Heavy trucks decrease by 3% in May, gas vehicles increase by 90%, new energy exports double or increase by 5%

In May, heavy truck sales slightly declined compared to the previous month. Have there been any new changes in the highly anticipated areas of gas vehicles, exports, and new energy?

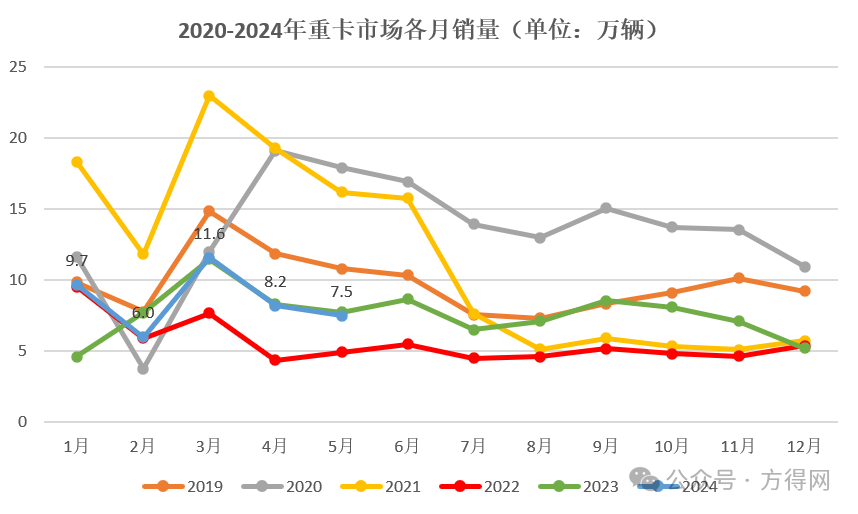

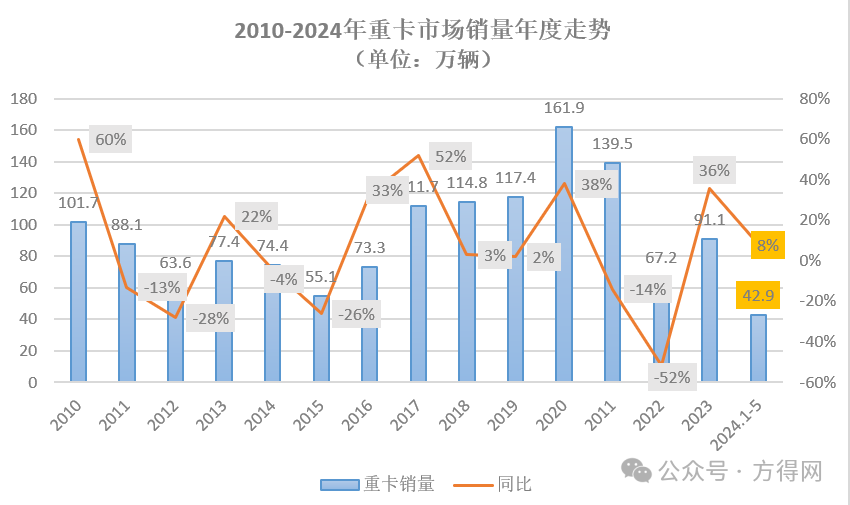

According to the latest data obtained by Fangde.com (enterprise invoicing caliber, the same below), in May 2024, China's heavy-duty truck market sold about 75000 vehicles, a year-on-year decrease of 3% and a month on month decrease of 9%. From January to May, China's heavy-duty truck market sold approximately 430000 vehicles, with a cumulative year-on-year growth of about 8%.

Will the popularity of gas vehicles continue in May? Can new energy heavy-duty trucks achieve a "16 consecutive increases"? How is the export performance?

Sales of 75000 vehicles in May decreased by 3%

Heavy truck sales further declined in May. The result of 75000 is slightly lower than the first month of the second quarter, only higher than the heavy truck sales in February during the Spring Festival. But this achievement is in line with the market trend in recent years, perhaps indicating that the relatively low season for heavy truck sales has arrived.

