In February, light trucks underperformed the market, who was eroded? Who rose to prominence again?

According to the production and sales data released by the China Association of Automobile Manufacturers in February, the truck market was as sluggish as expected due to the impact of the "Spring Festival month". The overall sales fell to 215000 units, a double decrease compared to the same period last year. Among the four major categories of trucks, only micro trucks were not affected by the market and showed a good trend of counter trend growth, while the sales of the other three categories of trucks all showed varying degrees of decline.

Among them, light trucks have performed poorly this month. Among the four major types of trucks, from a month on month perspective, light trucks are only better than heavy trucks, not as good as micro trucks and medium trucks, and have not outperformed the overall truck market; From a year-on-year perspective, light trucks have the worst performance. Even if the perspective is extended to the cumulative sales volume dimension of the first two months of this year, the performance of the light truck market is far inferior to the other three types of trucks, and there is also a significant gap with the overall truck market.

So, how did the light truck market perform in February? Please refer to the production and sales data analysis brought by commercial vehicle news media.

February

On the same month, there was a double decrease, and one company saw a significant increase against the trend

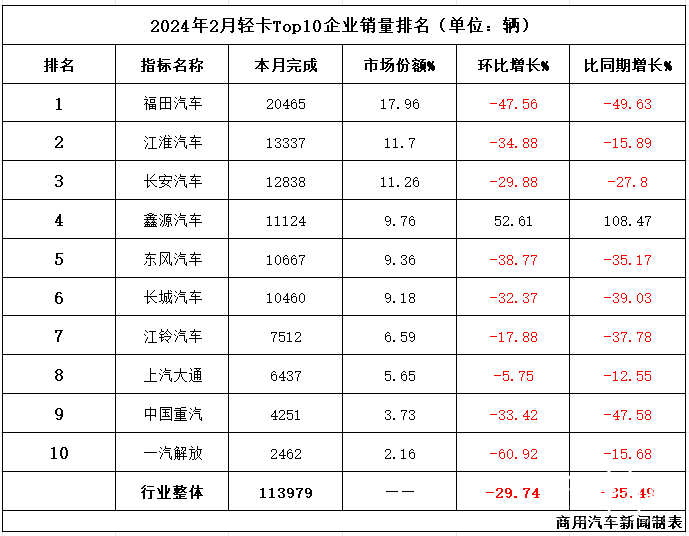

According to data from the China Association of Automobile Manufacturers, the sales volume of light trucks in February was 114000 units, a month on month decrease of 29.74% and a year-on-year decrease of 35.49%. Compared with last month, the month on month decline continues to widen, while the year-on-year increase has shifted from a significant increase to a significant decrease. However, the year-on-year performance is mainly due to the impact of the Spring Festival holiday (last year's Spring Festival was in January, this year it was in February), so the month on month performance is more valuable for reference.

From the performance of the top 10 companies, in February, with a month on month increase of 1 and a decrease of 9, only three companies outperformed the industry, namely Xinyuan Automobile, SAIC Maxus, and Jiangling Motors; Compared to the same period last year, there were also "1 increase and 9 decreases", with 6 companies outperforming the industry, namely Xinyuan Automobile, SAIC Maxus, FAW Jiefang, Jianghuai Automobile, Changan Automobile, and Dongfeng Motor.

This month, the following characteristics of the light truck market are worth paying attention to:

The "dark horse" Xinyuan Automobile has strong momentum. In February, Xinyuan Automobile unexpectedly climbed to fourth place on the Top10 list, breaking its best record in history. Moreover, it is the only company to achieve positive growth, leading the top 10 in both year-on-year and month on month increases. In fact, Xinyuan Automobile has always played a "crane tail" role in the top 10 light truck rankings, and even months with poor performance cannot squeeze into the list. However, based on the cumulative sales volume for the whole year of 2023, Xinyuan Automobile has maintained its position as the tenth place in the Top 10. In January of this year, it continued to make efforts and rose to seventh place, and in February, it surged to fourth place, showing strong momentum. Its subsequent performance is worth paying attention to.

Jianghuai Automobile maintains its second place. In February, Jianghuai Light Truck maintained its position as the second place in the Top 10, and the sales gap with the first place narrowed significantly compared to the previous month, setting a good start for the market performance for the whole year of 2024.

