Industry data | Diesel engines sold 3.65 million units in the first 11 months, Weichai led the rise with 690000 units, Yuchai maintained stable growth, and Dongkang saw a reverse increase of 2%

Double 11 has added fuel to the diesel engine market, with diesel engines increasing by 14% month on month in November!

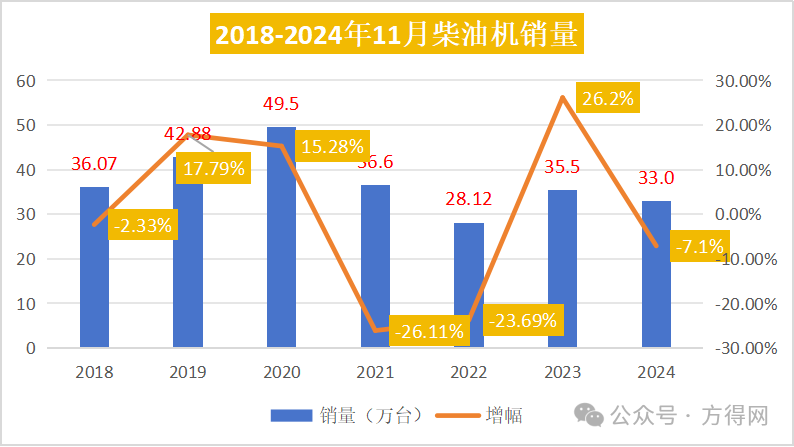

The last 'opportunity' before the year was seized by the diesel engine market. According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in November 2024, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) reached 354800 units, a significant increase of 14% compared to the previous month. This was the highest month of growth in the second half of this year, but still decreased by 7.11% year-on-year, only higher than 2022 and the lowest level in nearly five years.

While looking forward to 2025, how will each company perform in 2024? Who is experiencing industry growth?

