Diesel engines sold 2.71 million units in the first eight months, with Weichai's market share exceeding 18%. Yuchai/Yunnei competes for second place, with Dongkang increasing by 7%. Headlines

In August, diesel engines turned negative on a month on month basis to positive. In the last month of the second quarter, who grew against the trend?

In August, the commercial vehicle market and even the truck market achieved varying degrees of month on month growth, thanks to which the diesel engine market also rose.

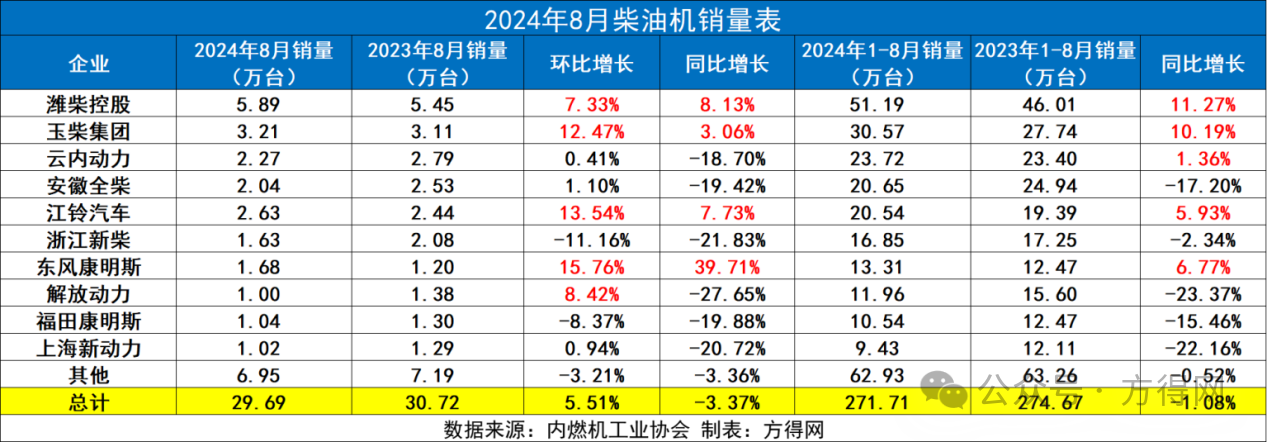

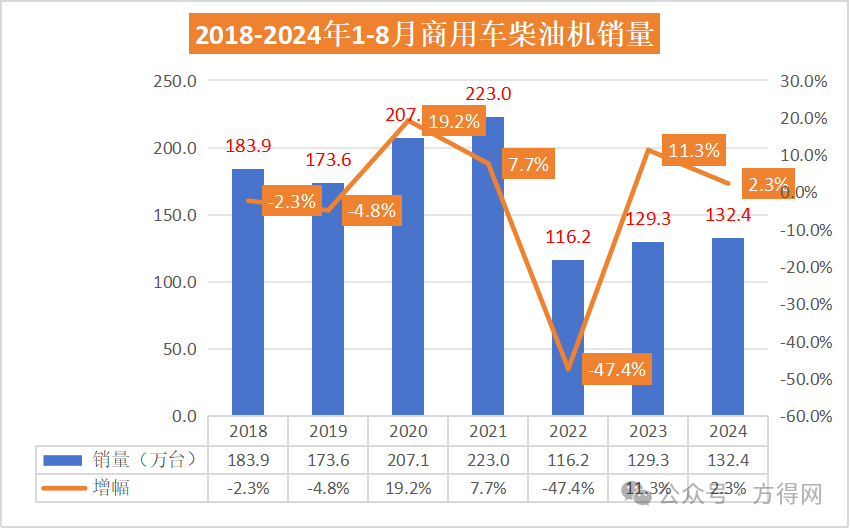

According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in August 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) reached 307200 units, a month on month increase of 5.51% and a year-on-year decrease of 3.37%; The cumulative sales volume from January to August was 2.7171 million units, a year-on-year decrease of 1.08%.

How have the top ten companies performed? Which segmented markets have surpassed the overall market growth rate?

