Who is the most profitable engine company by quarter?

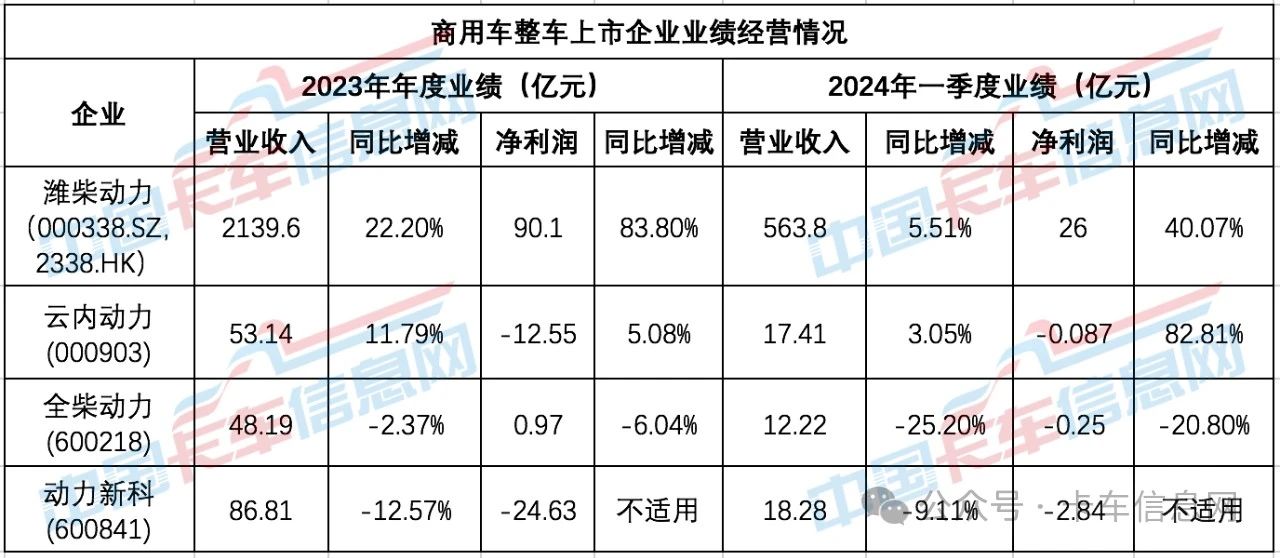

Recently, four engine listed companies including Weichai Power, Yunnei Power, Quanchai Power, and Power New Technology released their 2023 annual reports and 2024 first quarter reports.

Based on the annual performance in 2023, Weichai Power has the highest revenue and net profit among the four engine companies. Quanchai Power's net profit was 97 million yuan, Power New Technology suffered a loss of 2.463 billion yuan in 2023, and Yunnei Power suffered a loss of 1.255 billion yuan in 2023.

From the first quarter performance of 2024, Weichai Power's revenue and net profit are also the highest among the four engine companies. The other three companies are all losing money.