Expected 4 million units for the whole year of 2024

There are growth opportunities in 2025

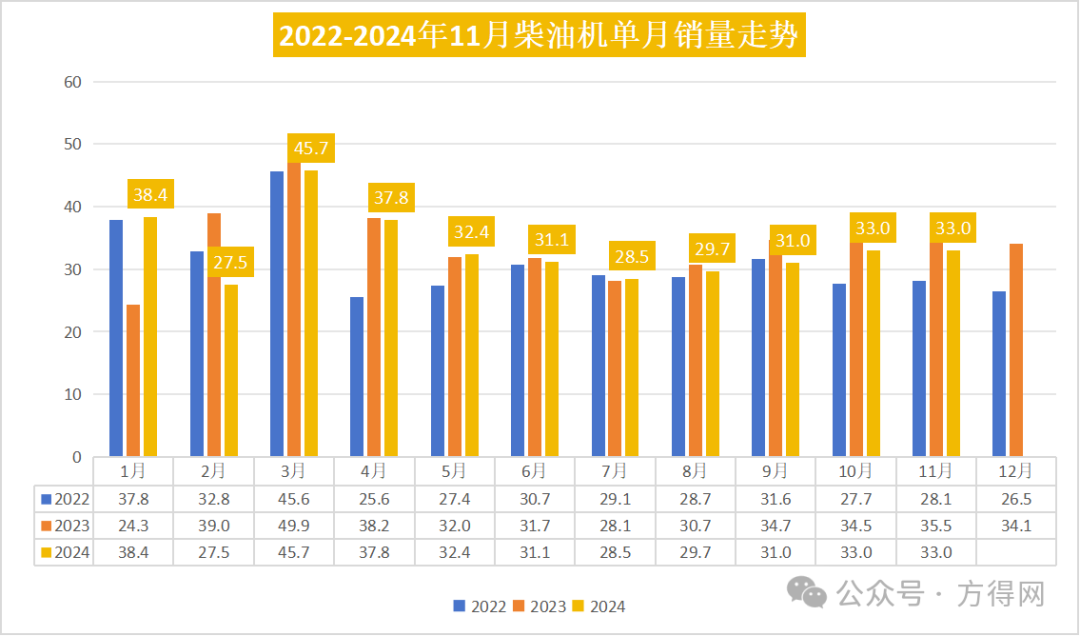

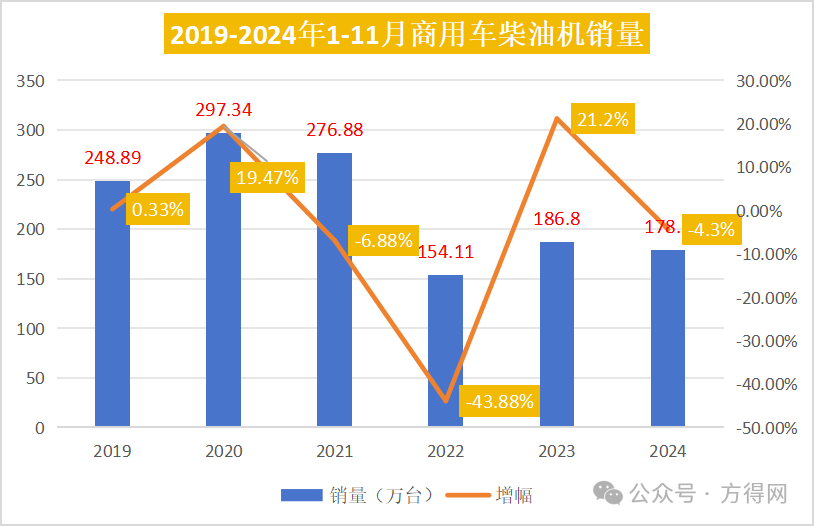

From January to November 2024, the trend of the diesel engine market is relatively stable. After reaching its peak in March, it continued to decline, and after reaching its lowest point in July, there was another upward trend. But almost the sales are hovering around 300000 units, and none of them have exceeded the same period last year.

November is the peak season for the logistics market, and this momentum has also been brought to the commercial vehicle market. According to data from the China Association of Automobile Manufacturers, in November, domestic sales of commercial vehicles reached 315000 units, an increase of 5.6% compared to the previous month; Sales of heavy-duty trucks reached 71000 units, a month on month increase of 7%; The light truck market grew by 3.9% month on month.

In addition to the commercial vehicle market, the engineering and other markets have shown significant signs of recovery. Excavators grew by 17.9%, while exports increased by 15.2%, both driving sales of construction machinery diesel engines. In November, the sales volume of multi cylinder diesel engines for construction machinery was 71500 units, an increase of 11.25% month on month and a year-on-year increase of -4.77%; The cumulative sales volume from January to November was 763600 units, a year-on-year increase of -4.30%.

The continuous growth of the commercial vehicle market, coupled with the Double 11, has been driven by factors such as the proximity of the "Double 11" promotional activities in the postal, Internet software and information technology services industries. During this period, auto shows and corporate promotional activities played a certain role, driving the consumption of some users who just need. Therefore, there was a significant increase in multi cylinder diesel engines in November compared to October.

But short-term growth still cannot 'catch up' with the sales gap of previous years.

Looking at the sales and growth trend chart of diesel engines in November of the past 7 years, it can be seen that the average monthly sales in November were all above 350000 units, with the lowest year being November 2022. Although the sales in November 2024 were higher than those in 2022, there was still a gap compared to the average sales in previous years.

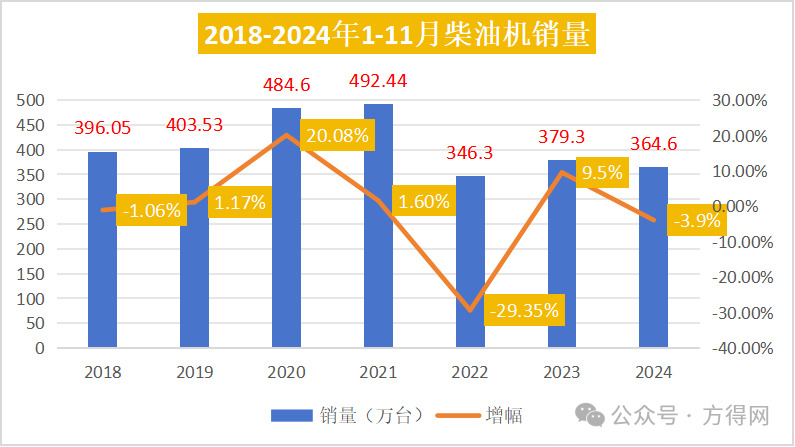

In terms of cumulative sales, from January to November 2024, the cumulative sales of diesel engines were 3.646 million units, ranking second to last in the past seven years. In 2019 before the epidemic, the sales volume of diesel engines from January to November was 4.03 million units. In 2024, the sales volume of diesel engines from January to November was 350000 units less than the average year. Although 2024 is higher than 2022, it will take time to reach the level of previous years.