August month on month conversion to regular

Expected to reach 3.9 million units by 2024

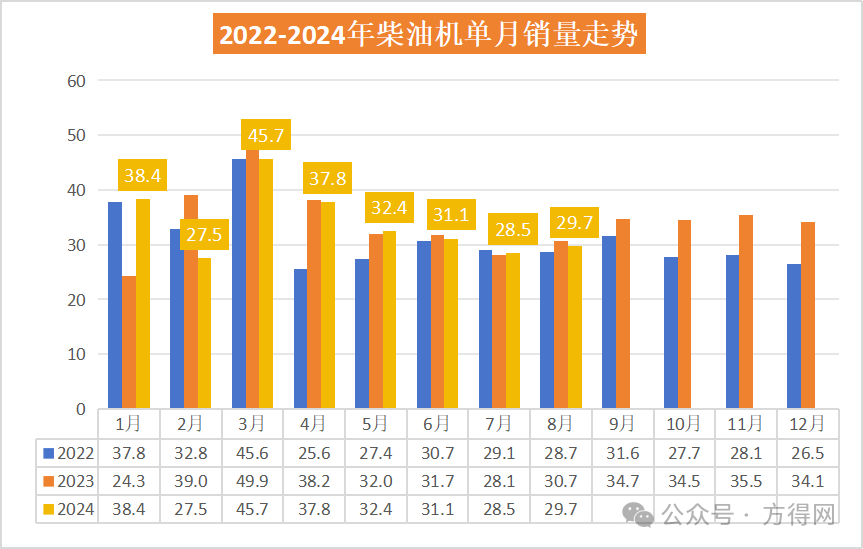

From January to August 2024, the diesel engine market showed a "V" trend in the first quarter, reaching its peak sales of 457000 units in March. Since April, monthly sales have continued to decline, and until July, there has been a month on month decline.

In August, the diesel engine market hit the brakes on its downward trend, although there was a slight year-on-year decrease, it turned positive for the first time compared to the previous month. This also sets the stage for the upcoming 'Golden September and Silver October'.

In August 2024, the diesel engine market showed a complex trend of a month on month growth of 5.51%, but a year-on-year decline of 3.37%. This phenomenon may be influenced by the following factors:

Firstly, there is a change in demand in the terminal market. The commercial vehicle market increased month on month in August, but decreased year-on-year, resulting in a cumulative year-on-year decline. This may be related to the seasonal demand and macroeconomic environment of the commercial vehicle market. The overall sales of commercial vehicles in August were 271900 units, a month on month increase of 1.38%, but a year-on-year decrease of 12.18%. This is basically consistent with the trend of diesel engines.

Secondly, the increasingly strict requirements for energy conservation and emission reduction in national policies have promoted the improvement and upgrading of diesel engine technology. Meanwhile, some regions may have implemented stricter emission standards, which have affected the sales of diesel engines. For example, the "2024-2025 Energy Conservation and Carbon Reduction Action Plan" released by the State Council proposes strict energy conservation and carbon reduction targets, which may prompt some companies to turn to more environmentally friendly energy solutions, thereby affecting the sales of diesel engines.

In industries such as construction machinery and agricultural machinery that use diesel engines, except for commercial vehicles, there was a month on month decline in August. The downturn in these industries or temporary reduction in market demand also affected the sales of diesel engines.

In August, the sales volume of multi cylinder diesel engines for construction machinery was 57500 units, a month on month increase of -7.85% and a year-on-year increase of -10.30%; The cumulative sales volume from January to August was 556700 units, a year-on-year increase of 4.27%.

