78000 vehicles! Heavy truck market turns weak in May: Heavy Duty Truck/Liberation maintains its top spot in Asia, with Foton leading the month on month gains

In May 2024, domestic heavy truck sales reached 78000 units, with little increase or decrease compared to the same period last year, indicating a relatively stable market performance.

According to the production and sales data released by the China Association of Automobile Manufacturers, in May 2024, the sales of trucks reached 299000 units, a year-on-year increase of 1.7%; Accumulated sales of 1.53 million vehicles from January to May, with a cumulative increase of 6.2%. In May, sales of heavy-duty trucks reached 78000 units, a year-on-year increase of 0.92%; From January to May, a total of 433000 vehicles were sold, with a cumulative increase of 7.7%.

Top 10 in May: Heavy Duty Truck Monthly Sales Exceed 20000 Vehicles Again

Futian increased by 25% month on month

Regarding the performance of various enterprises, in May 2024, the year-on-year growth rate of heavy-duty trucks changed from negative to positive. Among the top 10 enterprises, 7 achieved positive growth year-on-year, but the growth rate was less than 10%. Beiben increased by 6.2%, the largest increase.

From a month on month perspective, 7 out of the top 10 heavy-duty truck companies saw a decline, with the largest decrease approaching 20%. Only 3 companies maintained an upward trend, while Foton Motor, XCMG Motor, and Dayun Motor saw growth of 25.4%, 11.8%, and 0.3%, respectively. Among them, it is worth mentioning that Foton Motor not only turned positive year-on-year this month, but also achieved a significant increase on a month on month basis, making it the only Top 5 company to achieve dual growth and outstanding performance.

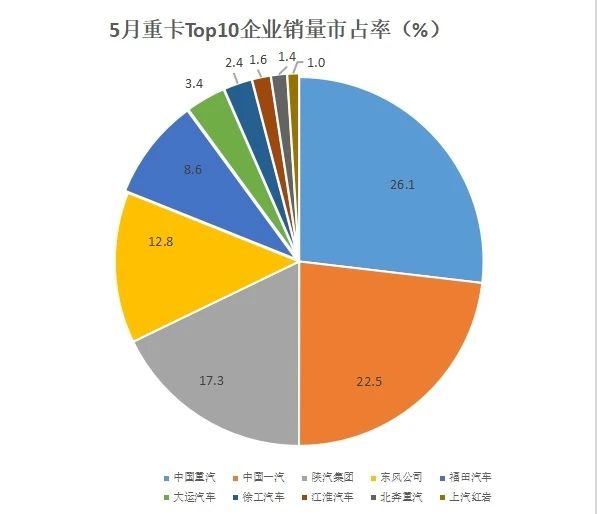

In terms of sales, in May 2024, there was no change in the ranking of the top 10 heavy-duty truck companies compared to the previous month. There were 4 companies with sales exceeding 10000 units, accounting for nearly 80% of the market share. China National Heavy Duty Truck Group was the only company with sales exceeding 20000 units, while China FAW, Shaanxi Automobile Group, and Dongfeng Motor Corporation had sales exceeding 10000 units, ranking 2nd to 4th respectively.

Specifically, this month, China National Heavy Duty Truck Group (CNHTC) took the lead with a monthly sales volume of 20405 vehicles and a market share of 26.1%; China FAW sold 17584 vehicles, with a market share of 22.5%, ranking second; Shaanxi Automobile Group sells 13541 vehicles per month, with a market share of 17.3%; Dongfeng Company sold 10041 vehicles, with a market share of 12.8%, ranking fourth; Foton Motor sold 6748 vehicles, with a market share of 8.6%, ranking fifth.

Top 10 from January to May: China National Heavy Duty Truck Group firmly holds the first place

Leading both in terms of liberation growth rate and market share

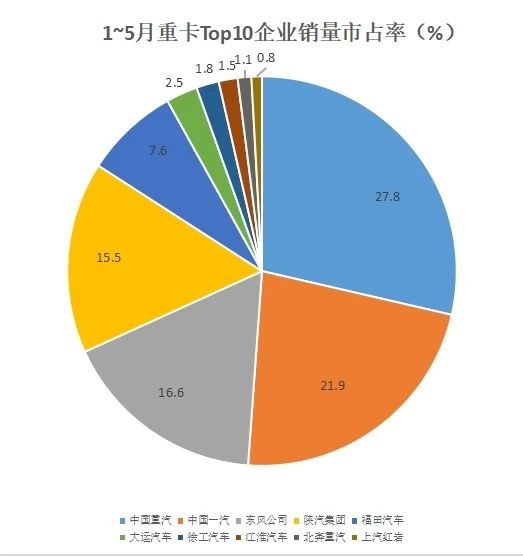

From January to May 2024, among the top 10 heavy-duty truck companies, 8 have achieved positive year-on-year growth, and 4 have outperformed the industry. China FAW has accumulated a year-on-year growth of 21.4%, with the largest increase; Beiben Heavy Duty Truck Group, China National Heavy Duty Truck Group, and XCMG followed closely behind, with growth rates of 15.2%, 10.6%, and 9.1%, respectively.

From the sales data, from January to May 2024, China National Heavy Duty Truck Group sold 120391 vehicles, surpassing the second place by 26000 vehicles and winning the sales championship; China FAW sold 94852 vehicles, ranking second; Dongfeng Company sold 71797 vehicles, ranking third; Shaanxi Automobile Group and Foton Motor ranked fourth and fifth respectively with sales of 66960 and 32933 vehicles.

In terms of market share, the total market share of the top 10 heavy truck enterprises is 97.2%, lower than the 97.7% in the same period last year; The total market share of the top 5 enterprises is 89.3%, which is 0.2 percentage points lower than the same period last year, and the market concentration is still very high. China FAW, China National Heavy Duty Truck Group, and Beiben Heavy Duty Truck Group have achieved positive market share growth, while 6 companies have shown varying degrees of market share shrinkage. Among them, China FAW's market share increased by 2.5%, continuing to lead the way.

Overall, after the peak sales season of "Golden Three, Silver Four", heavy truck sales remained stable in May, but the cumulative growth rate continued to narrow, and the market recovery momentum was clearly insufficient.

At present, the increase in the heavy-duty truck market mainly comes from the gas, export, and new energy markets, while the increase in other markets is very limited and the channel inventory is high. Among them, the large-scale replacement of fuel vehicles by gas heavy trucks has led to a downward trend in fuel transportation costs, resulting in a continued decline in freight rates, which has a significant negative impact on users' purchase of new cars. Meanwhile, as heavy truck sales gradually enter the off-season, this overall slightly sluggish market situation may continue.