From the trend of heavy-duty trucks in the past six years, it can be seen that the sales of heavy-duty trucks will show a certain downward trend after entering the second quarter. On the one hand, dealers are generally increasing their existing inventory in order to seize the growing demand for car purchases during the "peak season" of the post year market. This also means that the market will need time to thoroughly digest the inventory in the second quarter. On the other hand, after the end of the heating season, the reduction in production of raw materials such as coal and steel has to some extent affected the downstream transportation market, especially the demand for purchasing cars in resource transportation markets.

Under the comprehensive influence, it is not surprising that the sales volume of heavy trucks in May decreased by 9% month on month. A slight year-on-year decline of 3% is believed by Fangde.com to be related to high industry inventory and current low market freight rates. Data shows that domestic heavy-duty truck terminal sales are expected to increase by 10% year-on-year in May, which is in sharp contrast to the decline in invoicing sales and confirms this point.

In terms of cumulative sales, the industry's heavy-duty truck sales from January to May reached 430000 units, a cumulative year-on-year increase of 8%, which has narrowed compared to the cumulative increase of 12% in the previous four months. But optimistically speaking, within less than half a year, domestic heavy truck sales have approached about half of the annual sales in 2023. At the current growth rate, there are still significant opportunities worth seizing in the heavy truck market in 2024.

Gas, export, new energy

Is your performance okay?

Despite the impact of logistics demand in May, there was a certain decline in total sales. But looking specifically at the "three pillars" of the heavy truck market, there are still varying degrees of growth.

Firstly, let's take a look at one of the biggest driving forces for 2024, the gas vehicle market. Affected by factors such as the turbulent international situation, high oil prices, and stable domestic gas prices, natural gas has become an important direction for China's transportation industry to shift towards clean energy. Currently, the price of No. 0 diesel is around 7.5 yuan, and the price of natural gas is basically stable at around 4.3 yuan per kilogram (the prices of "small oil" and "small gas" will be lower).

In the face of significant oil and gas price differences, freight standards are gradually catching up with gas vehicles, which further accelerates the process of long-distance logistics transitioning to gas vehicles. Meanwhile, it can also be observed from the 2024 announcement that there is a trend of gas vehicles penetrating and transforming into express logistics.

In this context, Fangde Network expects the penetration rate of heavy-duty gas vehicles to reach around 40% by 2024. According to relevant data, the year-on-year growth rate of natural gas heavy-duty truck terminal sales in May may reach around 90%. And in terms of regional distribution, it shows the characteristics of accelerated infiltration from north to south and from west to east.

Secondly, let's take a look at the biggest potential market for "lane changing overtaking" in the heavy-duty truck industry, which is new energy heavy-duty trucks. After May, new energy heavy-duty trucks unexpectedly achieved a year-on-year "16 consecutive increases", once again demonstrating their strong potential and growth momentum. It is expected that by May 2024, the sales of new energy heavy-duty trucks will exceed 4000 units, doubling year-on-year.

At present, many regions across the country have introduced policies related to "exchanging old for new" and "encouraging the development of new energy heavy trucks". It is certain that new energy heavy-duty trucks will continue to maintain high growth rates. The growth rates of new energy heavy-duty trucks from January to May were 152%, 70%, 181%, 102%, or up to 110%, respectively. Based on the sales trend of new energy heavy-duty trucks over the years, it is expected that there will be greater growth in sales of new energy heavy-duty trucks in the second half of the year, which is worth paying attention to.

In addition, one of the driving forces, the export market, still achieved a slight growth, expected to increase by about 5%, basically unchanged from April. Data shows that Russia, as one of the main markets for China's heavy truck exports, has limited market demand growth in 2024. Fangde.com believes that without suppressing demand, the capacity of the Russian heavy-duty truck market may be affected by updates in cargo turnover and inventory. From the perspective of product structure, tractors are still the main export force, and by 2024, the total share of Chinese truck brands in Russia may reach 70%.

It is worth noting that the demand for Chinese heavy-duty trucks in Southeast Asia, Africa, Latin America, the Middle East and other regions is rapidly increasing, and is expected to become an important growth point for domestic heavy-duty truck brands to expand into overseas markets in 2024.

In May, the sales of heavy-duty trucks were 75000 units, a double decrease compared to the previous month. However, there is still significant growth performance in specific segmented markets, especially in gas vehicles and new energy. From the perspective of terminal sales, it is expected that the overall growth of heavy trucks in May will be 10%, which is better than the same period last year. It can be seen that the heavy truck industry is still in an upward trend.