Heavy trucks drop by 18% in August, new energy rises by 90%, and exports rebound! Did the 'Golden Nine and Silver Ten' fail?

In August, the heavy truck market fell short of expectations. Can the heavy truck market reverse its decline in the next four months?

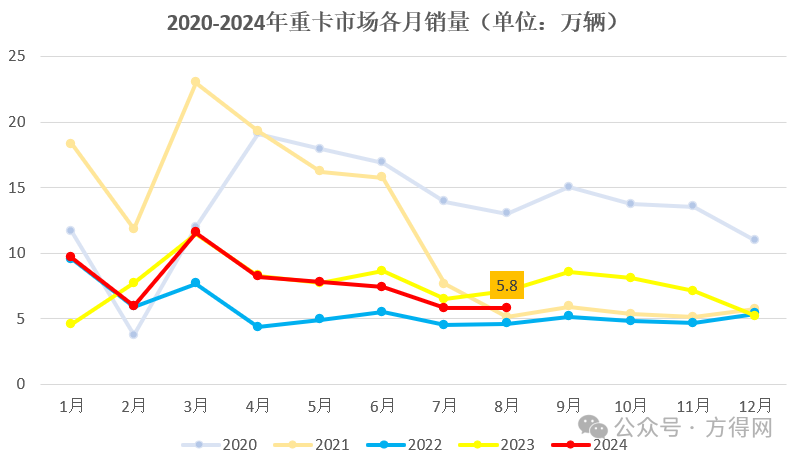

According to the latest data (wholesale sales, including exports and new energy), in August 2024, the heavy truck market sold approximately 58000 vehicles, a year-on-year decrease of 18% and unchanged from July; From January to August, the heavy-duty truck market sold a total of 621000 vehicles, which remained consistent with the same period last year. The growth of the heavy-duty truck market in 2024 seems to have hit the 'pause button'.

What are the characteristics of the heavy-duty truck market in August? What is the trend of the heavy-duty truck market in the next four months?

Sales of gas vehicles have declined

Continuous growth in exports and new energy

From the sales trend of the heavy-duty truck industry in the past 5 years, it can be seen that the heavy-duty truck industry maintained a high growth trend in the first quarter of 2024; The sales trend in the second quarter is similar to that of 2023; Since entering the third quarter, the sales of heavy trucks have been declining month by month, and their performance is not as good as the same period. If we take 2022 as a reference frame, the heavy truck industry maintained a high growth rate in 2023. From the continuously suppressed demand for car purchases in the first half of the year driving incremental replacement, to the opportunity of "oil to gas" driving industry growth in the second half of the year, the heavy truck industry can be said to have shown a significant recovery in 2023.

Looking at 2024, the sales of heavy trucks from January to August are still better than in 2022, with only a certain decline compared to the "higher growth" in 2023. Compared to 2023, on the one hand, the opportunity of "oil to gas" still exists: from January to May 2024, the sales trend of heavy trucks remained the same as last year; Since the market entered the off-season in June, sales have significantly declined compared to the same period last year.

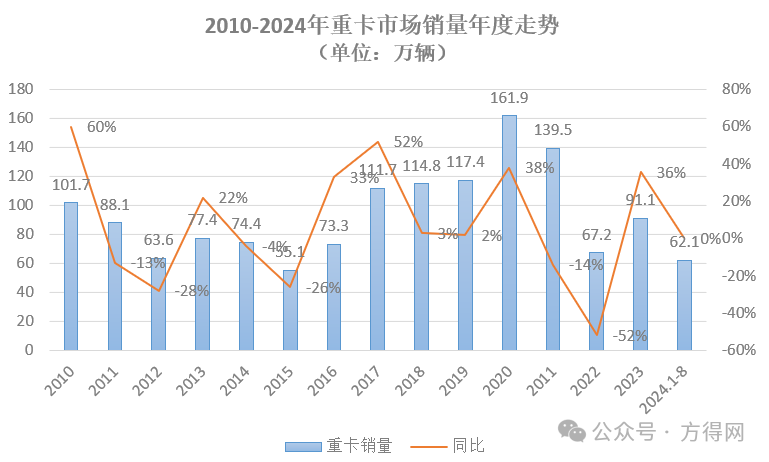

From the perspective of cumulative sales, 2024 is undoubtedly much better than the industry's "freezing point" in 2022. But compared to last year's "rapid rebound" to 910000 vehicles, the market performance from January to August 2024 is somewhat "unsatisfactory" - with cumulative sales of 621000, the cumulative growth rate is the same as the same period, which also raises doubts: can the heavy truck market do well in the next few months?

