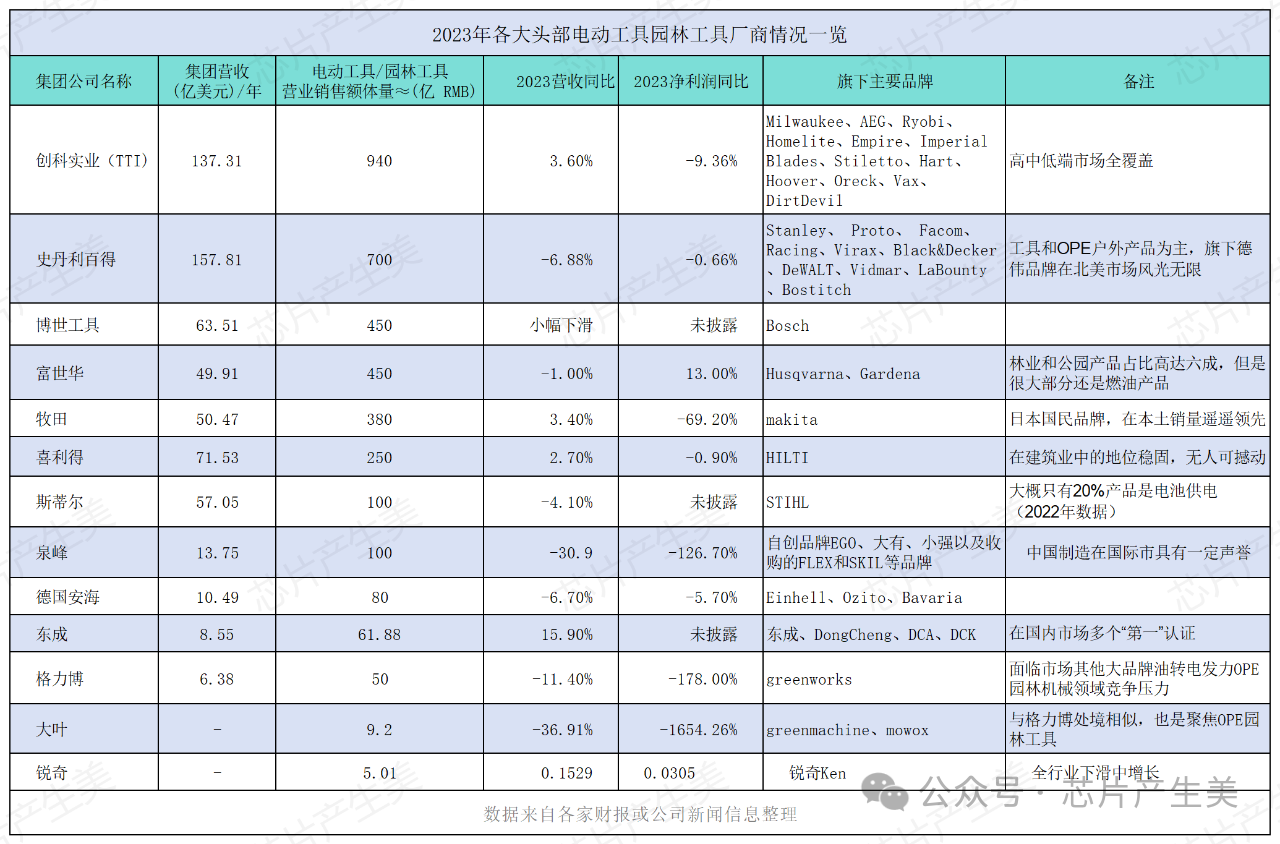

Revenue of Major Global Electric Tool and Landscape Tool Brands in 2023

01 Chuangke Industrial (TTI)

2023 Revenue: 13.731 billion US dollars

Revenue growth year-on-year: 3.60%

Net profit decreased year-on-year: 9.36%

Main brands: Milwaukee、AEG、Ryobi、Homelite、Empire、Imperial、Blades、Stiletto、Hart、Hoover、Oreck、Vax、DirtDevil

Full coverage of high, medium, and low-end markets

Main influencing factors: Ryobi brand decline, rising interest rates leading to increased interest expenses

TTi is a company with extensive influence in the field of tool manufacturing. It has a diversified brand portfolio that can cover various market levels from high-end to low-end, and this comprehensive market coverage ability makes competitors envious. TTi not only maintains a stable market position in the North American market, but also actively expands to regions such as Europe and Australia.

02 Stanley Baide

2023 Revenue: $15.781 billion

Year on year decrease in revenue: 6.88%

Net profit decreased year-on-year: 0.66%

Main brands: Stanley, Proto, Facom, Racing, Virax, Black&Decker

Mainly focusing on tools and OPE outdoor products, its subsidiary DeWei brand has unlimited popularity in the North American market

Main influencing factors: Decreased demand for outdoor and DIY tools from consumers, and customers destocking.

Stanley Black&Decker is an industrial giant with a long history dating back nearly two centuries. It has numerous brands under its umbrella, among which DeWalt stands out in the North American power tool market, enjoying a high reputation and market share. Stanley Baide's business is mainly dominated by tool manufacturing and outdoor power equipment (OPE), and in the tool product line, electric tools account for a significant proportion, almost half of the entire tool business.

03 Bosch Tools

2023 Revenue: 6.351 billion US dollars

Note: Slight decline, specific figures not disclosed

Bosch enjoys a high reputation in the global manufacturing of power tools and their accessories, and is highly regarded for its excellent product quality, continuous technological innovation, and outstanding customer service. Bosch's product line covers four main areas: portable power tools, workbench power tools, precision measuring tools, and power tool accessories.

