Diesel engine sales reached 2.14 million units in the first half of the year, with Weichai experiencing double-digit growth and entering the top three in the cloud. Dongfeng Cummins entered the top seven

The second quarter saw the completion of 2.14 million diesel engines, with an estimated 4.3 million units for the whole year!

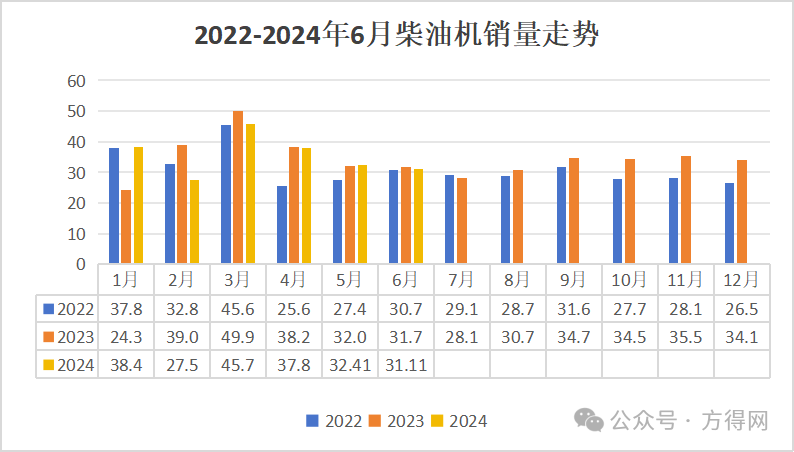

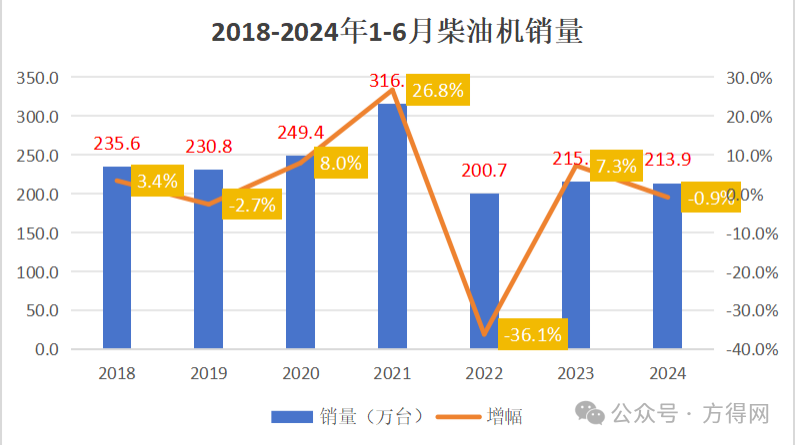

According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in June 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) were 311100 units, a year-on-year decrease of 1.97% and a month on month decrease of 4.01%, with a narrower decline compared to the previous month; The cumulative sales volume from January to June was 2.1388 million units, a year-on-year decrease of 0.87%.

For two consecutive months, there has been a month on month decline, but the decline is gradually narrowing, making the sales of diesel engines in the first half of the year "infinitely close". In 2023, standing at a "turning point", the second half of the year is about to usher in the peak season of the traditional commercial vehicle market. After the "Golden September and Silver October", can the annual sales exceed last year? How much growth?

How have diesel engine companies performed in the first half of the year? What changes have occurred in the ranking of enterprises?

Only 2 months of year-on-year growth in the first half of the yearRanked 6th in 7 years

In the first half of 2024, both the diesel engine industry and the commercial vehicle market are facing multiple pressures such as slow economic recovery and insufficient demand. With the support of multiple national policies, the market has rebounded, and the industry's market demand is slightly insufficient. Sales are still in a slow recovery stage.

In June 2024, the sales volume of diesel engines in the market decreased by 4.01% month on month and 1.97% year-on-year. While the month on month decline narrowed, the year-on-year decline turned negative.