Weichai Power

Achieved revenue of 56.38 billion yuan in the first quarter

Net profit of 2.6 billion yuan

Continue to explore the high-end market in 2024

Strengthen the control of overseas industries

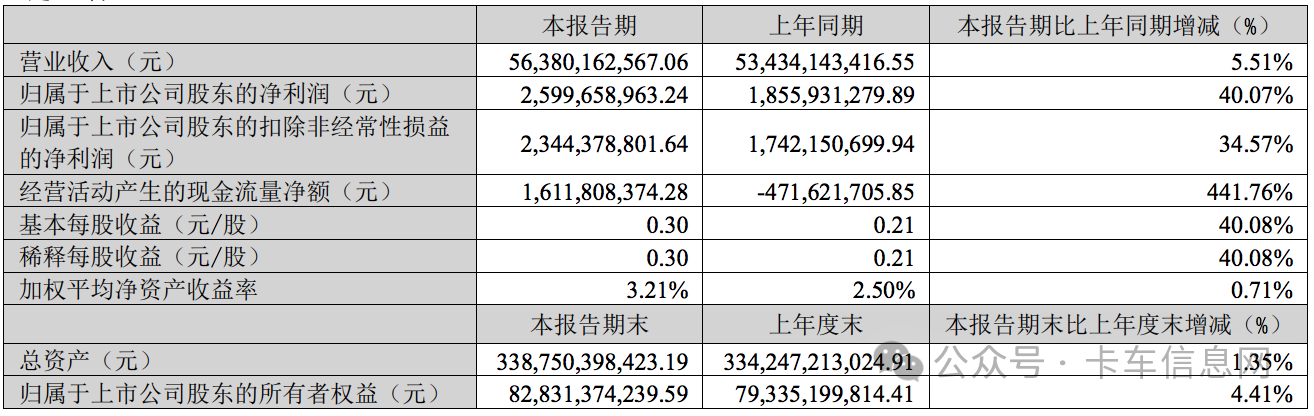

In 2023, Weichai Power (000338. SZ, 2338. HK) achieved a revenue of RMB 213.96 billion, a year-on-year increase of 22.2%; The net profit attributable to the shareholders of the parent company was RMB 9.01 billion, a year-on-year increase of 83.8%; Basic earnings per share of RMB 1.04, a year-on-year increase of 84.5%; Persist in creating good returns for shareholders, maintain a high dividend policy, and increase the cash dividend ratio to 50% for the whole year of 2023.

In the first quarter of 2024, Weichai Power achieved a revenue of 56.38 billion yuan, a year-on-year increase of 5.51%; Achieve a net profit of 2.6 billion yuan, a year-on-year increase of 40.07%; Basic earnings per share of 0.30 yuan; The weighted average return on equity (ROE) is 3.21%.

In 2024, Weichai Power is expected to generate sales revenue of approximately RMB 224.7-235.4 billion, an overall increase of approximately 5% -10% compared to 2023.

In 2024, Weichai Power's investment projects will focus on improving research and development testing capabilities, enhancing product quality, hydraulic powertrain, new energy product development and mass production, marine equipment manufacturing, artificial intelligence, and other aspects.

In 2024, Weichai Power will continue to adhere to innovation driven, deeply cultivate segmented markets, and enhance the core competitive advantages of product technology; Deepen structural adjustment, explore high-end markets, and further enhance profitability; Strengthen overseas industrial control and make every effort to achieve a historic leap in exports; Continuously improving management level, activating the internal driving force of the enterprise, leading the high-quality development of the industry, creating greater value for shareholders, and contributing Weichai's strength to society.

Cloud Power

Achieved operating revenue of 1.741 billion yuan in the first quarter

Net profit -86.762 million yuan

In 2024, the installation of heavy-duty cards will be expanded

Accelerate the matching and installation of micro cards and small cards in gasoline engine products