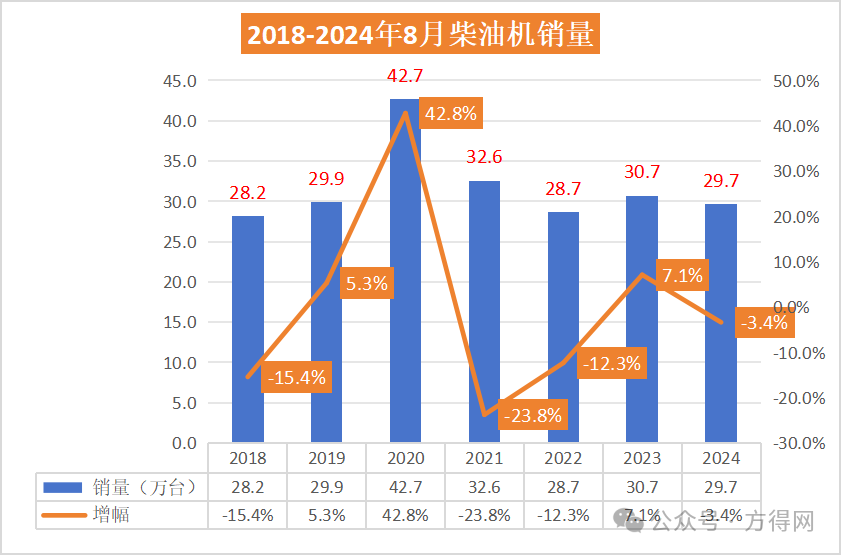

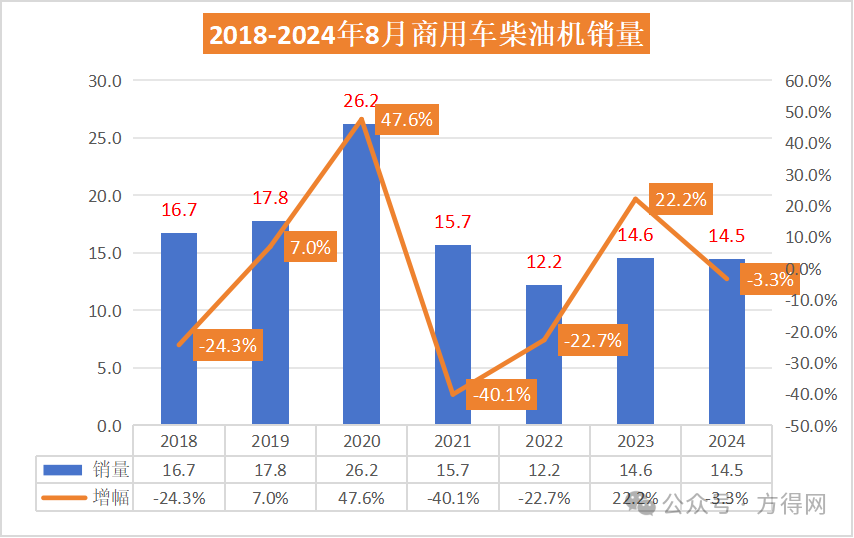

Looking at the sales and growth trend chart of diesel engines in August over the past 7 years, it can be seen that the average monthly sales in August were around 300000 units, with the lowest year being August 2018, the lowest point in five years. Although sales in August 2024 are slightly higher than in 2018, they are still at a relatively low level in recent years.

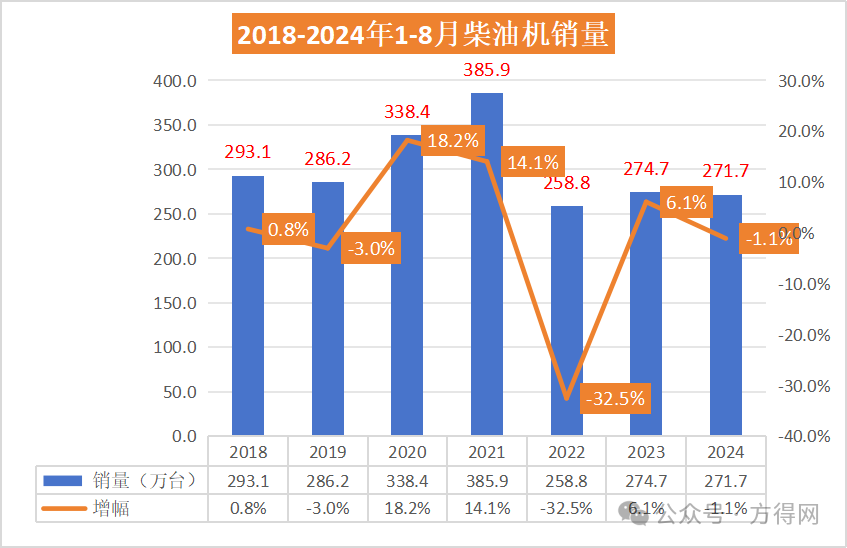

In terms of cumulative sales, from January to August 2024, the cumulative sales of diesel engines were 2.717 million units, ranking 6th in the past 7 years. In 2019 before the epidemic, the sales volume of diesel engines from January to August was 2.8618 million units. In 2024, the sales volume of diesel engines from January to August was 150000 units less than the average year, and it will take time to return to pre epidemic levels.

Weichai Double Increase leads the way

Dongfeng Cummins increases by 40%

In August 2024, four of the top ten companies in the diesel engine market showed positive year-on-year growth, with Weichai, Yuchai, Jiangling, and Dongfeng Cummins surpassing industry growth and outperforming the market.

From the perspective of competitive landscape, in August 2023, the top five diesel engine companies were Weichai, Yuchai, Quanchai, Jiangling, and Yunnei, while in August 2024, the top five companies were Weichai, Yuchai, Jiangling, Yunnei, and Quanchai. During the year, Jiangling ranks third and Yunnei ranks fourth.

In terms of sales, in August 2024, Weichai was the only company with monthly sales exceeding 50000 units; Yuchai sold 32100 units, widening the gap with the third and fourth places; Jiangling Motors, Yunnei, and Quanchai all have monthly sales of over 20000 units; The top ten companies have monthly sales exceeding 10000 units.