It can be seen that the trend of the diesel engine market in the first quarter of 2024 presents a V-shape, which continues the "residual heat" of last year for the diesel engine market. Major commercial vehicle manufacturers still have confidence in the market, with continuous good news and steady sales growth. In April, the monthly sales trend was downward, and thereafter, the monthly sales decreased month on month, which is consistent with the trend of the truck market.

The reason for the month on month contraction and year-on-year decline in June 2024 is still due to the slow recovery of the overall economic situation, PMI index below the critical point, insufficient market demand, and slow recovery of sales volume. Secondly, in 2024, the rise of the new energy market has taken over a significant portion of the diesel vehicle market, leading to a decrease in the proportion of diesel vehicles in the overall commercial vehicle market, and diesel engines have also been taken over. Meanwhile, it is a common phenomenon that the export market will outperform the domestic market in 2024, with diesel engine exports growing by over 40% from January to May, making it the most eye-catching niche market.

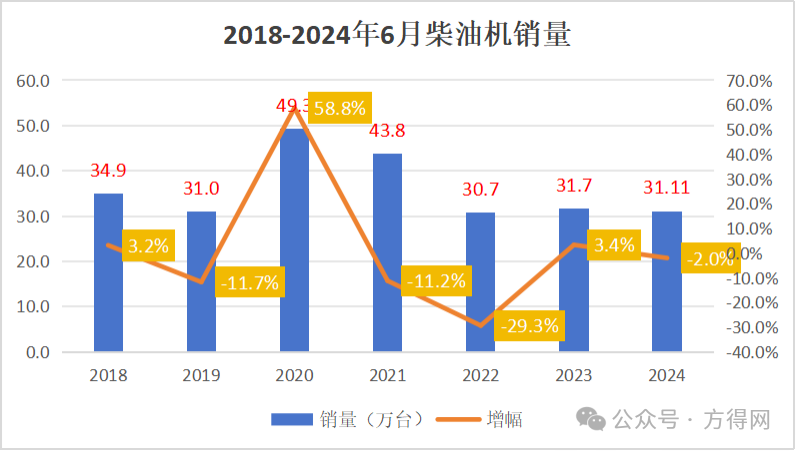

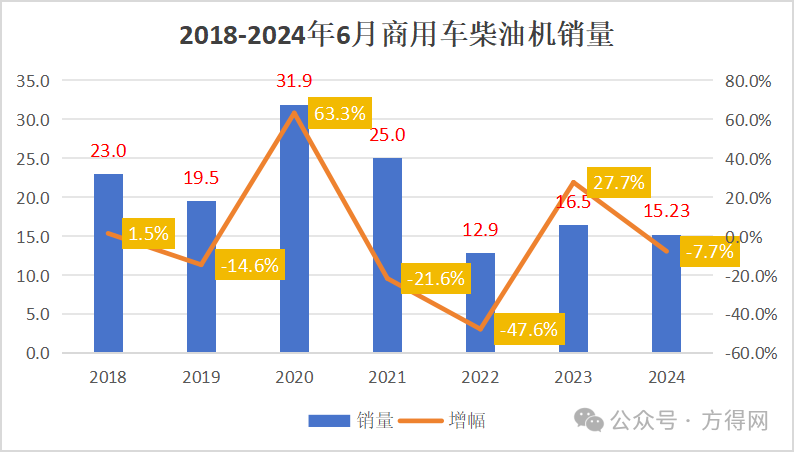

Looking at the sales and growth trend chart of diesel engines in June of the past 7 years, it can be seen that the average monthly sales in June were around 310000 units, with the lowest year being June 2022. June 2024 was a year with relatively low monthly sales in the past six years.

From the perspective of various segmented markets, due to factors such as the epidemic and material supply, the demand for diesel engines in the terminal market is still insufficient, and markets such as construction machinery and agricultural machinery are also in the adjustment stage. In June, sales of multi cylinder diesel engines for construction machinery reached 65100 units, a month on month increase of -2.73% and a year-on-year increase of -0.29%; The cumulative sales volume from January to June was 436800 units, a year-on-year increase of -5.12%.

