Foton's reverse increase in Dongfeng/Great Wall competes for third place, with heavy truck leading the rise by 21%. May's light truck quietly "heats up"?

The light truck market increased by 6.77% year-on-year in May, with an expected sales volume of 950000 in the first half of the year!

In May 2024, the sales volume of the light truck market narrowed from -24.49% the previous month to -0.79%, with a year-on-year increase of 6.77%. Is this a precursor to the recovery of the light truck market?

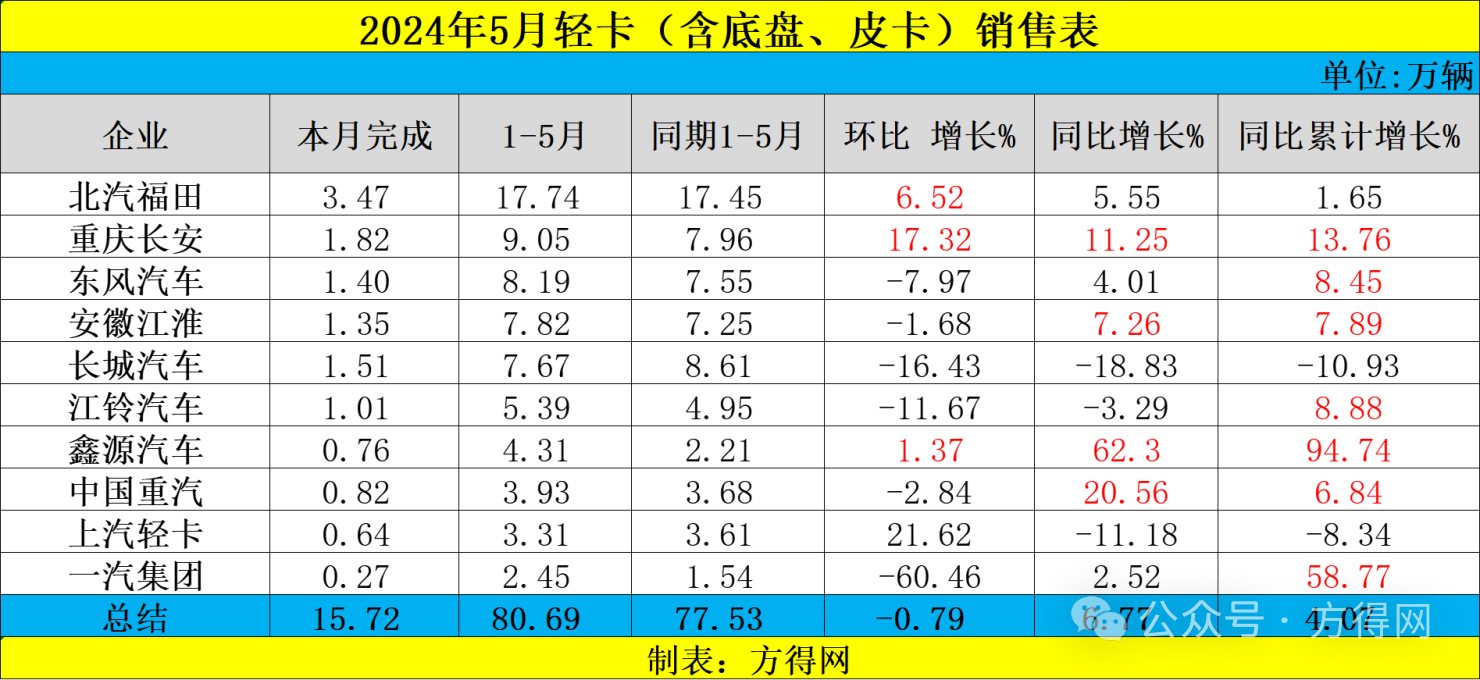

According to data, in May 2024, the sales volume of light trucks in the market was 157200 units, with seven of the top ten companies achieving positive growth year-on-year. Among them, Xinyuan Automobile's growth rate was as high as 62.3%, ranking first in the industry.