Compared to last month, 8 out of 10 companies achieved positive growth month on month, 7 more than last month; Enterprises with growth rates exceeding the overall market include Weichai, Yuchai, Jiangling, Dongfeng Cummins, and Jiefang, among which Dongfeng Cummins has the highest growth rate in the industry.

In terms of cumulative sales, from January to August 2024, only Weichai had a cumulative sales volume exceeding 500000 units; Yuchai has over 300000 units, while Yunnei, Quanchai, and Jiangling have over 200000 units; Xinchai followed closely behind with 170000 units; The cumulative sales of the top ten companies are all around 100000 units. The sales gap between Jiefang, Fukang, and Shangchai is relatively small, and the competition is fierce.

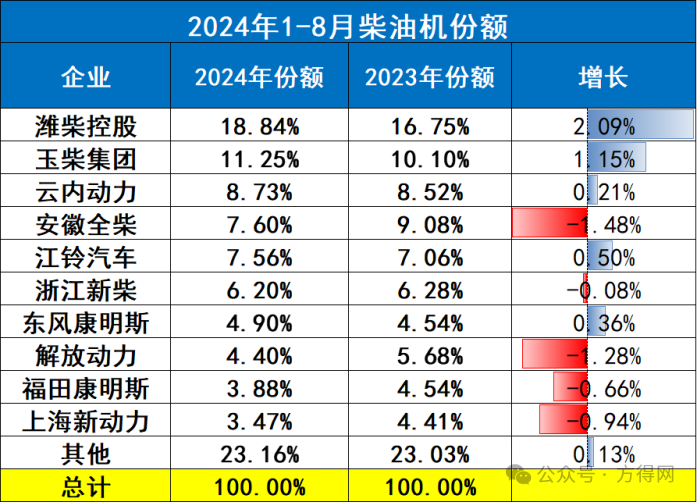

From the perspective of enterprise share, Weichai has been leading the industry from January to August 2024, accounting for 18.84% of the market share and the only company in the industry with a market share exceeding 18%. There is only one company, Yuchai, with a market share exceeding 10%. Among them, Weichai, Yuchai, Yunnei, Jiangling, and Dongkang's market share increased year-on-year, with Weichai's market share growing by 2.09%, the highest growth rate in the industry.

From January to August 2024, the proportion of the top ten companies in the industry (76.83%) slightly decreased compared to last year (76.96%), while the proportion of the top five companies (53.98%) increased compared to last year (51.51%). This means that the strong will always be strong, the Matthew effect is obvious, and the share of the last five diesel engine companies has decreased, which means that the top ten foreign companies are "eyeing" the share of the top ten, and the competition for the latter is fierce.

Commercial vehicle diesel engines increased by 11% month on month

Cloud led the year-on-year increase

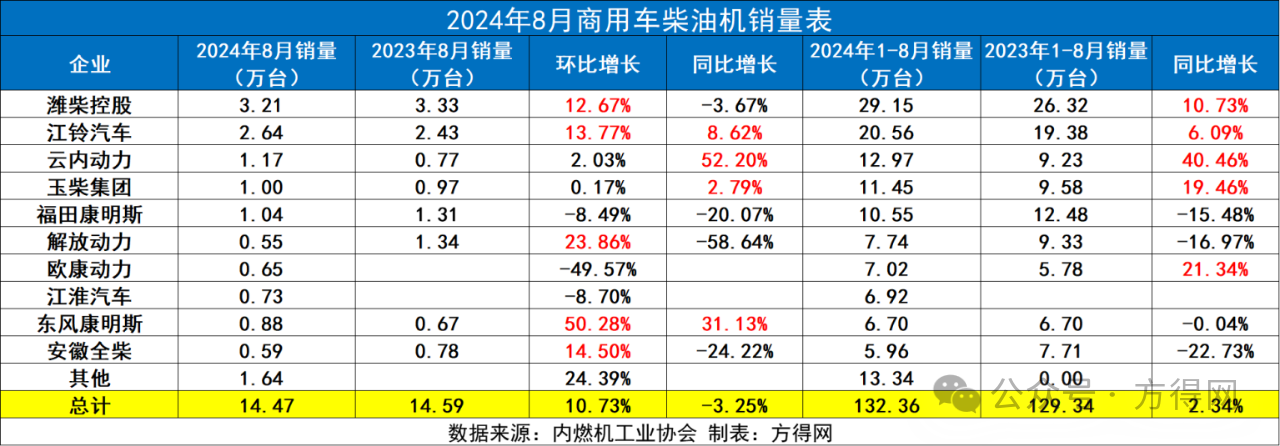

In 2024, the trend of the commercial vehicle diesel engine market is consistent with that of the commercial vehicle market, with a month on month growth and a further expansion of the year-on-year decline. The monthly sales of commercial vehicle diesel engines in August were 144700 units, a year-on-year decrease of 3.25%, a month on month increase of 10.73%, and a cumulative sales increase of 2.34%.