In terms of cumulative sales, the cumulative sales of diesel engines from January to June 2024 were 2.1388 million units, which is also an average low level in the past 7 years. In 2019 before the epidemic, the sales of diesel engines were around 2.308 million units from January to June, not to mention the sales of 3.16 million units from January to June 2023. The sales from January to June 2024 were about 200000 units less than the average annual sales.

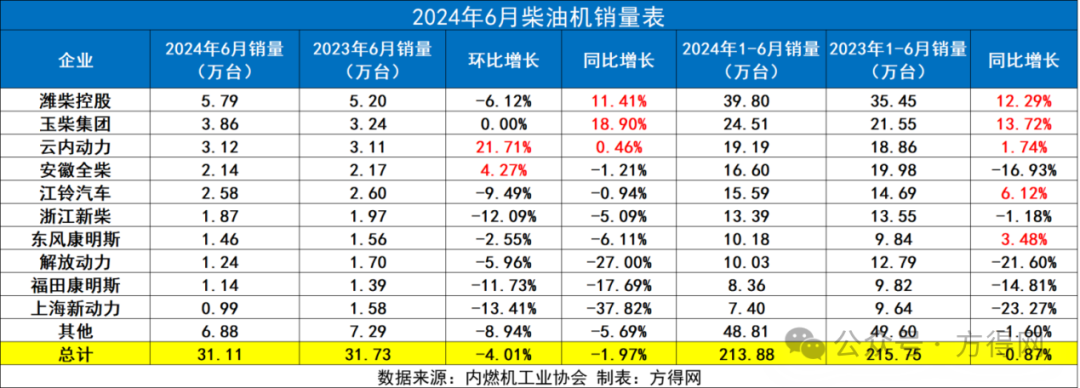

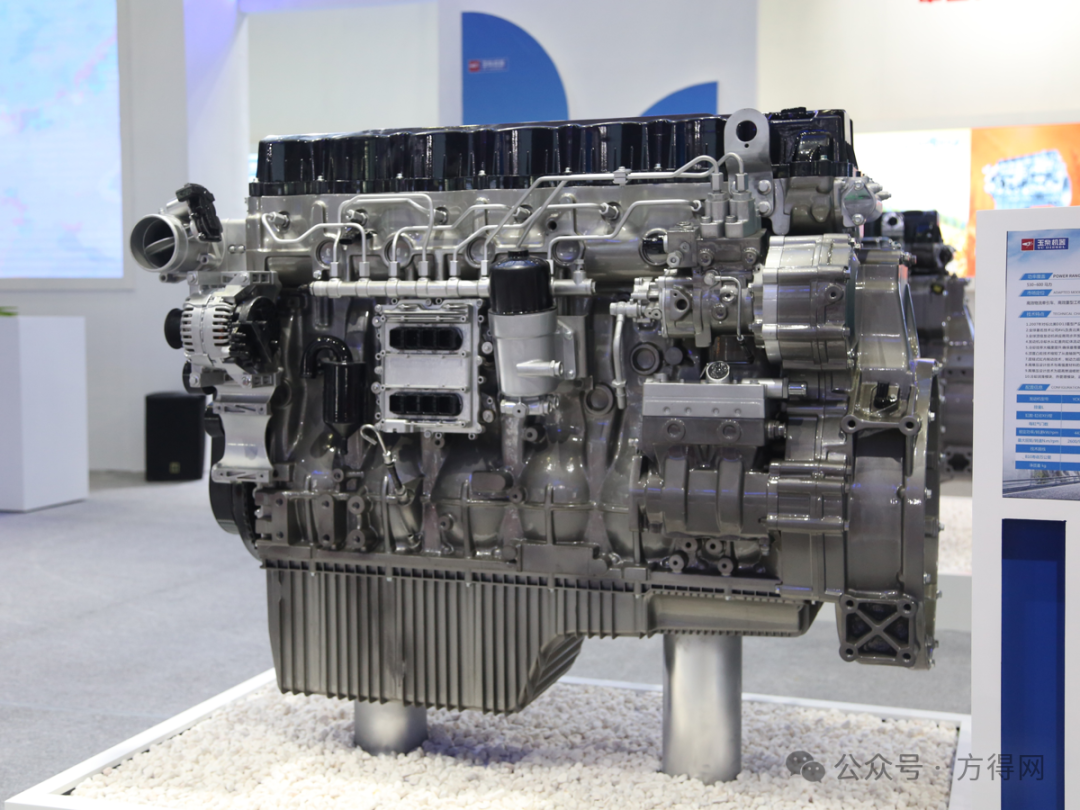

In June 2024, three of the top ten companies in the diesel engine market showed year-on-year growth, and these three are the top three in the industry: Weichai, Yuchai, and Yunnei. Among them, Yunnei Power is the only enterprise among the top three that has shown positive growth in month on month, year-on-year, and cumulative sales.

From the perspective of competitive landscape, in June 2023, the top five diesel engine companies were Weichai, Yuchai, Yunnei, Jiangling, and Quanchai, while in June 2024, the ranking of the top five companies remained unchanged.

In terms of sales, in June 2024, only Weichai sold over 50000 units per month, while Yuchai and Yunnei sold over 30000 units per month; More than 20000 units include Jiangling Motors and Quanchai; The top ten companies have a monthly sales volume of 10000 units.

Compared to last month, 3 out of 10 companies achieved positive month on month growth, with Yunnei and Quanchai surpassing the industry in terms of growth rate. Among them, Yunnei's month on month growth rate exceeded 22, leading the industry.