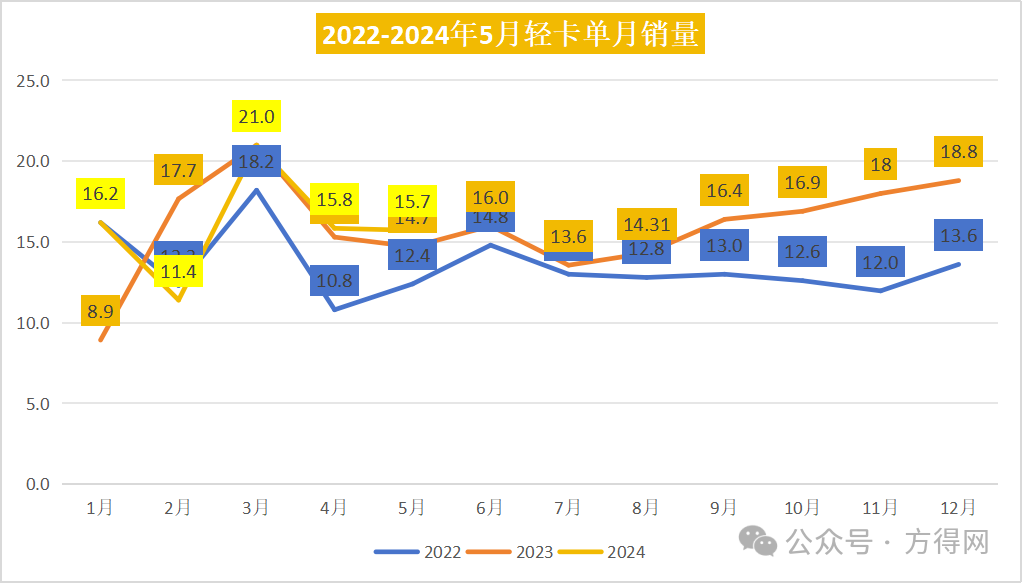

From the perspective of the past two years, the sales volume of 157200 vehicles in May 2024 was the peak of the past three years. After experiencing a low point of 114000 vehicles in February, the trend from January to May 2024 showed a V-shaped upward trend and is slowly recovering.

How have various companies in the industry performed? What changes have occurred in the competitive landscape?

01

The month on month decline in May sales narrowed to the peak of nearly three years

In May 2024, the light truck market had 157200 vehicles per month, a decrease of 20.79% compared to the previous month. However, compared to the 25% decrease in April, it narrowed and increased by 6.77% year-on-year. Compared to the low point of 124000 vehicles in the same period of 2022, it has grown by more than 30000 vehicles, which can be said to be a steady growth.

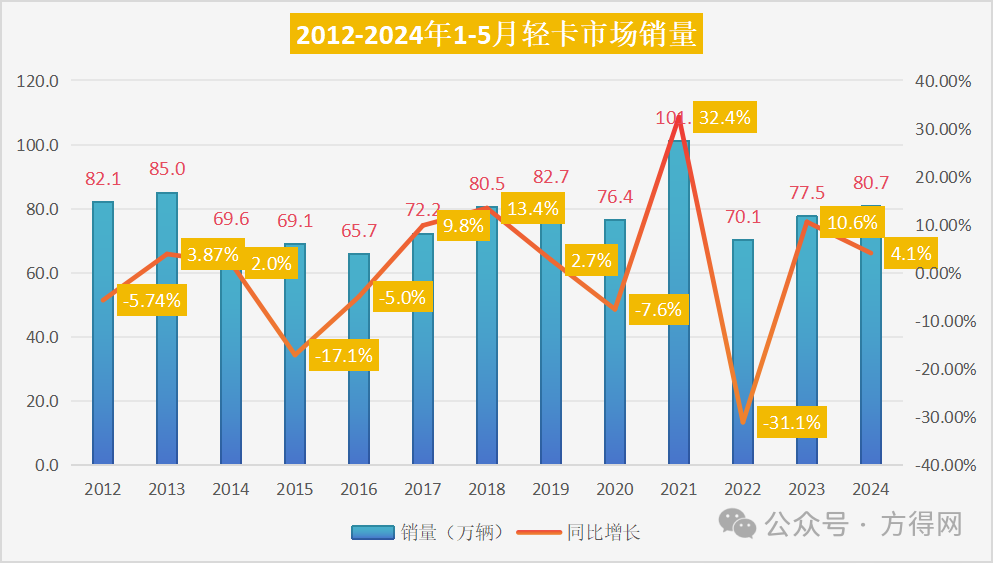

From January to May 2024, the domestic light truck market experienced monthly growth rates of -35.49% to 81.75%, respectively. Overall, the light truck market has seen a cumulative sales growth of 4.07% from January to May this year, with a total sales of 806900 vehicles, an increase of 31000 vehicles compared to the same period last year. This sales volume is even higher than the pre pandemic period of 2019.