From the market performance in August, there are several characteristics worth paying attention to:

Firstly, due to the off-season for freight transportation and weak market demand, both wholesale and retail sales of heavy trucks declined in August. This also indicates that there is still a "destocking" work in the industry. But unlike 2022, the vehicle structure has undergone significant adjustments: some National VI fuel vehicles, small batches of National V vehicles, and gas vehicle products within risk control. In 2024, users will return to rationality, and dealers will also be more restrained and cautious. Analysis reasons: On the one hand, during the off-season of freight transportation, users have insufficient driving force to purchase cars; On the other hand, the introduction of policies such as "trade in" and the narrowing of the "oil and gas price difference" brought about by the rebound of natural gas prices and the reduction of diesel prices have to some extent increased users' wait-and-see attitude towards purchasing cars - users who have the need to replace their cars are looking forward to the implementation and expansion of subsequent policies; Some users are also concerned about the continued rise in prices of gas vehicles in the future.

Secondly, new energy heavy-duty trucks maintain momentum, with expected terminal sales of over 5500 units, a year-on-year increase of over 90%. In addition, in terms of overseas exports, heavy truck export sales in August ended the "weakness" of June and July and returned to an upward trend, with an expected growth rate of over 13%.

Can the "Golden September and Silver October" come as scheduled?

Firstly, based on the recent trend of heavy truck sales, the growth of heavy truck sales in 2024 remains high compared to 2022. But compared to the almost year-round "high-speed growth" of heavy trucks in 2023, the "spring" of heavy trucks in 2024 may have reached its maximum energy storage moment. Fangde.com believes that the contraction of sales in the heavy-duty truck market from June to August may stimulate a significant increase in the heavy-duty truck market in the next four months.

Firstly, from the perspective of the highly anticipated "trade in" policy by the market and industry, although some manufacturers have introduced trade in subsidies, the implementation of local policies still requires some time. Based on the interviews conducted by the previous website with dealers, it can be seen that there have been many users paying attention to and inquiring about the implementation of relevant policies. It is expected that the policy implementation period will lead to a higher demand for replacement among users. From this, it can be seen that year-end sales may experience a "tail up" growth driven by policies.

Secondly, the current demand in the freight market is not strong; At the same time, the rise in gas prices has suppressed users' demand for replacement, including users' expectations for the introduction of the National IV Policy and other predictive psychological influences, which may affect the quality of the "Golden September and Silver October" in 2024. Taking Shanghai as an example, due to the "trade in" policy implemented in Shanghai, which covers the national quadruple truck market, many users, including those from surrounding areas, choose to purchase and enjoy subsidies in Shanghai. Some opinions point out that the current operating national triple truck industry has between 200000 and 300000 vehicles. The number of users who can meet the subsidy scope and also purchase new cars may only be around tens of thousands.

In addition, the "three carriages" will not weaken and are expected to release even greater increments in the future. In terms of gas vehicles, some western dealers have stated that a pricing system based on gas price standards has basically been formed, especially for long-distance logistics transportation, which will still mainly rely on exchanging for gas vehicles. Although some regions have achieved the transition from oil to gas, some institutions predict that there is still a possibility of significant growth in regions such as East China. But it cannot be denied that due to policy influences, such as the recovery of some lost ground by fuel vehicles such as cargo trucks, the proportion of gas vehicles may decrease to a certain extent. In terms of new energy, it is expected that with the change of weather, some steel mills and coal plants will stockpile fuel, and the growth of new energy heavy-duty trucks is expected to accelerate in the next four months. Exports are expected to maintain growth in September.

According to feedback from dealers, there is more uncertainty in the heavy truck market in 2024. The frequent changes in demand and policy have made market demand even more confusing. But the indispensable demand for freight transportation will still give rise to more opportunities and challenges.