Overseas is expected to create a new domestic heavy-duty truck market! Heavy Duty Truck Group, Weichai, Liberation, Foton and others welcome development opportunities

In today's increasingly globalized trade, China's heavy-duty truck industry is ushering in a new period of development opportunities.

This report will review the current situation of China's heavy-duty truck export market from multiple dimensions and look forward to its future development trends.

1、 Review: Export explosion, dominated by the CIS and Asian African markets

Total volume review: Starting from 2021, exports will be an important increase in heavy truck sales

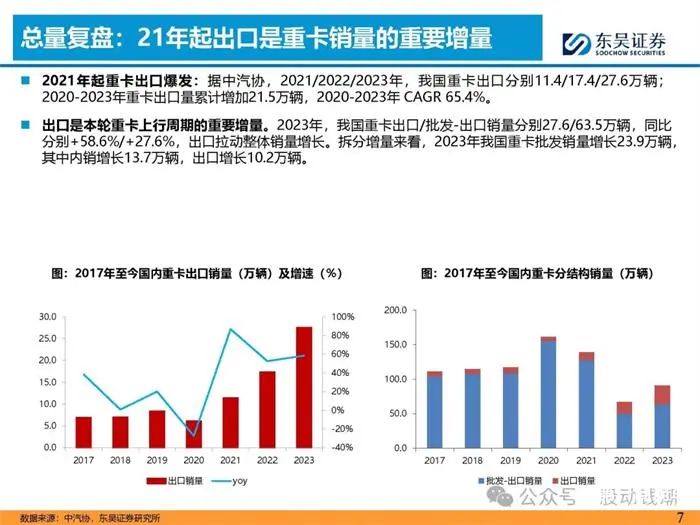

Starting from 2021, the export of heavy-duty trucks has exploded: according to the China Association of Automobile Manufacturers, in 2021/2022/2023, China's heavy-duty truck exports will be 114000/174000/276000 respectively; The cumulative increase in heavy truck exports from 2020 to 2023 is 215000 units, with a CAGR of 65.4% from 2020 to 2023.

Export is an important increment in this round of heavy truck upward cycle. In 2023, the export/wholesale sales of heavy-duty trucks in China reached 276000 units, with a year-on-year increase of 58.6% and 27.6% respectively, driving overall sales growth. Looking at the incremental growth, the wholesale sales of heavy-duty trucks in China will increase by 239000 units in 2023, including a domestic sales growth of 137000 units and an export growth of 102000 units.

Product category: Export products mainly consist of tractor and cargo trucks

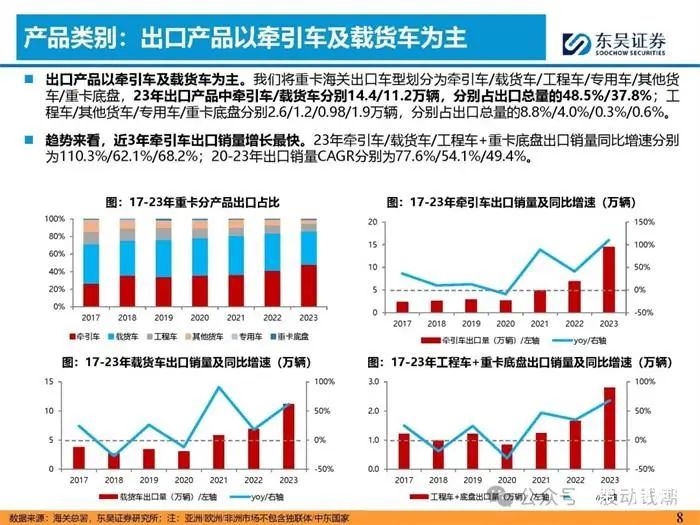

The main export products are tractor trucks and cargo trucks. We divide the export models of heavy-duty trucks from customs into tractor/cargo truck/engineering vehicle/special vehicle/other trucks/heavy-duty truck chassis. In 2023, the export products of tractor/cargo trucks were 14.4/11.2 million respectively, accounting for 48.5%/37.8% of the total export volume; There are 2.6/1.2/0.98/19000 engineering vehicles/other trucks/specialized vehicles/heavy-duty truck chassis respectively, accounting for 8.8%/4.0%/0.3%/0.6% of the total export volume.