May 2024 is not the "peak season" for the light truck market throughout the year. Faced with downward economic pressure, China's economic development is facing triple pressures of demand contraction, supply shock, and weakened expectations. The commercial vehicle market is facing unprecedented pressure and difficulties.

The Purchasing Managers' Index (PMI) for the manufacturing industry in May was 49.5%, still at a low level. In the sluggish freight environment, although the sales of light trucks in the industry seemed to increase from January to May, the year-on-year growth rate continued to decline, and the terminal sales were not satisfactory. In this context, the growth of light trucks in May is the 'surprise'.

Against the backdrop of a 4.5% month on month decline and a 3.3% year-on-year growth in commercial vehicles in May, and a 4.4% month on month decline and a 1.7% year-on-year growth in the truck market, the light truck market achieved a smaller month on month decline than the overall commercial vehicle and truck markets, and a higher year-on-year growth rate than the overall market.

Fangde Network believes that there are two reasons for the narrowing of the month on month growth and positive year-on-year growth in May. Firstly, the month on month increase in May comes from the gradual recovery of the national economy. Since the beginning of the year, China's economy has continued to show a trend of recovery. At the same time, as summer vacation and the recovery of the tourism industry drive economic growth, refrigerated trucks have also entered the peak sales season, and the transportation of refrigerated food has become a growth point in the light truck market.

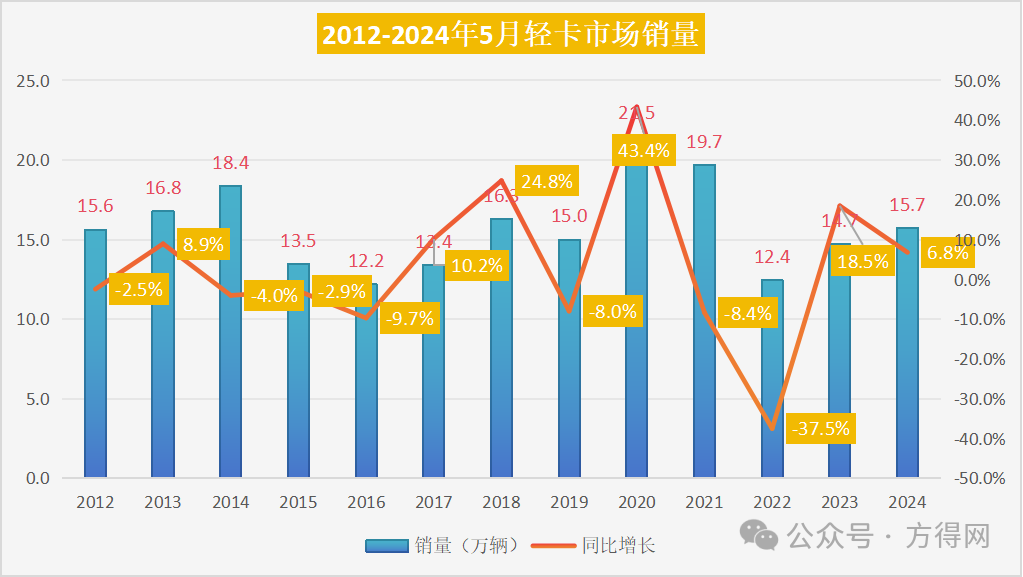

Observing the sales volume of light trucks in May over the years, it can be found that May is the traditional off-season for sales, with an average sales volume of around 130000 vehicles. Before the epidemic, except for 2013 and 2018, the monthly sales volume in May 2024 was higher than that of the same period in the past, and this sales volume was the highest in three years.

In terms of cumulative sales, the cumulative sales of light trucks from January to May 2024 were 807000 units, which is above average in the past 10 years and is on par with 2018. These years have been a "peak period" for the light truck industry, which also indicates that it is inevitable for the light truck market to gradually recover to previous levels after the peak in 2021.