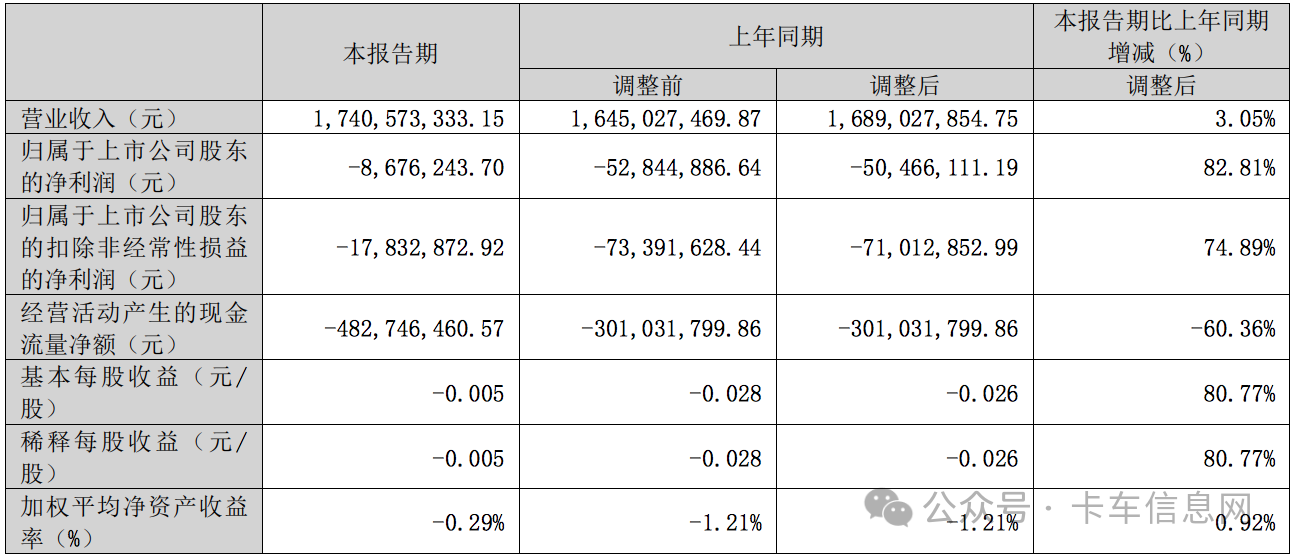

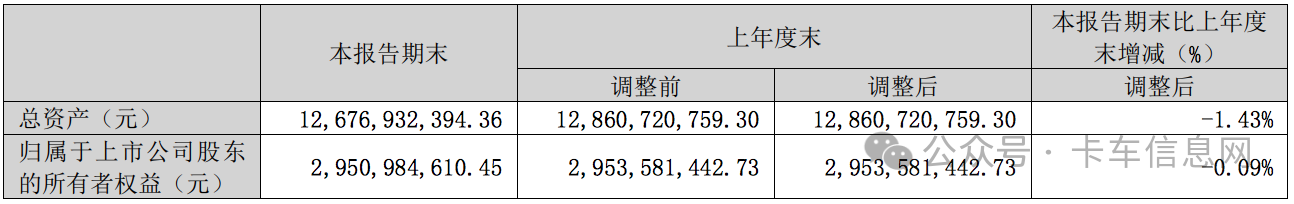

In 2023, Yunnei Power (000903) achieved a revenue of 5.314 billion yuan, a year-on-year increase of 11.79%; Achieve a net profit of -1.255 billion yuan, a year-on-year increase of 5.08%; Basic earnings per share -0.64 yuan.

In the first quarter of 2024, Yunnei Power achieved a revenue of 1.741 billion yuan, a year-on-year increase of 3.05%; Achieve a net profit of -86.762 million yuan, a year-on-year increase of 82.81%; Basic earnings per share -0.005 yuan.

In 2024, Yunnei Power will focus on strengthening its strengths and addressing its weaknesses.

In terms of automotive diesel engines, we will seize opportunities such as national policies and market changes, develop a "one factory, one policy" marketing strategy and brand differentiation promotion plan, and comprehensively promote the expansion of the independent and controllable automotive product market by using a good product portfolio. At the same time, while stabilizing the basic market, we will expand upward consumption, expand the installation of heavy-duty trucks, actively promote the mass production progress of fully autonomous and controllable automotive products in various host factories, and ensure that diesel engine sales exceed the industry average growth rate.

In terms of non road diesel engines: increase the proportion of installed capacity in the current stock market and achieve strategic transformation, realize the transformation of the company's traditional business to a large horsepower factory, fully utilize platform resources, accelerate the expansion of new markets and businesses such as agricultural machinery, fixed power sector, and international exports, and strengthen the advantages in the non road sector. Achieve breakthroughs in the new energy and power market through non road means.

In terms of automotive gasoline engines: On the basis of stabilizing the existing market, accelerate the matching and installation of micro and small trucks in the company's gasoline engine products, accelerate the mass production progress of gasoline engine extended range hybrid engines in light truck models, and gradually expand to cold chain logistics, engineering dump and other vehicle models.

In terms of new energy powertrain: fully improve the product layout of the new energy sector, seize the potential market of hybrid products, accelerate the development of gasoline engine extended range powertrain, natural gas extended range powertrain, hydrogen fuel cell powertrain, accelerate the layout of plug-in hybrid power and other products, and achieve significant breakthroughs in the new energy market.

In terms of international market: seize the opportunities brought by the opening of the China Laos railway to China's position as the largest export market in ASEAN, the RCEP coming into effect, the Xinjiang Free Trade Experimental Zone, and the opening of Northeast ports. Based on countries and regions in Southeast Asia, Africa, South America, and the Middle East, and on the basis of continuously increasing the volume export of the company's products with complete vehicles or trading companies, actively explore the "direct international market" to boost the company's business development in the international markets for vehicles and non roads.

All diesel power

Achieved a revenue of 1.222 billion yuan in the first quarter

Net profit of 25.362 million yuan

In 2023, Quanchai Power (600218) achieved a revenue of 4.819 billion yuan, a year-on-year decrease of 2.37%, a net profit attributable to shareholders of 97.22 million yuan, a year-on-year decrease of 6.04%, a net cash flow generated from operating activities of 120 million yuan, a year-on-year decrease of 69.25%, and an asset liability ratio of 47.27%, a year-on-year increase of 3.16 percentage points.