From a trend perspective, the export sales of tractor trucks have grown the fastest in the past three years. The year-on-year growth rates of export sales of tractor/cargo truck/construction vehicle+heavy-duty truck chassis in 2023 were 110.3%/62.1%/68.2% respectively; The CAGR of export sales from 2020 to 2023 were 77.6%/54.1%/49.4% respectively.

Regional flow: CIS/Africa/Southeast Asia as the main export markets

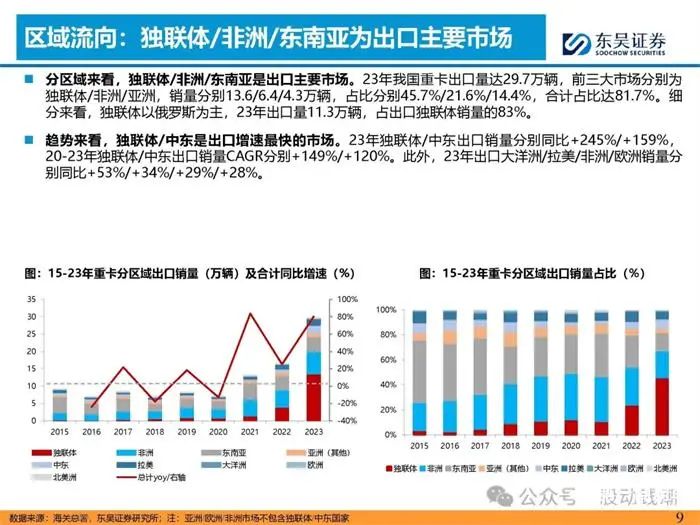

From a regional perspective, the CIS/Africa/Southeast Asia are the main export markets. In 2023, the export volume of heavy trucks in China reached 297000 units, with the top three markets being the Commonwealth of Independent States, Africa, and Asia, with sales of 136000/6400/43000 units, accounting for 45.7%/21.6%/14.4% respectively, totaling 81.7%. In terms of segmentation, the CIS is mainly dominated by Russia, with an export volume of 113000 vehicles in 2023, accounting for 83% of the CIS export sales.

From a trend perspective, the CIS/Middle East is the market with the fastest export growth rate. In 2023, the export sales of the CIS/Middle East increased by 245%/159% year-on-year, and the CAGR of the export sales of the CIS/Middle East from 2020 to 2023 increased by 149%/120% respectively. In addition, the sales of exports to Oceania/Latin America/Africa/Europe in 2023 increased by 53%/34%/29%/28% year-on-year, respectively.

Country flow: Russia is the main export destination country

Looking at it by country, from 2021 to 2023, the total proportion of CR10 countries in China's heavy truck export sales remained above 60%. The sales volume of the top 10 domestic heavy-duty truck export countries in 21/22/23 were 8.1/10.2/19900 units, accounting for 61.7%/61.9%/67.1% respectively.

Russia is the main export destination country. Starting from 2022, Russia will become the first destination country for China's heavy truck exports, with sales of 3.0/1.13 million vehicles flowing to Russia in 2022/2023, accounting for 18.4%/37.9% of the total export volume, significantly ahead of the second destination country's share.

Incremental source: The growth in 2023 was mainly driven by the Commonwealth of Independent States

Looking at the incremental growth, the export growth in 2023 was mainly driven by the Commonwealth of Independent States. In 2023, China's heavy truck exports increased by 132000 units, with the top three incremental markets of the Commonwealth of Independent States, Africa, and the Middle East growing by 96000/14000/14000 units respectively, contributing a total of 94% of the increase. The Commonwealth of Independent States contributed 72% of the increase, while the larger export markets in Asia remained stable.

The top three incremental export markets in the past three years are the Commonwealth of Independent States, Africa, and Asia. From 2020 to 2023, China's heavy truck exports have cumulatively increased by 225000 units, with the top three incremental markets of the Commonwealth of Independent States, Africa, and Asia growing by 127000/38000/26000 units respectively, contributing a total of 84.5% of the increase, of which the Commonwealth of Independent States contributed 56% of the increase.

2、 Outlook: Overseas is expected to recreate a domestic heavy-duty truck market

The total scale of the overseas market is about 1.54 million vehicles, and it can reach about 5.66 million vehicles in the market

Overall situation: The total scale of the overseas heavy truck market is about 1.54 million vehicles, of which Chinese brands can reach about 5.66 million vehicles in the market. Taking into account the local competitive landscape and assuming the market size remains unchanged, given the market share in 3-5 years, it is estimated that the export volume will reach 400000 vehicles in 3-5 years. According to the China Association of Automobile Manufacturers, the export volume of heavy-duty trucks in China will reach 276000 vehicles in 2023, with a cumulative growth potential of 45.7% in 3-5 years.