If this growth rate is maintained, it is expected to reach 950000 vehicles in the first half of 2024, and breaking through one million is not a difficult problem.

02

Seven out of the top ten companies showed positive year-on-year growth, while Huachen Xinyuan had the highest year-on-year growth

Although May 2024 is not the traditional peak season, seven companies achieved year-on-year positive growth in May. Against this backdrop, which light truck companies have achieved performance beyond the industry?

In terms of sales volume, the top ten companies include Foton with a monthly sales volume exceeding 30000 vehicles, 5 companies with sales volume exceeding 10000 vehicles, and Heavy Duty Truck Group, Xinyuan, SAIC Light Truck Group, and FAW Jiefang with sales volume below 10000 vehicles.

Compared with last month, three companies achieved a counter market growth in monthly sales, among which one company achieved a month on month increase of 17.32%, and this company is Chongqing Chang'an. In May, Foton and Xinyuan achieved positive month on month growth, with a monthly sales volume of 8180 vehicles, ranking seventh in the industry.

In May, Foton led the industry with a monthly sales volume of 34700 vehicles, Chongqing Changan ranked second with a sales volume of 18200 vehicles, Great Wall Motors ranked third with a monthly sales volume of 15100 vehicles, and Dongfeng ranked fourth with a monthly sales volume of 14000 vehicles.

From the ranking perspective, the top five companies have a relatively stable ranking, while the bottom five have undergone significant changes. Xinyuan Automobile ranked 9th in the industry in May 2023 and 8th in May 2024, rising one place in the ranking. Liberation ranked 12th in the industry during the same period in 2023 and will return to the top ten in 2024.

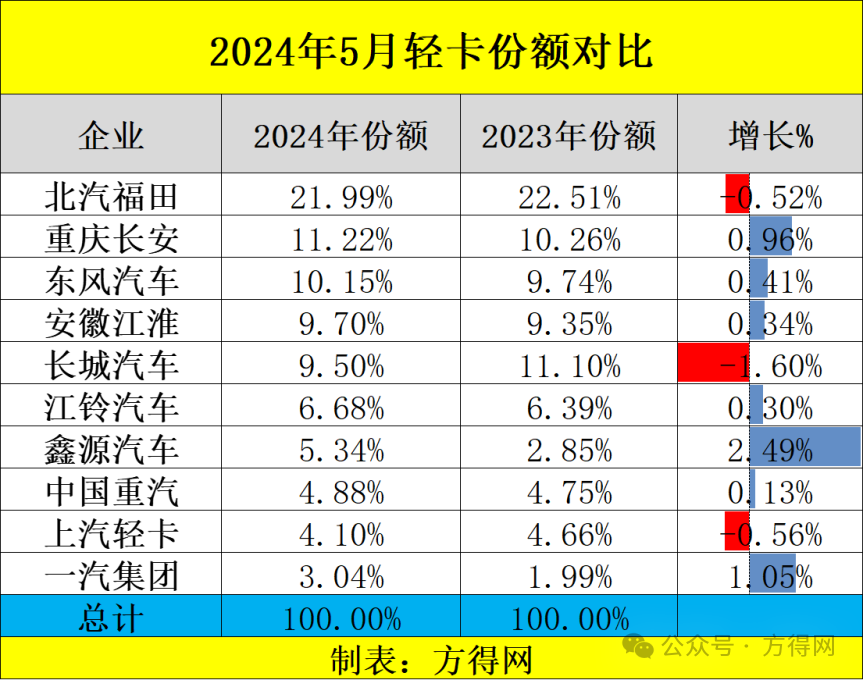

In terms of cumulative sales, seven out of the top ten companies have achieved positive growth. The top ranked Foton has a market share of 21.99%, with two other companies (Chongqing Chang'an 11.22% and Dongfeng 10.15%) having a market share exceeding 10%.

Among the top five enterprises, Chongqing Chang'an had the highest increase in market share, reaching 0.96%. Among the last five companies, Huachen Xinyuan, Heavy Duty Truck Group, and FAW Jiefang achieved market share growth, with Xinyuan's market share increasing by 2.49%, the highest growth rate.