In terms of cumulative sales, Weichai sold 400000 units from January to June 2024, with Yuchai being the only company that sold over 200000 units. Those with over 150000 units include Yun, Quanchai, and Jiangling. The cumulative sales of Xinchai, Dongkang, and Jiefang have exceeded 100000 units, while the cumulative sales of Fukang and Shangchai have both exceeded 70000 units.

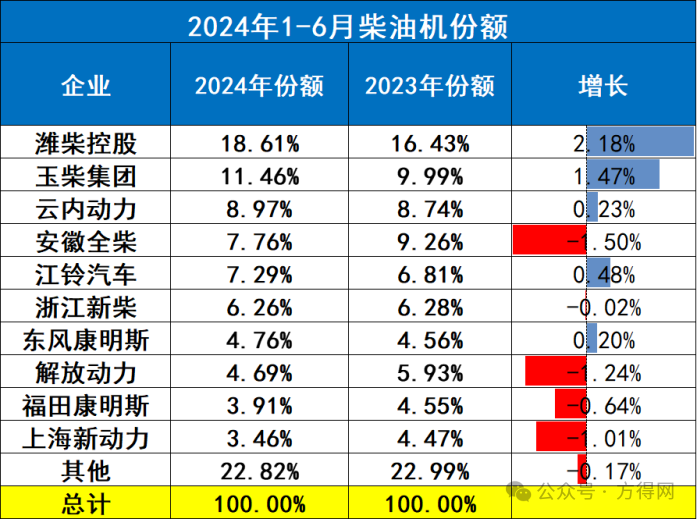

From the perspective of enterprise share, from January to June 2024, Weichai dominated the industry with a market share of 18.61%, making it the only company in the industry with a market share exceeding 18%. Enterprises with a market share exceeding 10% have Yuchai. Yunnei ranks third with an 8.97% share and a growth rate of 0.23%. Quanchai and Jiangling have very similar shares. Among the top ten companies, Dongkang's share increased by 0.2% year-on-year, Yuchai's share increased by 1.47%, and Weichai's share increased by 2.18%, with the highest industry growth rate.

From January to June 2024, the proportion of the top ten companies in the industry (77.17%) increased year-on-year (77.02%); The share of the top five diesel engine companies has increased compared to last year, which means that the strong in the top five companies will always be strong. In times of industry downturn and decline, only the group army can withstand greater pressure.