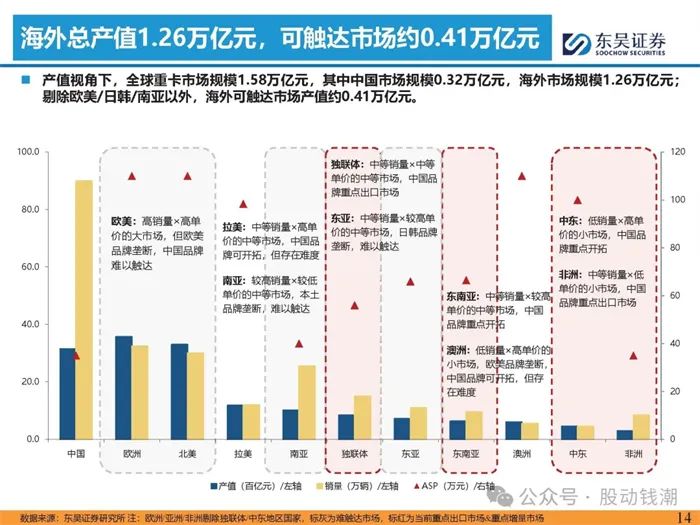

The total overseas output value is 1.26 trillion yuan, which can reach the market by about 0.41 trillion yuan

From the perspective of output value, the global heavy-duty truck market is worth 1.58 trillion yuan, of which the Chinese market is worth 0.32 trillion yuan and the overseas market is worth 1.26 trillion yuan; Excluding Europe, America, Japan, South Korea, and South Asia, the overseas touchable market output value is approximately 0.41 trillion yuan.

Europe - Total volume: Market size of 300000 to 350000 vehicles, with a focus on updating demand

Market size: According to ACEA data and our calculations, the market size in Europe (EU+EFTA countries) is approximately 300000 to 350000 vehicles. Requirement characteristics: 1) High GDP corresponding to bicycles; 2) Heavy trucks have a long lifecycle and low scrap rate; 3) The sales volume of heavy trucks is mainly based on scrapped updates. Among the 342000 vehicles sold in 2023, it is estimated that the demand for new transportation capacity/scrapped updates will be 2.6/31.6 million vehicles respectively.

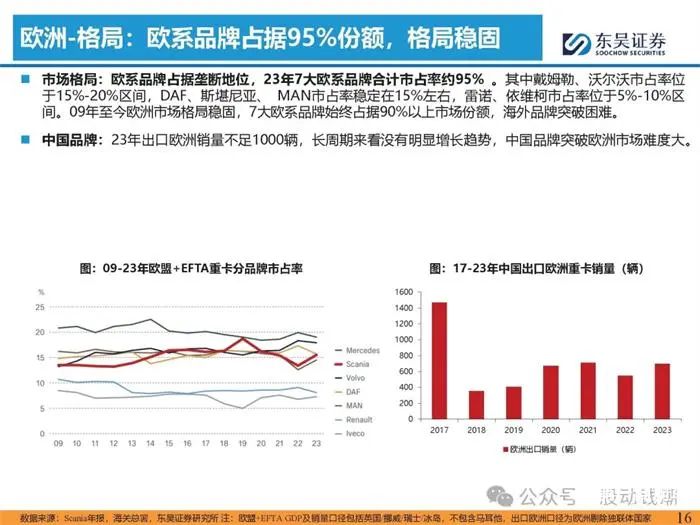

Europe - Landscape: European brands occupy 95% of the market share, with a stable landscape

Market pattern: European brands occupy a monopoly position, with a total market share of about 95% for the seven major European brands in 2023. Among them, Daimler and Volvo have a market share ranging from 15% to 20%, DAF、 Scania and MAN's market share remains stable at around 15%, while Renault and Iveco's market share ranges from 5% to 10%. Since 2009, the European market has remained stable, with 7 major European brands consistently holding over 90% of the market share, while overseas brands have overcome difficulties. Chinese brands: In 23 years, the export sales to Europe were less than 1000 units, and there is no obvious growth trend in the long term. It is difficult for Chinese brands to break through the European market.

