How much did Dongfeng/XCMG reverse their upward trend? 59000 heavy-duty trucks sold in July | Headlines

The heavy-duty truck market has experienced a double decline on a month on month basis!

According to relevant data, in July 2024, China's heavy-duty truck market sold about 59000 vehicles (wholesale caliber, including exports and new energy), a decrease of 17% compared to June and a decrease of 4% compared to the previous year's 61300 vehicles, a decrease of about 2000 vehicles. Both year-on-year and month on month declines have made the heavy truck market appear quite bleak in July.

From January to July, China's heavy-duty truck market sold approximately 563500 vehicles of various types, an increase of 2% compared to the same period last year, with a net increase of nearly 14000 vehicles, and the cumulative growth rate further narrowed compared to January to June.

01

Poor monthly sales

Cumulative growth rate further narrows

In terms of sales, July is undoubtedly the off-season for the entire heavy-duty truck industry. With a sales volume of 59000 vehicles, even if viewed over the past 8 years, it is only slightly higher than July 2022 (45200 vehicles).

The reason for such a situation is related to several characteristics of the heavy truck industry in July. Firstly, in July, due to high channel inventory in the first half of the year, various car companies were reducing their inventory, resulting in relatively low wholesale sales in China.

Secondly, the pain points of the freight industry in July have not been greatly alleviated, and the entire industry is still shrouded in a market environment of low freight rates and low returns. The overall terminal demand is weak, making it difficult to achieve breakthrough sales.

In addition, although the export performance of non Russian regions supported the export market to remain above 23000 vehicles in June and July, the export sales of heavy trucks decreased slightly by about 7%, which still had a certain impact on the overall performance.

02

July Heavy Truck Ranking

Dongfeng/XCMG achieve counter trend growth

Although the overall sales of heavy trucks in July were slightly weak, some of the top ten companies in the industry still achieved a reverse increase.

Specifically, among the top ten companies, three have sold over 10000 units. Among them, China Heavy Duty Truck sold 16000 vehicles, becoming the industry leader. Jiefang and Shaanxi Automobile also achieved sales exceeding 10000 units, with sales of 12000 and 10000 units respectively. It is worth mentioning that three companies have achieved counter trend growth. Among them, the year-on-year growth rate of Liberation reached 43%, Dongfeng reached 4%, and XCMG reached 25%.

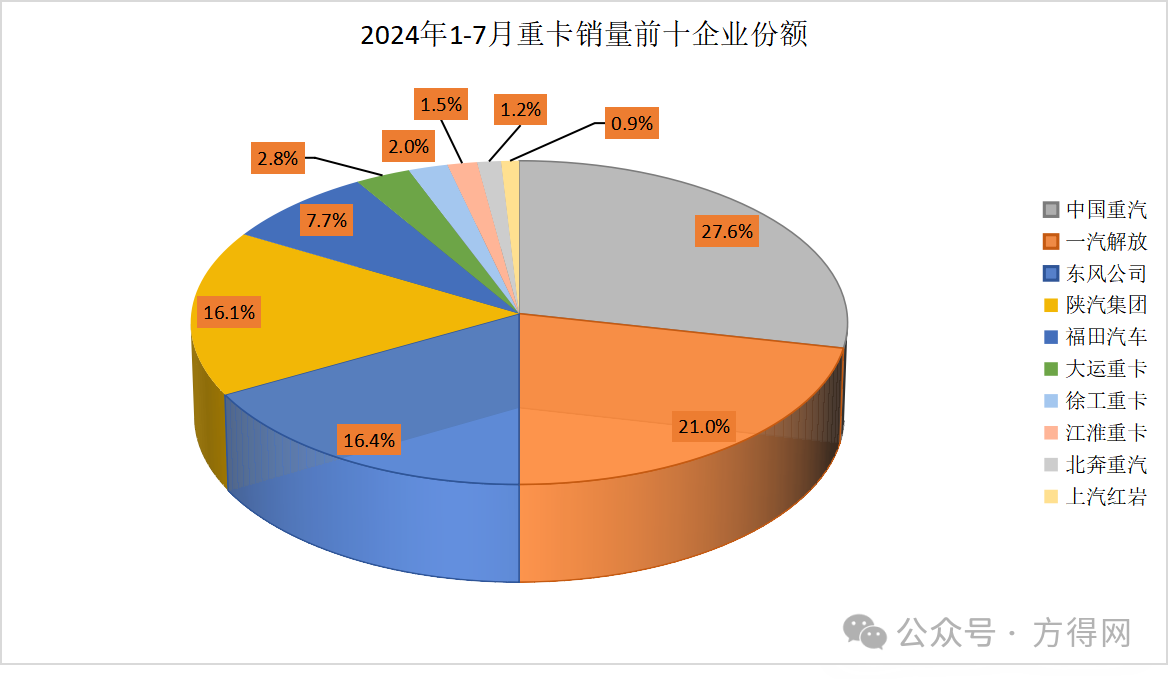

From a cumulative perspective, there are also 5 companies that have achieved year-on-year growth, namely Heavy Duty Truck Group, Liberation, Dongfeng, XCMG, and Beiben. Specifically, China National Heavy Duty Truck Group was the leader in July, with sales of approximately 16000 heavy-duty trucks, far ahead of the industry; Its cumulative sales from January to July were about 155400 vehicles, a year-on-year increase of 4%, and its market share rose to 27.6%, an increase of 0.3 percentage points.

FAW Jiefang ranked second, with sales of approximately 12000 heavy-duty trucks in July, a year-on-year increase of 43%; From January to July, the cumulative sales volume of Jiefang heavy-duty trucks was about 118100 units, a year-on-year increase of 8%, with a market share of about 21%, an increase of 1 percentage point year-on-year.

Dongfeng Corporation (including Dongfeng Commercial Vehicles, Dongfeng Liuqi Chenglong Automobile, Dongfeng Huashen, etc.) ranked third, with sales of approximately 8500 heavy-duty trucks in July, a year-on-year increase of 4% against the trend; From January to July, Dongfeng Motor Corporation sold approximately 92500 heavy-duty trucks, a year-on-year increase of 6%, with a market share of approximately 16.4%, maintaining the top three in the industry and a market share increase of 0.6 percentage points.

Shaanxi Automobile Group (including Shaanxi Automobile Heavy Trucks, Shaanxi Automobile Commercial Vehicles, etc.) ranked fourth, with sales of approximately 10000 heavy trucks in July and 90500 various types of heavy trucks from January to July, a year-on-year increase of 2%, and a market share of 16.1%.

Foton Motor (including Foton Daimler) ranks fifth, with a sales volume of about 5000 heavy trucks in July. From January to July this year, it has sold a total of about 43200 heavy trucks of various types, with a market share of about 7.7%.

Although the performance of the heavy truck market in July was not satisfactory, the mainstream enterprises were still relatively awesome. Therefore, the short-term decline in sales will not have a great impact on the confidence of the entire industry. The trade in policy will also become a driving force for the increase in sales in the heavy truck industry.

Based on the performance of various companies in the current market and policies, September to December 2024 will be a period of concentrated policy efforts, and diesel heavy-duty trucks and new energy heavy-duty trucks may usher in a new round of development opportunities. Therefore, the upcoming "Golden September and Silver October" in the heavy truck industry is still worth looking forward to.

Article source: Reprinted from Fangde.com