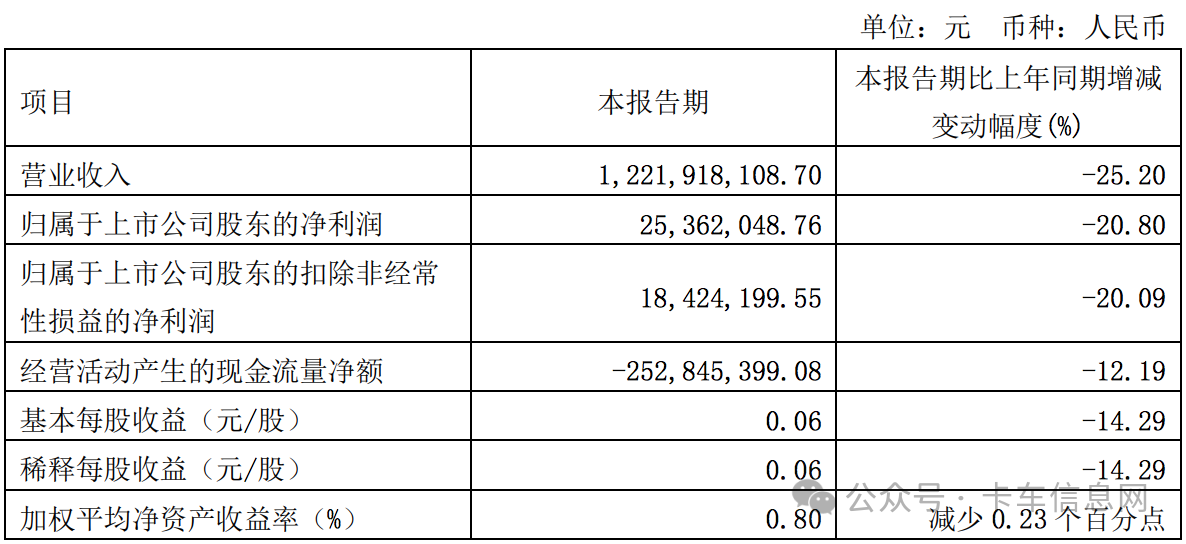

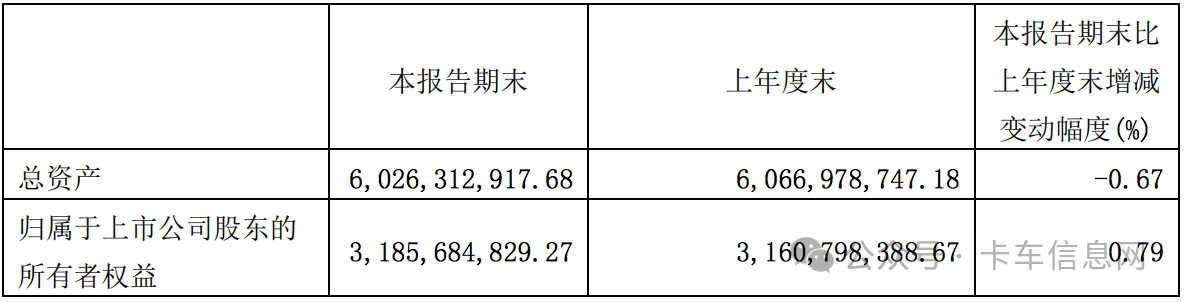

In the first quarter of 2024, Quanchai Power achieved a revenue of 1.222 billion yuan, a year-on-year decrease of 25.20%; Achieve a net profit of 25.362 million yuan, a year-on-year decrease of 20.80%; Basic earnings per share of 0.06 yuan; The weighted average return on equity (ROE) is 0.80%.

New Power Technology

Achieved a revenue of 31.4918 million yuan in the first quarter

Net profit of -162.256 million yuan

Focus on the segmented market of new energy heavy-duty trucks in 2024

Continuously iterating and developing new car models

In 2023, Power New Technology (600841) achieved a revenue of 8.681 billion yuan, a year-on-year decrease of 12.57%, a net profit attributable to the parent company of -2.463 billion yuan, a year-on-year increase of 52.81% in losses, a net cash flow generated from operating activities of 283 million yuan, and an asset liability ratio of 69.50%, a year-on-year increase of 5.49 percentage points.