North America - Total: Steady state scale of 300000 vehicles, with a focus on updating demand

Market size: Steady state sales volume of around 300000 vehicles. From 2017 to 2023, the total GDP of North America had a CAGR of 2.1%, and the sales of heavy-duty trucks had a CAGR of 5.2%. Requirement characteristics: 1) North American heavy-duty trucks correspond to relatively high GDP values; 2) Under the slow economic growth, there is not much demand for new transportation capacity, and the sales of heavy trucks are mainly based on the demand for scrapped and updated vehicles. It is estimated that in the total sales of 297000 vehicles in 2023, the demand for new transportation capacity/scrapped and updated vehicles will be 76000 and 22000 respectively; 3) The 5-year average scrap rate is 7.2%, slightly lower than the average scrap rate in China.

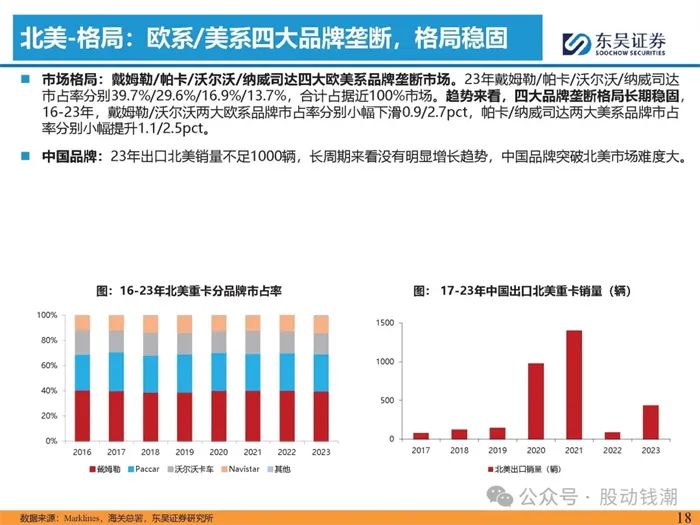

North America - Pattern: Four major European/American brands monopolize, with a stable pattern

Market pattern: The four major European and American brands of Daimler, Parker, Volvo, and Navistar monopolize the market. In 2023, Daimler/Paka/Volvo/Navistar had market share of 39.7%/29.6%/16.9%/13.7% respectively, totaling nearly 100% of the market. From a trend perspective, the monopoly pattern of the four major brands has remained stable for a long time. From 2016 to 2023, the market share of the two European brands, Daimler and Volvo, slightly decreased by 0.9/2.7 pct respectively, while the market share of the two American brands, Paka and Nvidia, slightly increased by 1.1/2.5 pct respectively. Chinese brands: In 23 years, the export sales to North America were less than 1000 units, and there is no obvious growth trend in the long term. It is difficult for Chinese brands to break through the North American market.

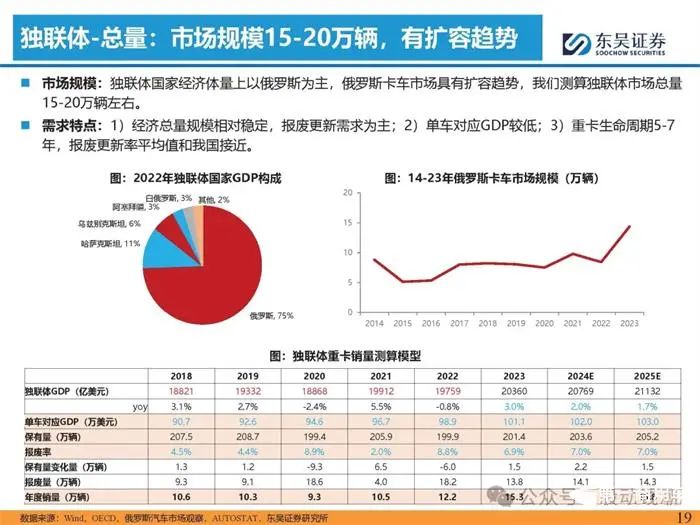

CIS - Total volume: Market size of 150000 to 200000 vehicles, with expansion trend

Market size: In terms of economic volume, the CIS countries are mainly dominated by Russia, and the Russian truck market has a trend of expansion. We estimate that the total volume of the CIS market is around 150000 to 200000 vehicles. Requirement characteristics: 1) The economic aggregate scale is relatively stable, and the demand for scrapping and updating is mainly based; 2) Bicycles correspond to lower GDP; 3) The lifecycle of heavy trucks is 5-7 years, and the average scrap and renewal rate is similar to that of China.

