Industry data | Weichai leads with 620000 units, Yuchai leads with a 12% increase, Dongkang stabilizes in the top seven! Diesel engines are expected to sell 3.9 million units throughout the year

Silver Ten fell short, diesel engines decreased by 16% year-on-year in October!

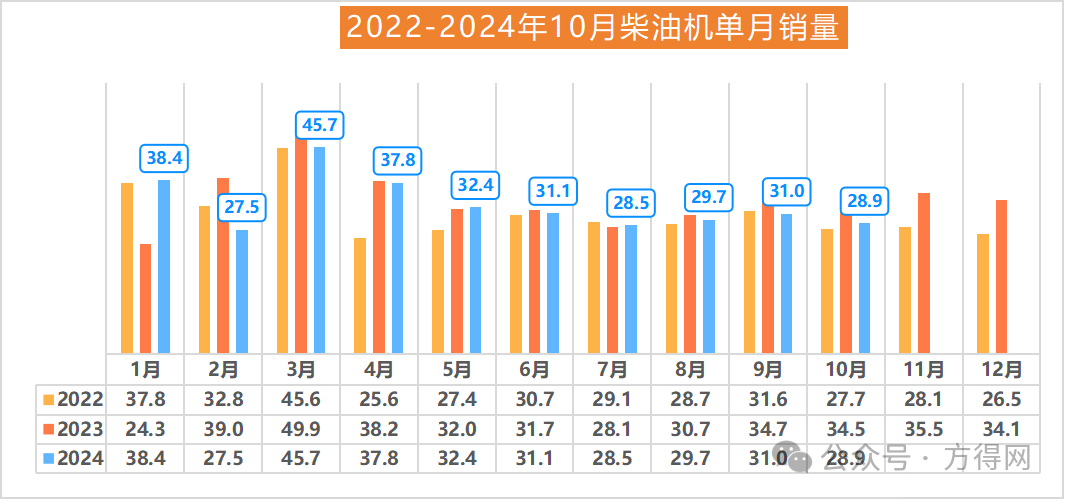

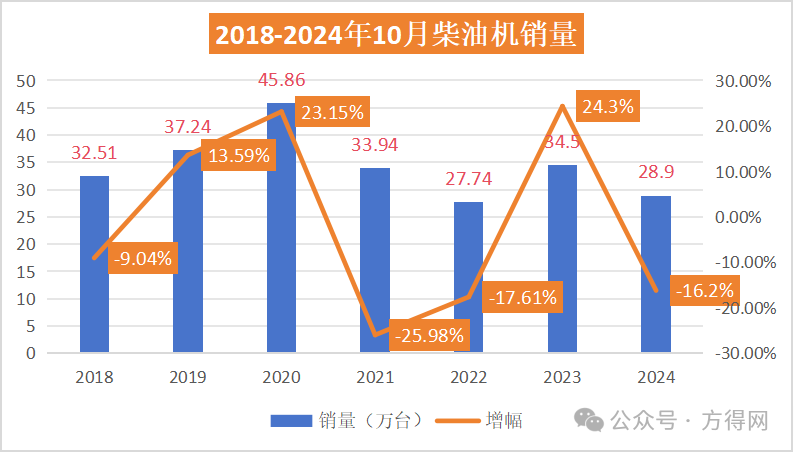

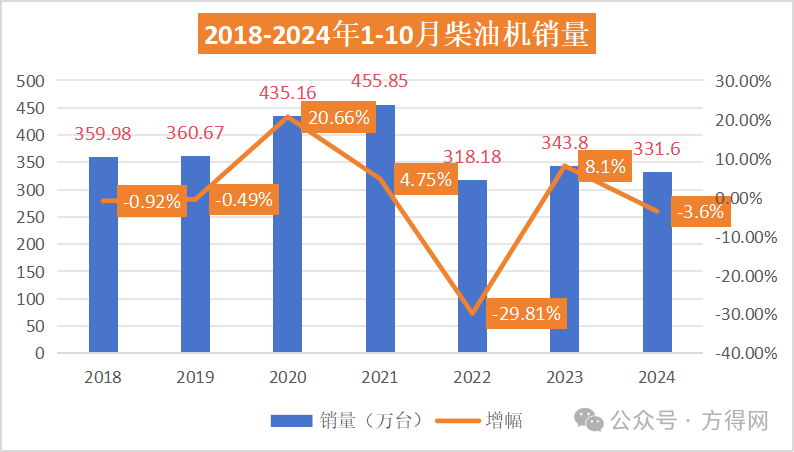

The "Silver Ten" did not bring miracles to the diesel engine market. According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in October 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) were 299100 units, a month on month decrease of 6.67% and a year-on-year decrease of 16.2%; The cumulative sales volume from January to October was 3.316 million units, a year-on-year decrease of 3.57%.

Against the backdrop of a market downturn, who is growing against the trend?

Sales in October decreased by 26% year-on-year

Difficult to break through 4 million units in 2024

In October 2024, the diesel engine market showed a downward trend. Since July, monthly sales have remained stable at around 300000 units, but after a brief increase in September, they have fallen below 300000 units again.

October is approaching Double 11, which is the peak season for the commercial vehicle and even truck markets, but the peak season is not prosperous, resulting in a lukewarm diesel engine market related to it. According to data from the China Association of Automobile Manufacturers, commercial vehicle sales reached 298000 units in October 2024, a year-on-year decrease of 18.3%. From January to October, commercial vehicle sales reached 3.19 million units, a year-on-year decrease of 3.4%.

Multi cylinder diesel engines are widely used in the field of commercial vehicles, and the demand situation in the commercial vehicle market has a significant impact on the multi cylinder diesel engine market. Under the macroeconomic situation in 2024, the commercial vehicle market is facing problems such as weak logistics and transportation demand, rising transportation costs, which have led to a decline in commercial vehicle sales and reduced demand for multi cylinder diesel engines.