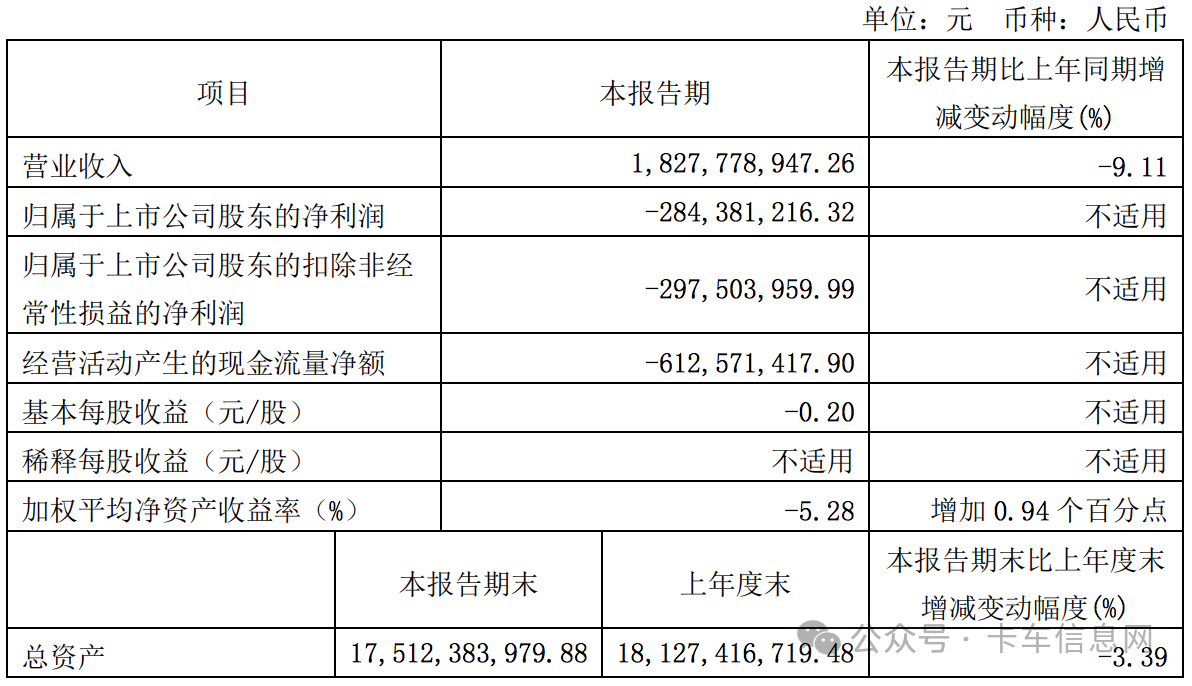

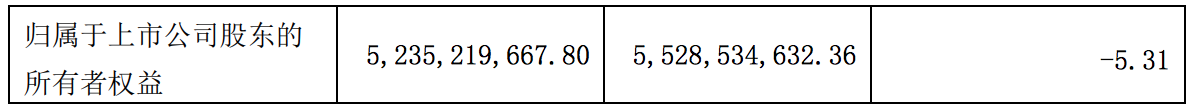

In the first quarter of 2024, Power New Technology achieved a revenue of 1.828 billion yuan, a year-on-year decrease of 9.11%; Achieve a net profit of 284 million yuan; Basic earnings per share -0.20 yuan.

In 2024, Power New Technology expects the domestic macro economy to continue to rebound and improve. The company will seize market opportunities, strive to increase sales in domestic and overseas markets, improve efficiency, control costs, and strengthen capabilities, striving to achieve sales of 191500 diesel engines and 20000 heavy trucks throughout the year, with a total operating income of 13.168 billion yuan.

In terms of diesel engine business, Yunnei Power further consolidates and enhances its competitive position in the industrial, agricultural, and marine power markets, focusing on sales breakthroughs in markets such as excavators, loaders, harvesters, power station data centers, and inland transport ships, seizing opportunities in overseas markets, accelerating overseas network construction, and achieving sales growth targets; Deeply cultivate and focus on our main business, diversify and innovate, complete the mass production of Xuzhong 130T and 200T truck crane hybrid projects, continue to promote intelligent networking projects, and enhance product development capabilities and innovation.

In terms of heavy truck business, we will continue to expand overseas marketing channels, focus on the segmented market of new energy heavy trucks, transform business models, and strive to achieve the target of year-on-year sales growth; Continuously iterate and develop new car models to increase the contribution rate of new product sales. Accelerate the research and development of new generation heavy-duty trucks to enhance product competitiveness.

Article source: Reprinted from Truck Information Network