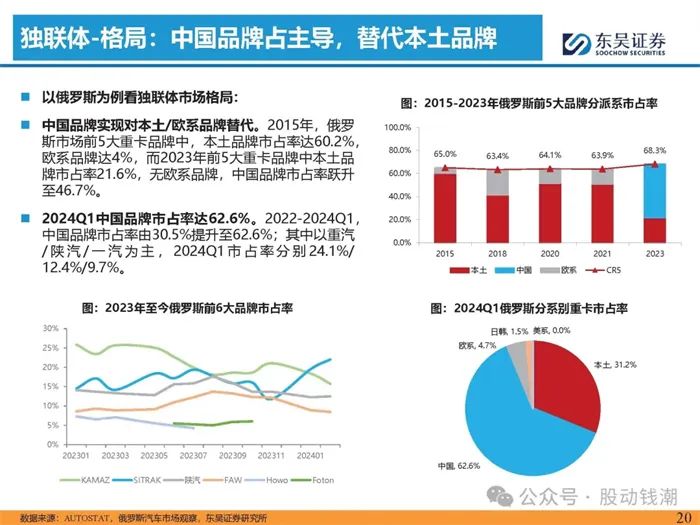

CIS - Pattern: Chinese brands dominate, replacing local brands

Taking Russia as an example to examine the market landscape of the Commonwealth of Independent States: Chinese brands are replacing local/European brands. In 2015, among the top 5 heavy truck brands in the Russian market, local brands accounted for 60.2% of the market share, while European brands accounted for 4%. By 2023, among the top 5 heavy truck brands, local brands accounted for 21.6% of the market share, while there were no European brands. The market share of Chinese brands had jumped to 46.7%. In Q1 2024, the market share of Chinese brands reached 62.6%. 2022-2024Q1, The market share of Chinese brands has increased from 30.5% to 62.6%; Among them, Chongqing Heavy Duty Truck Group, Shaanxi Automobile Group, and FAW Automobile Group are the main players, with market share of 24.1%, 12.4%, and 9.7% respectively in Q1 2024.

Asia East Asia: Market size of approximately 110000 vehicles, mainly consisting of Japanese and Korean brands

Market size: According to our calculations, the scale of heavy trucks in the East Asian market in 2023 is about 110000, of which the reachable market (Mongolia&North Korea) has a scale of about 13500, rapidly expanding with GDP growth. Market pattern: Local brands dominate the Japanese and Korean markets, while Chinese brands find it difficult to break through. In terms of the overall competitive landscape of the truck market, in the 2023 Japanese and Korean truck markets, Hyundai Kia/Isuzu/Toyota respectively held 49.0/20.0/17.3% of the market share, while CR3 reached 86.3%; Other brands are mainly European based Daimler and Indian based Tata Group.

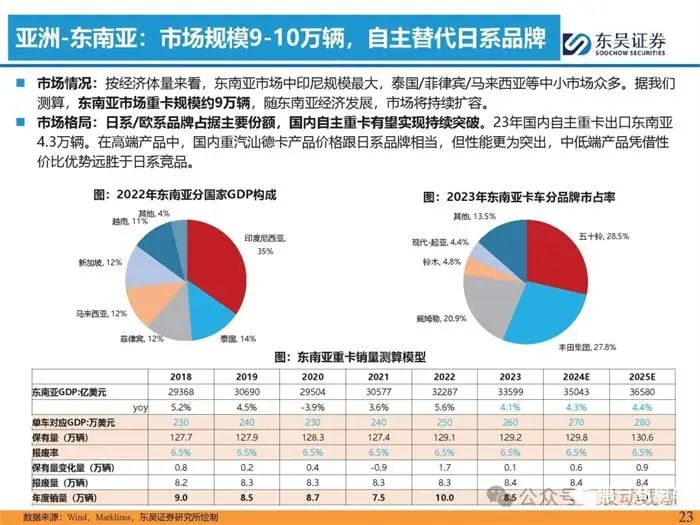

Asia Southeast Asia: Market size of 90000 to 100000 vehicles, independent replacement of Japanese brands

Market situation: In terms of economic size, Indonesia is the largest market in Southeast Asia, with numerous small and medium-sized markets such as Thailand, the Philippines, and Malaysia. According to our calculations, the scale of heavy trucks in the Southeast Asian market is about 90000, and with the development of the Southeast Asian economy, the market will continue to expand. Market pattern: Japanese/European brands dominate the market share, and domestic independent heavy trucks are expected to achieve sustained breakthroughs. In 2023, 43000 domestically produced heavy-duty trucks were exported to Southeast Asia. In high-end products, the price of domestic heavy-duty truck Shandeka products is comparable to Japanese brands, but their performance is more outstanding. Mid to low-end products far outperform Japanese competitors with their cost-effectiveness advantage.