04 Fushihua

2023 Revenue: 4.991 billion US dollars

Year on year decrease in revenue: 1.00%

Net profit year-on-year growth: 13.00%

Main brands: Husqvarna, Gardena

Forestry and park products account for as much as 60%, but a large part is still fuel products

Main influencing factors: organic sales decline, exchange rate fluctuations, acquisition impact

Husqvarna AB, also known as Fushihua, is a world leading manufacturer of forestry, park, and horticultural equipment, as well as the largest manufacturer of construction machinery products. Among all categories, forestry and park products are its main products, accounting for up to 60%.

05 Makita

2023 Revenue: 5.047 billion US dollars

Revenue growth year-on-year: 3.40%

Net profit decreased by 69.20% year-on-year

Main brand: Makita

Japanese national brand, far ahead in local sales

Makita Makita, from Asia, is very dedicated to both the brand and the field he is deeply involved in, and he stands firmly in the forefront of the world's power tool industry. The revenue in Japan is even higher than its revenue in North America, truly deserving of being a Japanese national brand! Electric tools, as its core category, account for nearly 60% of the company's total revenue.

06 Xilide

2023 Revenue: 7.153 billion US dollars

Revenue growth year-on-year: 2.70%

Net profit decreased year-on-year: 0.90%

Main brand: HILTI

Stable position in the construction industry, unshakable by anyone

Originating from Europe, serving the world! HILTI's European headquarters contribute more than half of its revenue, helping its performance improve year by year.

07 Steele

2023 Revenue: 5.705 billion US dollars

Year on year decrease in revenue: 4.10%

Main brand: STIHL

Only about 20% of products are battery powered (2022 data)

Steele Group develops, manufactures, and sells motor-driven equipment for forestry and agriculture, as well as landscape protection, construction, and private garden owners. Since 1971, Steele has been the world's best-selling chainsaw brand.

08 Quanfeng

2023 Revenue: 10 billion RMB

YoY decrease in revenue: 30.90%

Net profit decreased year-on-year: 126.70%

Main brands: self created brands EGO, Dayou, Xiaoqiang, as well as acquired brands FLEX and SKIL

Made in China has a certain reputation in the international market

Quanfeng's largest revenue still comes from North America, so its performance is closely related to changes in the economic environment in North America. At the same time, it can also be seen that Quanfeng is vigorously expanding the electric tool market while stabilizing the basic stock of OPE products, striving to walk on two legs.

09 Anhai, Germany

2023 Revenue: 1.049 billion US dollars

Year on year decrease in revenue: 6.70%

Net profit decreased year-on-year: 5.70%

Main brands: Einhell, Ozito, Bavaria

It is one of the top ten electric tool brands in Germany

Established in 1964, Einhell is one of the top ten electric tool brands in Germany, with a long history and guaranteed quality. It has been listed and mainly produces electric tools and electric gardening equipment.

10 Dongcheng

2023 Revenue: 6.188 billion RMB

Revenue growth year-on-year: 15.90%

Main brands: Dongcheng DongCheng、DCA、DCK

Multiple 'first' certifications in the domestic market

Dongcheng, with its strong brand power, product strength, and research and development innovation capabilities, has obtained multiple "first" certifications from third-party authoritative institution iMedia Consulting, including "National Sales First in Electric Tool Category for 11 consecutive years" certification, "National Sales First in Lithium Battery Electric Tool Category for 3 consecutive years from 2021 to 2023" certification, "Number of Chinese Electric Tool Brand Stores First" certification, and "Number of Domestic Electric Tool Product Types First" certification.

11 Greebo

2023 Revenue: 5 billion RMB

Year on year decrease in revenue: 11.40%

Net profit decreased year-on-year: 178.00%

Main brand: Greenworks

The competition pressure in the field of garden machinery is high, facing the market and other major brands' oil to electricity conversion power OPE

Greenworks was once a leading enterprise in the domestic OPE industry, enjoying a high market reputation. But with the changing market environment, especially other large electric tool brands taking advantage of the industry transformation opportunity of "oil to electricity" and starting to make efforts in the OPE (outdoor power equipment) garden machinery field, Greebo is facing unprecedented competitive pressure. Although Greebo spares no effort in product launch and market efforts, it is limited to a single product line, which puts it at a disadvantage in diversified competition.

12 large leaves

2023 Revenue: 920 million RMB

YoY decrease in revenue: 36.91%

Net profit decreased year-on-year: 1654.26%

Main brands: Greenmachine, Mowox

The competition pressure in the field of garden machinery is high, facing the market and other major brands' oil to electricity conversion power OPE

Daye Daye, listed on the ChiNext board, is also focused on OPE landscaping tools, just like Greebo, so its current situation is also under great pressure.

13 Ruiqi

2023 Revenue: $501 million

Revenue growth year-on-year: 15%

Net profit year-on-year growth: 3%

Main brand: Ruiqi Ken

Industry wide decline with growth

Ruiqi focuses on electric tools. From the financial report figures, it can be seen that the two companies are two different worlds, one suffering huge losses and the other unexpectedly rising instead of falling in the overall industry downturn.

The above data is compiled from various financial reports or company news information. Through these data, we can see the financial performance and market situation of different companies in 2023, as well as their brand layout and market strategy in the fields of electric tools and garden tools.

From these data, we can see that different brands face different challenges and opportunities. Some brands such as Dongcheng and Stihl have shown positive growth, although Stihl's growth is affected by exchange rates. However, other brands such as Stanley Black&Decker and Quanfeng are facing the problem of declining revenue. Exchange rate fluctuations, market demand changes, inflation, and macroeconomic uncertainty are key factors affecting the financial performance of these brands. In addition, some brands such as Fushihua and Dongcheng have responded to challenges through acquisitions and product innovation.

Article source: Reprinted from "The Beauty Generated by Chips"