From January to May 2024, the share of the top five companies in the light truck market did not significantly decline, indicating that veteran light truck companies have stronger resilience in the market downturn. The share of the top five companies has declined compared to the same period in 2023. From January to May 2023, the share of the top five companies was 63.69%. From January to May 2024, the share of the top five companies reached 62.31%, a decrease of 1.38%. This growth rate is lower than that of the industry's top five companies, indicating that the strong are always strong. And the rear five positions of the light truck are frequently swapped, making the competition even more intense.

03

The threshold for the first ten months of January to May is 24500 vehicles, with a difference of 3141 vehicles in 11 positions

From the data in the table above, it can be seen that from January to May 2024, the total share of the top ten light truck companies reached 86.6%, a year-on-year increase of 3% compared to the top ten companies' share (83.6%) from January to May 2023, indicating that the top ten companies have strengthened their dominance in the industry.

The bottom five companies have seen a decrease in market share, indicating that companies outside the top ten are eyeing them closely. Among them, from January to May 2024, the ninth and tenth places in the bottom ten frequently swapped positions, which also indicates the intense competition in the bottom ten.

From January to May 2024, the sales volume of the tenth place in the light truck market was 24500 units, while from January to May 2023, the sales volume of the top ten in the light truck market was 21900 units, with a threshold of 2600 units higher than in 2023. Under the premise of increasing industry concentration, competition among latecomer enterprises is becoming increasingly fierce.

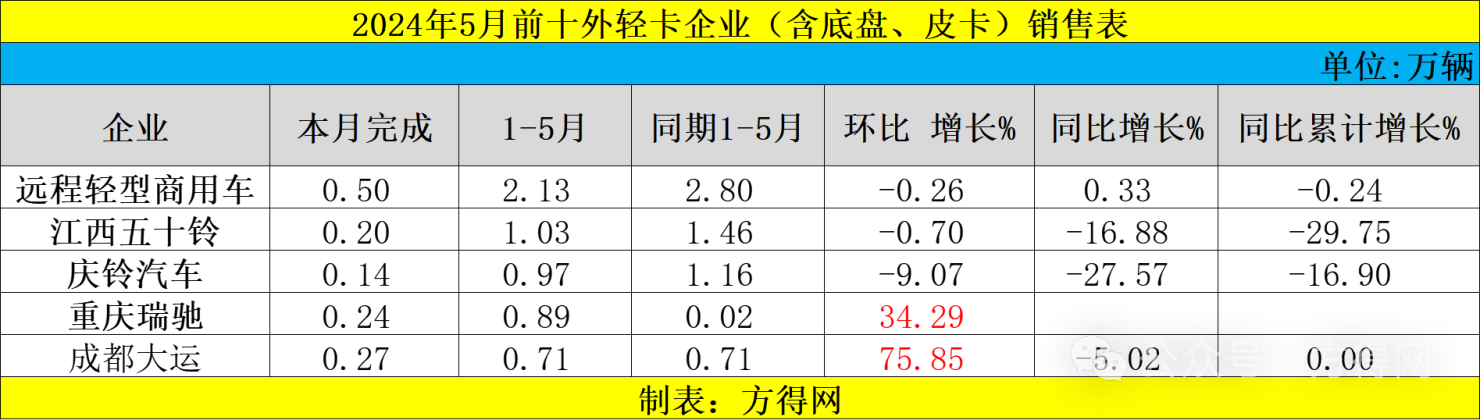

The eleventh enterprise in light trucks is remote commercial vehicles. In 2023, remote commercial vehicles have repeatedly entered the top ten. After calculating the sales of all remote commercial vehicle brands (including Geely Sichuan, Jiangxi Geely, and Tang Jun), the monthly sales of 5042 vehicles can enter the top ten.

In 2024, the last strong competitors in the top ten of the light truck industry are Jiangxi Isuzu, Qingling, Ruichi, and Chengdu Dayun.

The first half of 2024 is coming to an end and entering the off-season of the industry. How are the market performances of various enterprises? Can it continue to grow during the off-season?

From January to May 2024, the top ten players in light trucks always belong to those who are "prepared and capable". And among the light truck companies such as Remote, Jiangxi Isuzu, and Qingling, who can once again "enter" the top ten? It also depends on who can seize the opportunity of the golden September and silver October in the second half of the year.