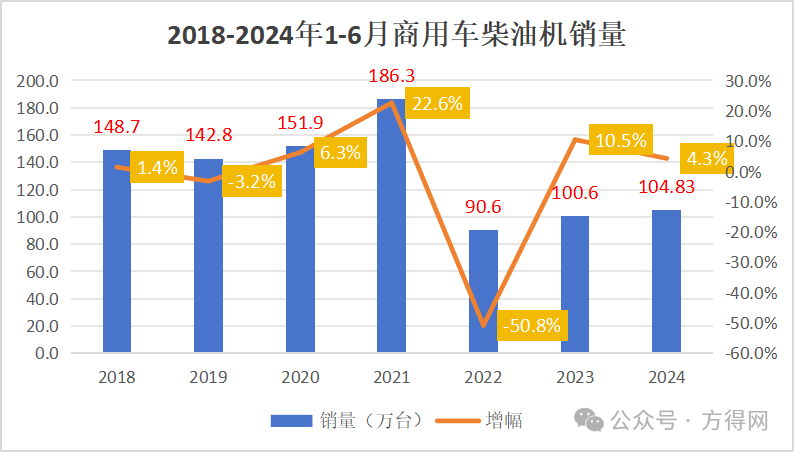

The sales of commercial vehicle diesel engines in the second quarter were 186200 units in April, 160000 units in May, and 152300 units in June. After experiencing a V-shaped growth in the first quarter, it can be seen that the year-on-year growth rate of the commercial vehicle diesel engine market gradually narrowed until June when it began to turn negative.

From 2017 to 2024, the average sales volume of commercial vehicle diesel engines in June was around 220000 units. However, in June 2024, the sales volume of 152300 units was not only lower than the average, but also only higher than the lowest point in 2023, and did not reach the monthly sales level of June 2019 before the epidemic. This indicates that the commercial vehicle diesel engine market still faces the dilemma of insufficient domestic demand.

From January to June 2018, the sales volume of commercial vehicles in the market was 2.291 million units, a year-on-year increase of 10.6%, which was 5.1 percentage points higher than the overall automobile sales. The sales volume of commercial vehicle diesel engines was 1.487 million units, a year-on-year increase of 1.4%. The sales volume of commercial vehicles in the market from January to June 2024 was 2.068 million units, a year-on-year decrease of 9.7% compared to 2017, but the assembly rate of commercial vehicle diesel engines increased.

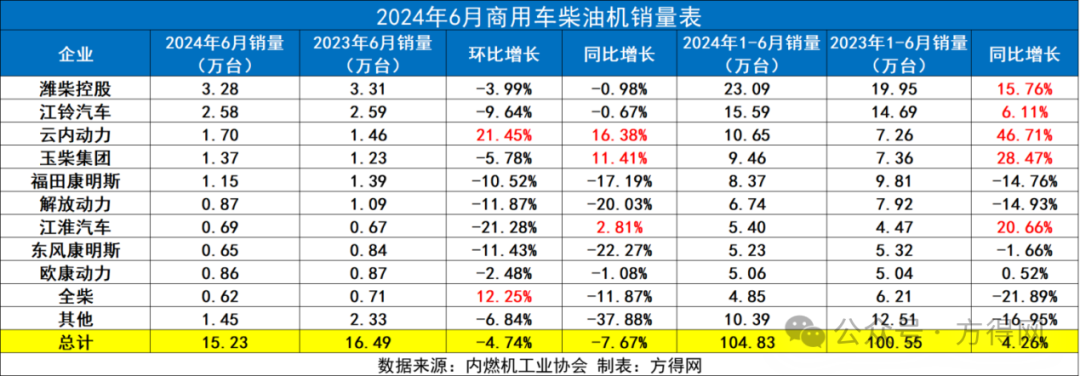

In June 2024, among the top ten companies in the commercial vehicle diesel engine market, only two companies saw month on month growth, with Yunnei growing by 21.45% and Quanchai growing by 12.25%. In addition, the decline in Oukang Power was lower than the industry, outperforming the overall market.