In August 2024, the sales of commercial vehicle diesel engines ranked second to last in the past seven years, 22000 units lower than before the 2018 pandemic. The year-on-year decline trend is consistent with the trend of the commercial vehicle industry. According to data from the China Association of Automobile Manufacturers, the overall commercial vehicle industry decreased by 14.16% year-on-year, and the truck industry decreased by 14.16% year-on-year. The decline in the diesel engine market is smaller than that of the commercial vehicle market and the truck market.

From January to August 2024, the sales volume of commercial vehicles in the market was 2.6086 million units, and the sales volume of commercial vehicle diesel engines was 1.324 million units. From January to August 2023, the sales volume of commercial vehicles in the market was 2.568 million units, and the sales volume of commercial vehicle diesel engines was 1.293 million units, with an assembly ratio increase of 0.4%. The market share of commercial vehicles equipped with diesel engines is growing. Although the natural gas and new energy power markets are hot, diesel engines are still the mainstream of the commercial vehicle market.

In August 2024, seven of the top ten companies in the commercial vehicle diesel engine market achieved positive growth compared to the previous month, with Weichai, Jiangling, Jiefang, Dongkang, and Quanchai surpassing the overall market growth rate. Among them, Dongfeng Cummins had the highest month on month growth, increasing by 50.28%. This is not only due to Dongfeng Cummins' continuous technological upgrades and product innovation, but also its integrated power chain products, with their efficient and environmentally friendly technological advantages, have successfully seized market opportunities. At the same time, the expansion of Dongfeng Cummins in overseas markets has also contributed to its sales growth. Its products are increasingly competitive in the international market, especially in countries along the "the Belt and Road".

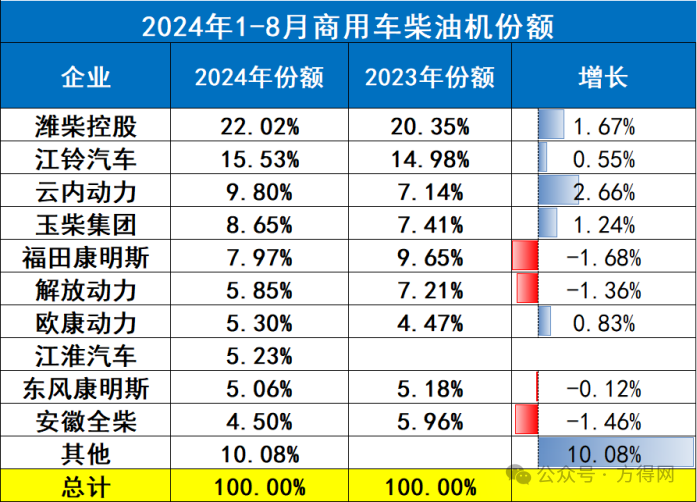

The top ten commercial vehicle diesel engine sales in August 2024 are Weichai, Jiangling, Yunnei, Yuchai, Fukang, Jiefang Power, Oukang Power, Jianghuai, Dongkang, and Quanchai, with the top ten accounting for 89.92% of total sales; Weichai holds a leading market share of 22.02%, Jiangling 15.53%, Yunnei 9.80%, Yuchai 8.65%, Fukang 7.97%, Jiefang Power 5.85%, Oukang 5.30%, Jianghuai 5.23%, Dongkang 5.06%, and Quanchai 4.50% in the commercial vehicle multi cylinder diesel engine market.

Among them, 5 enterprises achieved an increase in market share, with the highest growth rate of 2.66% in cloud market share.

In August 2024, the top five companies in the commercial vehicle diesel engine market had a share of 63.97%, while in August 2023, the share was 59.53%, a year-on-year increase of 4.44%. The distribution of the top five companies returned to the "one dominant and many strong" situation, with Weichai's share exceeding 22%. The share of the top ten companies was also higher than that of 2022, indicating that many old players are still strong.

In August 2024, the diesel engine market and commercial vehicle market showed consistent trends, with a month on month positive trend and a year-on-year decline widening. But this slight increase is not enough to bring the diesel engine market back to pre pandemic levels, with an expected annual sales of around 3.9 million units.

Will the upcoming 'Golden September and Silver October' perform better? Worth looking forward to.