowest year being in 2020. Due to the impact of the epidemic, the diesel engine market has almost "stagnated", with sales of 520000 units. Looking at the sales in January and February 2024 over the years, it is not only lower than the pre epidemic period of 2018-2019, but also lower than last year, ranking sixth.

According to the trend of previous years, March at the beginning of the year will be the highest point of monthly sales for the whole year. In the first quarter of 2024, influenced by economic recovery and policy promotion, diesel engine sales are expected to reach 400000 to 450000 units in March, and are expected to exceed 1 million units in the first quarter.

02

Weichai leads Yuchai's super industry growth

Dongkang's growth rate ranks first in the industry

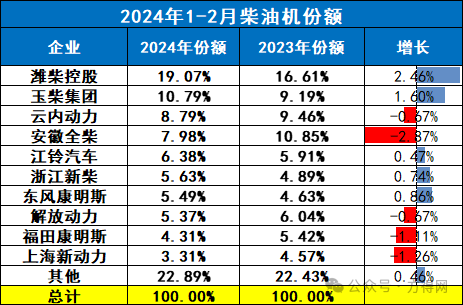

In February 2024, there was little change in the ranking of the diesel engine market, with the top five still locked in Weichai, Yuchai, Yunnei, Jiangling, and Quanchai. Among them, Yuchai ranks second.

From the perspective of monthly sales, the average monthly sales of the top five diesel engine companies in February 2024 have decreased compared to February 2023, with the highest monthly sales exceeding 55100 units. However, companies with sales exceeding 40000 units have disappeared, and there are four companies with sales exceeding 20000 units. The difference between 3, 4, and 5 is very small.

Among the top ten companies in the diesel engine market, 10 companies have no year-on-year growth, while Weichai, Yuchai, and Dongkang have lower declines than the industry. On a month on month basis, all employees showed negative growth, while Weichai, Yuchai, Jiangling, Xinchai, and Fukang had lower month on month declines than the industry.

In terms of cumulative sales, diesel engine sales in January and February 2024 were slightly higher than the same period last year. Only Weichai has exceeded 100000 units in the industry, with a year-on-year increase of 20.06%, making it the top selling enterprise among the top five companies. Enterprises with over 50000 units include Yuchai, Yunnei, and Quanchai; Enterprises that have exceeded 30000 units include Jiangling Motors, Xinchai, Dongkang, and Jiefang Power; There are two companies with around 20000 units, Fukang and Shangchai.

From January to February 2024, the company with the highest cumulative growth rate is Dongfeng Cummins. At the beginning of 2024, Dongfeng Cummins' integrated power chain is highly favored by users in the high-power heavy-duty truck market, and the star combination of Yingdong AMT and Dongkang Z13 all core helps customers operate efficiently.

From the perspective of enterprise share, in February 2024, Weichai dominated the industry with a market share of 19.07%, making it the only company in the industry with a market share exceeding 19%. There is one company with a market share exceeding 10%, Yuchai, among which Weichai's market share increased by 2.46% year-on-year, the highest growth rate. Yunnei accounts for 8.79%, while Quanchai accounts for 7.98%. The gap between Dongkang and Jiefang is relatively small, while Yuchai, Jiangling, Xinchai, and Dongkang have all achieved slight growth in market share.

In February 2024, the proportion of the top ten companies in the industry (77.12%) slightly decreased compared to last year (77.57%). However, the share of the top five diesel engine companies increased compared to last year, which means that the strong players in the top five companies will always be strong, and new forces in the bottom will enter, making the competition for positions more intense.