Latin America - Scale: Market size of approximately 140000+vehicles, dominated by European and American brands

Market size: It is expected that the Latin American market size will be over 140000 vehicles, mainly in Brazil and Mexico. In 2023, the Latin American heavy-duty truck market will have a size of 139000 vehicles, of which Mexico and Brazil will have approximately 116000 vehicles, accounting for 83.5% of the total size. Brazil is the largest market. Competitive landscape: Chinese brands mainly focus on non Brazilian markets such as Mexico, with a continuous increase in market share, but the Brazilian market is monopolized by European and American brands. In 2023, Chinese brands will export 18000 vehicles to Latin America, of which Mexico will account for 36%, and the rest will be exported to various small Latin American countries. According to our calculations, from 2020 to 2023, the market share of Chinese brands in Latin America will increase from 4.0% to 13.1%. In 2023, the top six brands in the Brazilian market, Scania/MAN/Daimler/Volvo/Iveco/Paka, together hold 99% of the market share, monopolized by European and American brands, making it difficult to break through.

3、 Positive news: Heavy Duty Truck Group, Weichai, Liberation, Foton and others all benefit

The export pattern is relatively concentrated, and the market share of heavy-duty trucks is leading

From the perspective of different enterprises, the concentration of heavy truck exports is relatively high: according to data from the China Association of Automobile Manufacturers, in 2022/23, domestic heavy truck exports were 210000/276000 units, and CR5 heavy truck exports were 198800/258000 units, accounting for 94.0%/93.6%. China National Heavy Duty Truck Group's export market share is leading in the industry: In 2023, among the major automobile companies exporting heavy-duty trucks, China National Heavy Duty Truck Group's/Shaanxi Heavy Duty Truck Group's/FAW Jiefang's/Dongfeng Motor's/BAIC Foton's export market share were 43.7%/20.5%/16.2%/5.9%/7.2%, respectively.

Vehicle companies: Heavy Duty Truck Group and Shaanxi Heavy Duty Truck Group have significant advantages in exporting complete vehicles and chassis respectively

China National Heavy Duty Truck Group's market share in the export of heavy-duty trucks is leading by a cliff: in 2023, 75000 heavy-duty trucks were exported domestically, of which 59000 were exported by China National Heavy Duty Truck Group, accounting for 78.9%, ranking first in the industry. China National Heavy Duty Truck Group and Shaanxi Heavy Duty Truck Group have a relatively high market share in the export of semi-trailer tractors: in 2023, 136000 semi-trailer tractors were exported domestically, of which 59000 were exported by China National Heavy Duty Truck Group and 22000 were exported by Shaanxi Heavy Duty Truck Group, accounting for 43.5%/16.5% respectively, and the total CR2 accounted for 60.0%. Shaanxi Heavy Duty Truck Co., Ltd. ranks first in the industry in terms of export market share of heavy-duty truck chassis: In 2023, 65000 heavy-duty truck chassis were exported domestically, of which 34000 were exported by Shaanxi Heavy Duty Truck Co., Ltd., accounting for 52.5%.

China National Heavy Duty Truck Group: High end continues to advance, with both domestic and international prices rising in volume and price

The company's high-end heavy-duty trucks are steadily advancing, with high-end products supporting the price center. The cost-effectiveness of the group's products is relatively high, coupled with strong economies of scale and channel management capabilities. Despite the pressure on the group's sales, the average price of heavy trucks remains resilient. With the supporting application of new development technologies in the future, the competitiveness and discourse power of the company's high-end products will be further enhanced, and the price center is expected to rise along with market demand, releasing greater performance elasticity.

Both domestic and foreign dual wheel drive systems have seen a rise in both quantity and price in overseas markets. In 2023, the average domestic bicycle price of the company was 349500 yuan, which remained basically unchanged year-on-year, maintaining resilience in the fierce market competition; The average price of overseas bicycles reached 318400 yuan, a year-on-year increase of 22900 yuan. With the continuous optimization of overseas channels and marketing layout, economies of scale will drive cost reduction and efficiency improvement, and the group's overseas market share is expected to expand, opening up new space for performance growth.

Excerpts from the report

Report Producer/Author: Dongwu Securities, Huang Xili, Yang Huibing