Among them, the heavy truck market experienced the largest decline of 21%, while the light truck market fell by 1.6%. Due to the sluggish commercial vehicle market, the diesel engine market also performed worse than expected.

In addition, construction machinery is also one of the important application areas of multi cylinder diesel engines. In 2024, due to factors such as real estate market regulation and a slowdown in infrastructure investment growth, the demand for construction machinery in the market is sluggish, with a decrease in new construction projects and a slower pace of equipment upgrades, resulting in a corresponding decrease in demand for multi cylinder diesel engines.

In October, the sales volume of multi cylinder diesel engines for construction machinery was 64200 units, a month on month increase of -9.74% and a year-on-year increase of -8.40%; The cumulative sales volume from January to October was 692100 units, a year-on-year increase of -4.25%.

Looking at the sales and growth trend chart of diesel engines in October over the past five years, it can be seen that the average monthly sales in October were around 350000 units, with the lowest year being October 2022, which is the lowest point in five years.

In terms of cumulative sales, from January to October 2024, the cumulative sales of diesel engines were 3.316 million units, ranking second to last in the past five years. In 2019 before the epidemic, the sales volume of diesel engines from January to October was 3.6067 million units. In 2024, the sales volume of diesel engines from January to October was nearly 300000 units less than the average year. Although 2024 is higher than 2022, it is difficult to restore the pre epidemic level.

Weichai leads with 620000 units

Yuchai leads a 12% increase

Dongkang is among the top seven in terms of stable growth against the market trend