03

Commercial vehicle diesel engines only grow at Weichai

Top three in the cloud

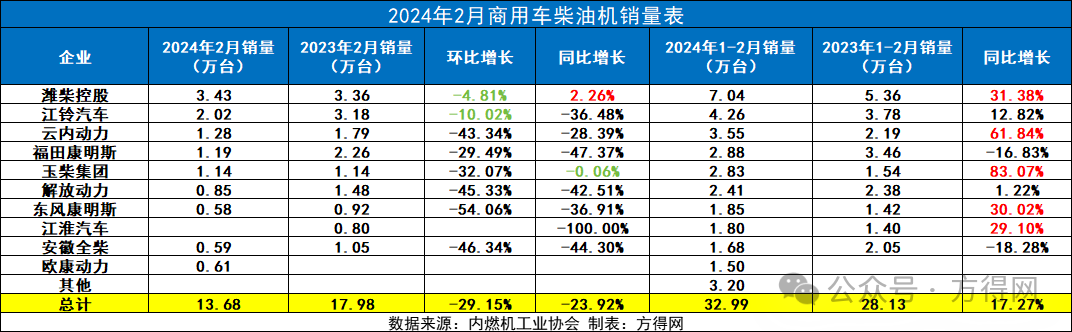

In February 2024, the commercial vehicle diesel engine market also ended its consecutive rise.

Not only is it lower than before the pandemic in 2018 and 2019, but it also ranks 6th in monthly sales within 7 years. This is consistent with the trend of the commercial vehicle and even truck markets.

In February 2024, China's commercial vehicle market decreased by 22.5% year-on-year and 22.6% month on month. Among them, heavy trucks experienced a double decline on a month on month basis, with a decrease of 22.5% and 38.3% respectively, while light trucks also saw a decrease of 35.5%. The decline in diesel engines was higher than that of the commercial vehicle market, on par with the heavy truck market, but lower than that of the light truck market.

From a month on month perspective, in February 2024, the top ten companies in the commercial vehicle diesel engine market achieved varying degrees of month on month decline, with Weichai and Jiangling experiencing lower month on month declines than the industry.

From a year-on-year perspective, only Weichai saw growth, while Yuchai experienced a lower decline compared to the industry.

In January and February 2024, Weichai will have a sales volume of over 70000 units in the commercial vehicle diesel engine market; Jiangling Motors has over 40000 units; Yunnei, Fukang, Yuchai, and Jiefang Power have exceeded 20000 units; The top ten have all sold over 10000 units.

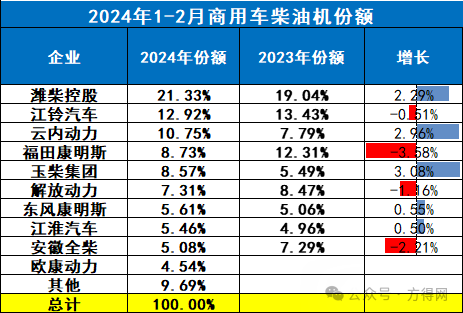

In terms of market share, the top ten sellers are Weichai, Jiangling, Yunnei, Fukang, Yuchai, Jiefang Power, Dongkang, Jianghuai, Quanchai, and Oukang Power, with the top ten accounting for 90.31% of total sales; Weichai holds a leading market share of 21.33% in the commercial vehicle multi cylinder diesel engine market, followed by Jiangling 12.92%, Yunnei 10.75%, Fukang 8.73%, Yuchai 8.57%, Jiefang Power 7.31%, Dongkang 5.61%, Jianghuai 5.46%, Quanchai 5.08%, and Oukang 4.54%.

Among them, 5 companies achieved an increase in market share, with Yuchai experiencing the highest growth rate of 3.08%.

In January February 2024, the top five commercial vehicle diesel engine companies had a share of 62.3%, and in January February 2023, the top five companies had a share of 61.04%, a year-on-year increase of 1.26%. Weichai and Yunnei's share increased.

In February 2024, the "late spring cold" in the commercial vehicle market affected the diesel engine market. The sales level in February 2024 has been at the bottom of the list for the past seven months of February.

But there is still hope for the first quarter of 2024, as March has always been the peak of sales for the whole year. We look forward to the performance of various companies in March and what kind of tone it can set for the whole year. According to previous sales forecasts, the sales volume in the first quarter can reach one million units.