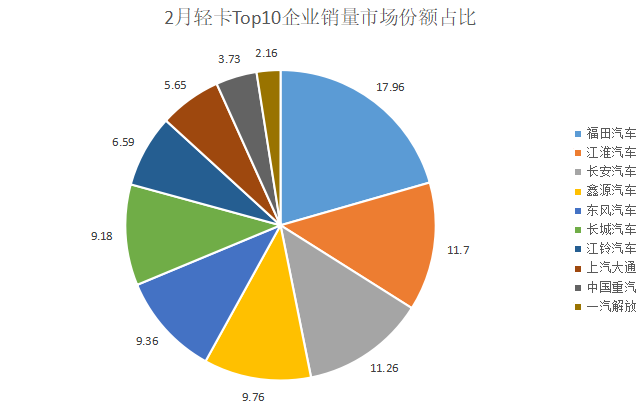

In terms of market share, in February, the top 10 companies in the light truck market had a market share of 87.35%, a decrease of 3.06 percentage points from the previous month, indicating a decrease in market concentration.

1-2 months

276000 vehicles, a slight increase of 3.92% year-on-year

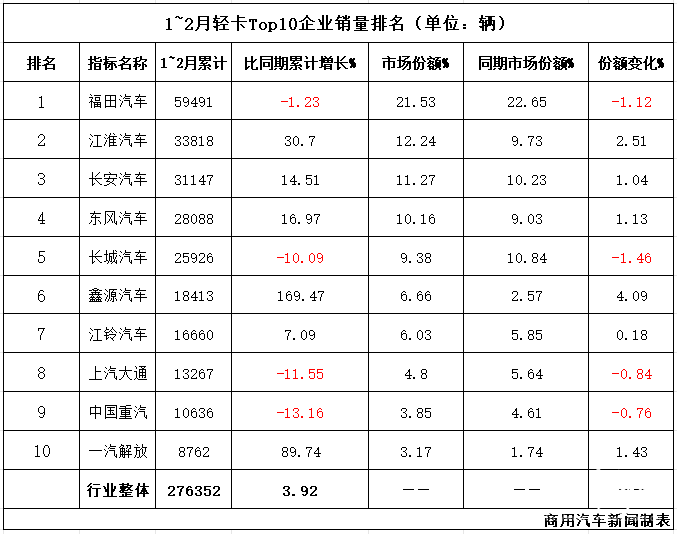

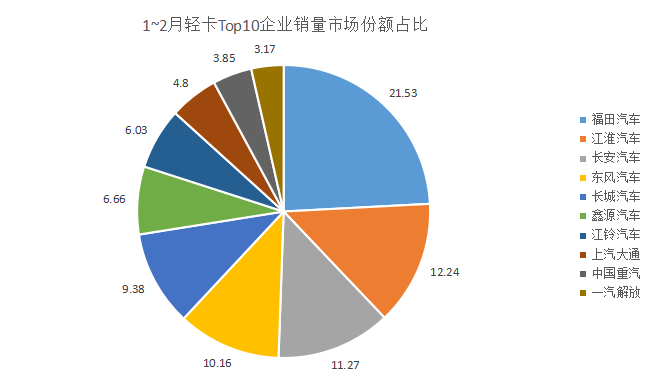

From the perspective of cumulative sales volume, the light truck market sold a total of 276000 vehicles from January to February, with a cumulative year-on-year increase of 3.92%. Although affected by the Spring Festival holiday, the cumulative sales of light trucks have maintained positive growth, indicating that the market is still in a state of recovery.

Compared with the same period last year, from January to February this year, among the top 10 companies in the light truck market, there was a year-on-year increase of 6 and a decrease of 4. Against the backdrop of a slight year-on-year increase of 3.92% in the industry, all six companies with positive growth have outperformed the industry, while China National Heavy Duty Truck Group, SAIC Maxus, Great Wall Motors, and Foton Motor have failed to keep up with the pace of industry growth. It is worth noting that among the four negative growth companies, SAIC Maxus and Great Wall Motors both rely on pickup trucks as their sales backbone, indicating poor performance in the pickup truck segment market this month.

In terms of market share, compared with the same period last year, from January to February this year, 6 out of the top 10 companies in the light truck market achieved positive growth in share, namely Xinyuan Automobile increased by 4.09%, Jianghuai Automobile increased by 2.51%, FAW Jiefang increased by 1.43%, Dongfeng Motor increased by 1.13%, Changan Automobile increased by 1.04%, and Jiangling Motors increased by 0.18%. Xinyuan Automobile's market share led the top 10 gains.

The light truck market, due to its largest size, has always been a focus of competition for truck manufacturers, and due to its wide coverage of application scenarios, it is expected to have a larger share of the market. For example, micro trucks competing upwards, light and micro trucks competing across borders, and various new energy light vehicles emerging due to their road rights advantages... In short, the light truck market is constantly adjusting under various impacts, and the industry landscape is also changing frequently. Apart from traditional giants with stable foundations, the ranking at the bottom of the Top10 list is not stable, and the competition among various companies is also quite fierce.

In 2024, as the national economy stabilizes and improves, how will the light truck market develop under the comprehensive influence of various factors? Can the upcoming "Golden Three Silver Four" drive the market volume of light trucks?