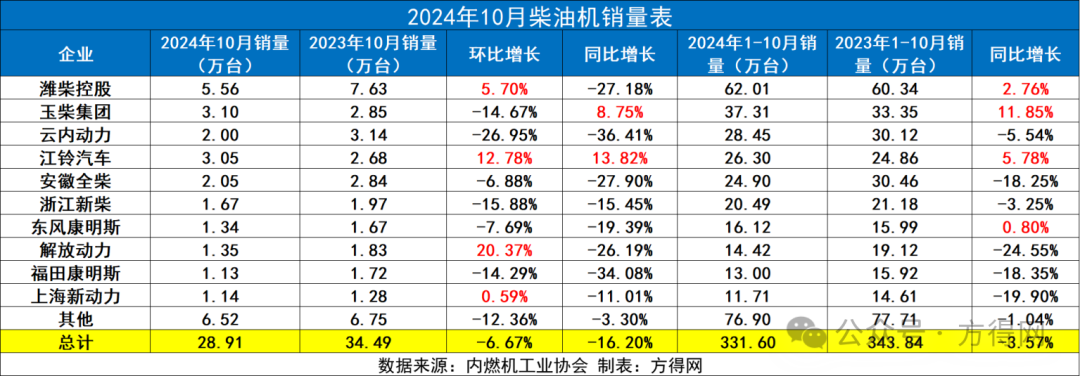

In October 2024, the top ten companies in the diesel engine market, Yuchai and Jiangling, grew against the trend, with growth rates of 8.75% and 13.82%, respectively. The decline in the price of new and old diesel is lower than that of the industry.

From the perspective of competitive landscape, in October 2023, the top five diesel engine companies were Weichai, Yunnei, Yuchai, Jiangling, and Quanchai, while in October 2024, the top five companies were Weichai, Yuchai, Jiangling, Quanchai, and Yunnei. In October 2024, Yuchai ranked second, Jiangling entered the top three in monthly sales, and Quanchai jumped to fourth place.

In terms of sales, in October 2024, Weichai was the only company with monthly sales exceeding 50000 units; Yuchai and Jiangling have a monthly sales volume of over 30000 units. The sales of Quanchai and Yunnei exceeded 20000 units. The top ten companies have monthly sales exceeding 10000 units.

Compared to last month, 4 out of 10 companies achieved positive growth month on month; Enterprises with higher growth rates than the overall market include Weichai, Jiangling, Jiefang, and Shangchai. Among them, Jiefang Power has the highest growth rate in the industry.

In terms of cumulative sales, from January to October 2024, only Weichai had a cumulative sales volume exceeding 620000 units; There is one Yuchai company with over 300000 units; Yunnei, Jiangling, Quanchai, and Xinchai have accumulated sales exceeding 200000 units; Dongkang, Jiefang, Fukang, and Shangchai have all sold over 100000 units cumulatively.

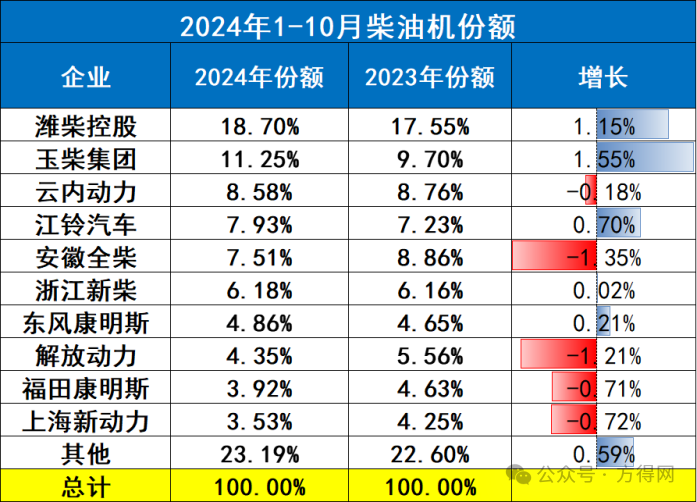

From January to October 2024, Weichai has been leading the industry with a market share of 18.7%, making it the only company in the industry with a market share exceeding 18%. There was another time when the share exceeded 10%, with a share of 11.25%.

Among them, Weichai's share increased by 1.15% year-on-year, while Yuchai's share increased by 1.55%, the highest growth rate in the industry. Jiangling, Xinchai, and Dongkang have also experienced varying degrees of market share growth.

From January to October 2024, the proportion of the top ten companies in the industry (76.81%) decreased compared to last year (77.35%).

However, the share of the top five companies has increased compared to last year, which means that the Matthew effect of the top five companies is obvious, and the strong will always be strong. Against the backdrop of a downturn in the industry, the advantages of the group army in combat have once again expanded, and the enterprises with increased market share are mostly among the top five.

