Weichai leads the way with over 40000 units, soaring 73% in the cloud. Jianghuai enters the first seven months, with commercial vehicle diesel engines increasing by 5% in April

Will the diesel engine market experience a downturn in April? Both month on month and year-on-year have turned negative!

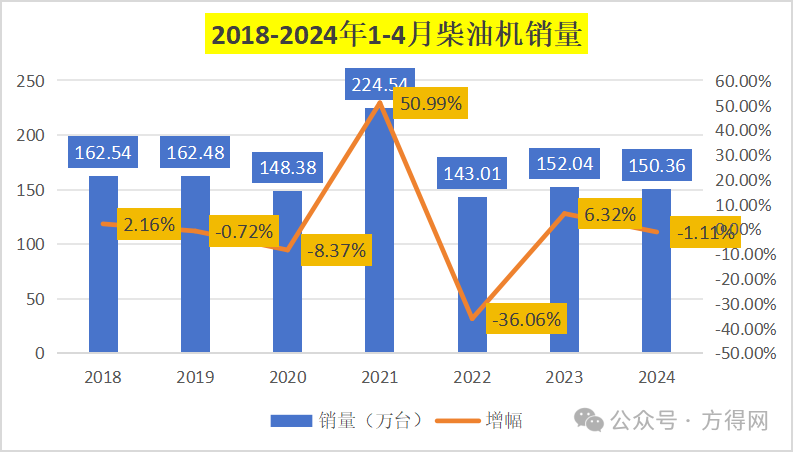

In April, the commercial vehicle market and even the truck market achieved varying degrees of growth, but the diesel engine market went against the norm. In April 2024, diesel engine sales decreased slightly by 1.02% year-on-year and 17.28% month on month.

According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in April 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) were 378100 units, a year-on-year decrease of 1.02% and a month on month decrease of 17.28%,; The cumulative sales volume from January to April was 1.5236 million units, a year-on-year decrease of 1.1%.

Although the commercial vehicle diesel engine market has declined month on month, it is higher than the overall market year-on-year, and the cumulative sales are also higher than the same period last year.

In this context, what are the performances of various diesel engine companies?

01

April month on month decline

Accumulated sales turn negative again in 2024

In April 2024, after reaching its peak in March, the diesel engine market declined year-on-year and also turned negative month on month.

This is consistent with Fang Dewang's previous prediction that the growth of the diesel engine market has "hidden dangers" and "difficulty in sustainability".

As can be seen from the above chart, the trend of the diesel engine market began to decline after reaching its peak in March over the past two years, and remained stable at around 300000 units from April to August. It can be predicted that the trend in the second quarter will also be a stable downward trend.

As an attribute of production materials, commercial vehicles are highly related to macroeconomic, infrastructure investment, real estate investment and other factors. The sales situation in the engineering and other markets is still relatively severe, and April to August is also a traditional off-season, making market recovery more difficult.

In April 2024, the commercial vehicle market saw a year-on-year growth of 3%. In the three major truck segments of heavy, medium, and light, heavy trucks saw a slight decrease of 1%, while light trucks saw a year-on-year growth of 3.8%. Compared to the overall market, the year-on-year growth of the diesel engine market is lower than the overall market and lower than the light truck market.

Looking at the sales and growth trend chart of diesel engines in April over the past 7 years, it can be seen that the average monthly sales in April were around 400000 units, with the lowest year being April 2023, the lowest point in 7 years, and April 2024 ranking second to last in 7 years.

From the perspective of various segmented markets, after the beginning of 2024, the real estate market will continue to be sluggish, and most construction projects will still be in a state of suspension, making the construction machinery diesel engine market still severe. In April, the sales volume of multi cylinder diesel engines for construction machinery was 80300 units, a month on month increase of -15.52% and a year-on-year increase of 5.38%; The cumulative sales volume from January to April was 304800 units, a year-on-year increase of -7.72%.