From a year-on-year perspective, three companies achieved positive growth, among which Yunnei, Yuchai, and Jiefang all exceeded the industry's year-on-year growth. Among them, Yunnei saw a year-on-year growth of 16.28%, leading the industry.

In June 2024, Weichai had the highest sales volume in the commercial vehicle diesel engine market, with a monthly sales volume of 32800 units, ranking first in the industry. Jiangling Motors sold over 20000 units in a single month, while Yunnei, Yuchai, and Fukang sold over 10000 units. The market ranking has also undergone significant changes. In June 2023, the top five companies for commercial vehicle diesel engines were Weichai, Jiangling, Yunnei, Fukang, and Yuchai. The top five sales figures in June 2024 are Weichai, Jiangling, Yunnei, Yuchai, and Fukang. Within a year, Yuchai ranked fourth.

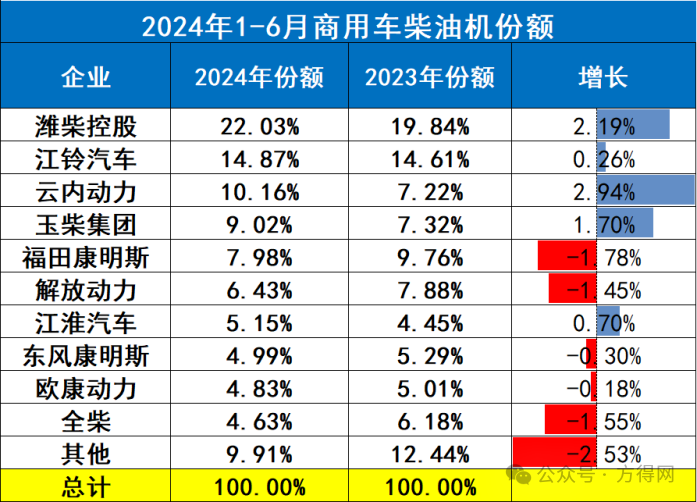

In terms of market share, the top ten sellers are Weichai, Jiangling, Yunnei, Yuchai, Fukang, Jiefang Power, Jianghuai, Dongkang, Oukang Power, and Quanchai, with their top ten sales accounting for 90.09% of the total sales; Weichai holds a leading market share of 22.03% in the commercial vehicle multi cylinder diesel engine market, followed by Jiangling 14.87%, Yunnei 10.16%, Yuchai 9.02%, Fukang 7.98%, Jiefang Power 6.43%, Jianghuai 5.15%, Dongkang 4.99%, Oukang 4.83%, and Quanchai 4.63%. Among the top five companies, four have seen an increase in market share, with Yunnei experiencing the highest industry share growth of 2.94%. Among the last five, Jianghuai Automobile grew by 0.7%.

From January to June 2023, the top five commercial vehicle diesel engine companies accounted for 59.41% of the market share, while in June 2024, the top five companies accounted for 64.06%, a year-on-year increase of 4.56%. The pattern has gradually shifted from being dominated by one company to a "one super, many strong" pattern. The top ten companies also have a higher market share than in 2023, indicating that after overcoming the industry downturn, veteran diesel engine companies have regained control of the industry.

From January to June 2024, the diesel engine market experienced a year-on-year decline, with the month on month decline narrowing. The cumulative sales volume in the first half of the year was 2.14 million units, although slightly lower than last year, there is still a chance for a turnaround.

In the second half of 2024, many companies predict that the growth trend will be slightly more obvious than the first half. With the country's economic stimulus, the infrastructure industry is gradually recovering, and it is expected that the annual sales of diesel engines will be around 4.3 million units.

But there are still "variables" involved - the impact of new energy power on traditional power. Many engine giants are laying out the development of multi energy, pure electric, hybrid, and even hydrogen fuel, which is an irreversible trend.

Can the diesel engine market surpass last year's sales in 2024? How much will it increase? Let's take a look at the market development in the second half of the year.