Commercial vehicle diesel engines slightly increased by 2% compared to the previous period

The highest increase in cloud share

In October 2024, the commercial vehicle market showed the most significant decline in heavy trucks, followed closely by the growth rate of light trucks, while passenger cars saw a slight increase.

The market trend of commercial vehicle diesel engines is consistent with the commercial vehicle market, and the decline has further expanded. In October, the monthly sales of commercial vehicle diesel engines were 195000 units, a year-on-year decrease of 26.45% (expanding the decline compared to 21.83% last month), and the cumulative sales decreased by 3.72% year-on-year, also expanding the decline.

This also makes commercial vehicle diesel engines the lowest point in five years except for 2022 in October 2024.

From January to October 2023, the sales volume of commercial vehicles in the market was 3.303 million units, and the sales volume of commercial vehicle diesel engines was 1.672 million units. In 2024, the sales volume of commercial vehicles in the market was 3.19 million units, and the sales volume of commercial vehicle diesel engines was 1.61 million units. The assembly ratio decreased by 0.2%, almost the same as last year.

In October 2024, four of the top ten companies in the commercial vehicle diesel engine market achieved positive growth compared to the previous month. Among them, Jiefang Power had the highest month on month growth, with a growth rate of 56%. Weichai, Jiangling, and Quanchai also achieved counter trend growth.

In October 2024, Weichai had the highest sales volume in the commercial vehicle diesel engine market, with a monthly sales volume of 31400 units, ranking first in the industry. Jiangling sold 30300 units per month; Fukang and Yuchai both have monthly sales of around 11300 units, with a difference of only a few dozen units, ranking third and fourth.

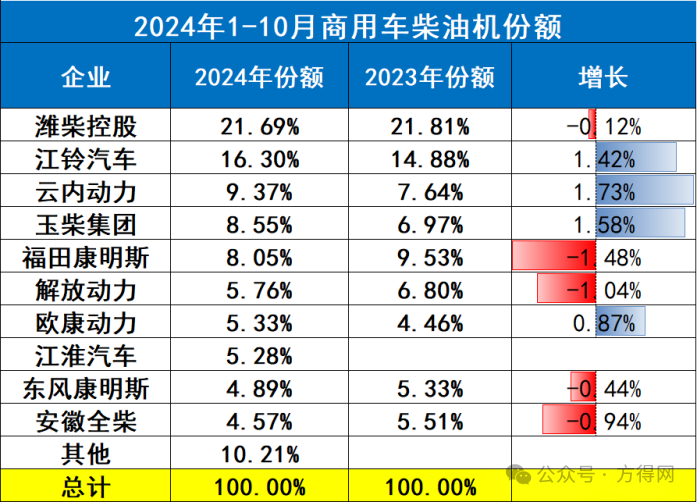

In terms of market share, the top ten sellers are Weichai, Jiangling, Yunnei, Yuchai, Fukang, Jiefang Power, Oukang Power, Jianghuai, Dongkang, and Quanchai, accounting for 89.79% of the total sales; Weichai holds a leading market share of 21.69% in the multi cylinder diesel engine market for commercial vehicles, followed by Jiangling Motors at 16.30% and Yunnei at 9.9% 37%, Yuchai 8.55%, Fukang 8.05%, Jiefang Power 5.76%, Oukang 5.33%, Jianghuai 5.28%, Dongkang 4.89%, and Quanchai 4.57%. Among them, Jiangling Motors, Yunnei, Yuchai, and Oukang achieved an increase in market share, with Yunnei experiencing the highest growth rate of 1.73%.

From January to October 2024, the top five commercial vehicle diesel engine companies accounted for 63.96% of the market share, while in October 2023, the top five companies accounted for 60.83%, a year-on-year increase of 3.13%.

At the same time as Weichai returns to the top of the industry, its market share has once again exceeded 21%. The top ten companies also have a higher share than in 2023, indicating that veteran diesel engine companies will make significant efforts in 2024, be very stable, and have stronger risk resistance capabilities.

The performance of "Silver Ten" as the last growth opportunity at the end of the year in October 2024 was unsatisfactory, and it is predicted that the number of diesel engines is expected to exceed 4 million by 2024, around 3.9 million.