In terms of cumulative sales, from January to April 2024, the cumulative sales of diesel engines were 1.5036 million units, ranking fifth in the past seven years. In 2019 before the epidemic, the sales volume of diesel engines from January to April was 1.6248 million units. In 2024, the sales volume of diesel engines from January to April was about 120000 units less than the average year, and efforts are still needed to return to before the epidemic.

02

Weichai Double Growth

Cloud grows by 28%, ranking first in the industry

In April 2024, four of the top ten companies in the diesel engine market showed positive growth, with Weichai, Yuchai, Yunnei, and Jiangling achieving growth rates surpassing the industry. Among them, Yunnei saw a year-on-year increase of 28% in April, becoming the enterprise with the highest growth in April.

From the perspective of competitive landscape, in April 2023, the top five diesel engine companies were Weichai, Yuchai, Quanchai, Xinchai, and Yunnei, while in April 2024, the top five companies were Weichai, Yuchai, Yunnei, Quanchai, and Jiangling. During the year, Weichai remained in first place, Yuchai closely followed, Yunnei took third place, and Jiangling advanced to the top five.

In terms of sales, in April 2024, Weichai was the only company with monthly sales exceeding 70000 units; Yuchai sold 43100 units; Cloud sales reached 33400 units, while total diesel sales reached 31600 units. Jiangling Motors and new cars both sell over 20000 units per month; The top ten companies have monthly sales exceeding 10000 units.

Compared to last month, the total number of employees in 10 companies decreased month on month, with Weichai, Yuchai, Jiangling, and Shangchai experiencing lower declines than the overall market. Among them, Shangchai Huan had the lowest decline compared to last month.

In terms of cumulative sales, from January to April 2024, only Weichai exceeded 270000 units among the top ten companies. There are four companies with over 100000 units, namely Yuchai, Yunnei, Quanchai, and Jiangling; Following closely behind are 93800 units of new diesel, while Liberation and Dongkang both have around 70000 units, with a difference of no more than a thousand units; Fukang and Shangchai have both sold over 50000 units cumulatively.

From the perspective of enterprise share, Weichai has been leading the industry from January to April 2024, accounting for 18.52% of the market share and the only company in the industry with a market share exceeding 18%. There is only one company, Yuchai, with a market share exceeding 10%. Among them, Weichai's market share increased by 2.33% year-on-year, the highest growth rate in the industry. Yuchai, Yunnei, Jiangling, and Dongkang all achieved slight growth in market share.

From January to April 2024, the proportion of the top ten companies in the industry (77.14%) decreased compared to last year (77.24%), while the proportion of the top five companies (53.68%) also increased compared to last year (51.15%). This means that the top five companies are always strong, while the top ten diesel engine companies are eyeing the top ten market share, and the last five companies frequently switch positions.

03

Commercial vehicle diesel engines slightly increased by 5.19%

Jianghuai and Dongkang compete for seventh place

In April 2024, the commercial vehicle market experienced a higher growth rate than the multi cylinder diesel engine market, surging by 60%.

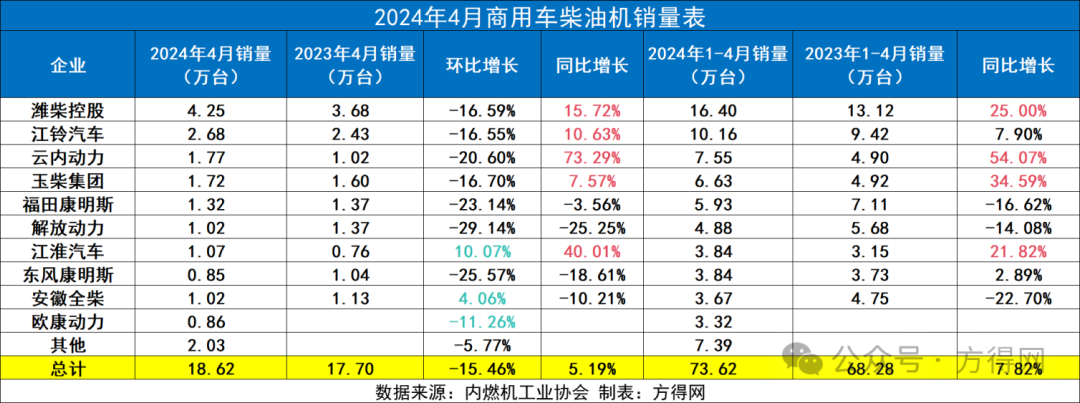

The trend of the commercial vehicle diesel engine market is consistent with that of the commercial vehicle market, with a further expansion in year-on-year growth and a decline in month on month growth. The monthly sales volume of commercial vehicle diesel engines in April was 186200 units, a year-on-year increase of 5.19%, and the cumulative sales volume increased by 7.82% year-on-year, which was narrower compared to the previous month.

Although the year-on-year and cumulative growth in April were both positive, the month on month decline suggests that the trend in the second quarter may also be downward. In the past 7 years, the sales of commercial vehicle diesel engines in April have also ranked relatively low, with a significant gap compared to 2018-2019 before the epidemic.

From January to April 2024, the sales volume of commercial vehicles in the market was 1.39 million units, and the sales volume of commercial vehicle diesel engines was 736200 units. In 2023, the sales volume of commercial vehicles in the market was 1.286 million units, and the sales volume of commercial vehicle diesel engines was 652800 units, with a 2% increase in assembly ratio. Although the new energy market is currently booming, commercial vehicles equipped with diesel engines still dominate, and the process of replacing diesel engines with new energy may not be as fast as imagined.

In April 2024, the top ten companies in the commercial vehicle diesel engine market all experienced a month on month decline, with Jianghuai, Quanchai, and Oukang experiencing lower declines than the industry.

In April 2024, Weichai had the highest sales volume in the commercial vehicle diesel engine market, with a monthly sales volume of 42500 units, ranking first in the industry. Jiangling sold 26800 units per month; Yunnei, Yuchai, Fukang, Jiefang, Jianghuai, and Quanchai all have over 10000 units. Five out of ten companies achieved positive growth year-on-year, with Weichai, Jiangling, Yunnei, Yuchai, and Jianghuai surpassing the overall market in terms of growth, and Yunnei growing by over 70%, leading the industry.

From January to April, the top ten sellers of multi cylinder diesel engines for commercial vehicles were Weichai, Jiangling, Yunnei, Yuchai, Fukang, Jiefang Power, Jianghuai, Dongkang, Quanchai, and Oukang Power, accounting for 89.96% of total sales; Weichai holds a leading market share of 22.27% in the multi cylinder diesel engine market for commercial vehicles, followed by Jiangling Motors at 13.80%, Yunnei at 10.26%, Yuchai at 9.00%, Fukang at 8.05%, Jiefang Power at 6.63%, Jianghuai at 5.22%, Dongkang at 5.22%, Quanchai at 4.99%, and Oukang at 4.51%.

From January to April 2024, the top five commercial vehicle diesel engine companies accounted for 63.38% of the market share, and by March 2023, the top five companies accounted for 58.94%, a year-on-year increase of 4.44%. This growth rate is higher than any other company's share increase, which means that as the industry recovers, the top five companies will "regain lost ground" and increase their dominance in the industry. The top ten companies also have a higher share than in 2023, indicating a more concentrated pattern in the diesel engine industry.

In April 2024, the diesel engine market decreased both month on month and year on year, while commercial vehicle diesel engines were growing, but the growth rate did not exceed the overall market.

The spring breeze brought by the "Golden Three and Silver Four" is not enough to bring the diesel engine market back to pre pandemic levels, and the decline in the second quarter is also a consensus. The question is how much will it decrease? Can it rise in the third quarter?