Weichai leads with 690000 units

Yuchai has the highest year-on-year growth rate

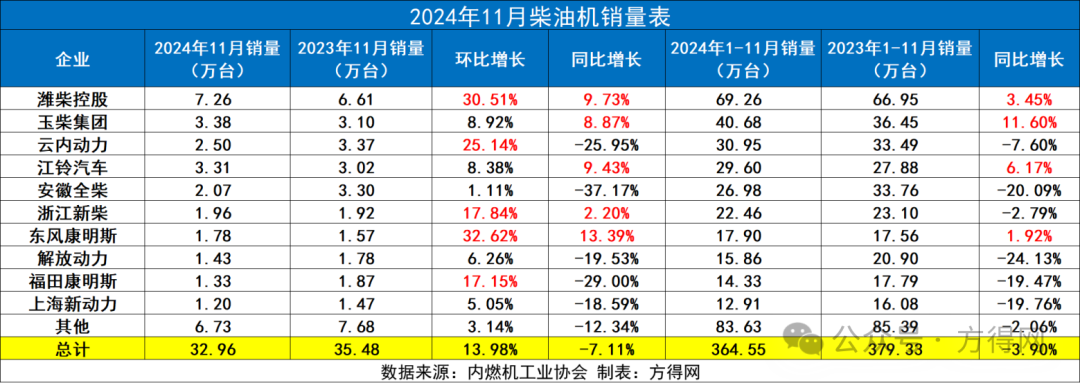

In November 2024, five of the top ten companies in the diesel engine market showed positive year-on-year growth, among which Weichai, Yuchai, Jiangling, Xinchai, and Dongkang grew against the trend and outperformed the market.

From the perspective of competitive landscape, in November 2023, the top five diesel engine companies were Weichai, Yunnei, Quanchai, Yuchai, and Jiangling, while in November 2024, the top five companies were Weichai, Yuchai, Jiangling, Yunnei, and Quanchai. In 2024, Yuchai will take second place and Jiangling will leap to third place.

In terms of sales, in November 2024, Weichai was the only company with monthly sales exceeding 70000 units; Yuchai and Jiangling have a monthly sales volume of over 30000 units; Enterprises with over 20000 units include Yunnei and Quanchai, followed closely by Xinchai and Dongkang in terms of sales volume.

Compared to last month, all 10 companies achieved positive growth month on month, with Weichai, Yunnei, Xinchai, Dongkang, and Fukang showing higher growth rates than the overall market. Among them, Dongkang has the highest growth rate in the industry.

In terms of cumulative sales, from January to November 2024, only Weichai had a cumulative sales volume of nearly 700000 units; Only Yuchai has over 400000 units, while Yunnei and Jiangling have around 300000 units respectively; The cumulative sales of whole diesel and new diesel have exceeded 200000 units; Dongkang, Jiefang, Fukang, and Shangchai have all sold over 100000 units cumulatively.

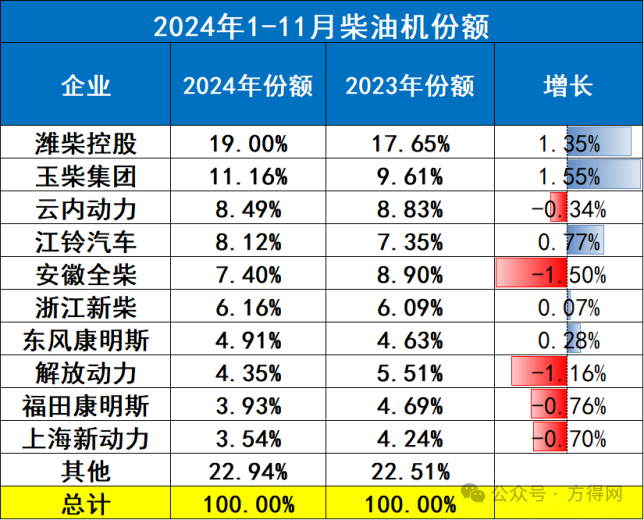

From the perspective of enterprise share, from January to November 2024, Weichai has been leading the industry, accounting for 19% of the market share and the only company in the industry with a market share of nearly 20%. Despite the industry downturn in 2024, Weichai still achieved market share growth. In addition, Yuchai's market share increased by 1.55% year-on-year, the highest in the industry. Jiangling, Xinchai, and Dongkang have all achieved market share growth.

From January to November 2024, the proportion of the top ten companies in the industry (77.06%) decreased compared to last year (77.5%), while the share of the top five companies increased compared to last year. This means that the Matthew effect is evident among the top five companies, with the strong remaining strong and the top ten diesel engine companies eyeing fiercely, leading to intense industry competition.

Commercial vehicle diesel engines increased by 19% month on month

Liberation leads the rise

In November 2024, in the commercial vehicle market, heavy trucks increased by 7% month on month, light trucks increased by 3.9% month on month, and exports of buses over 3.5 meters increased by 25.21% year-on-year, all of which have driven sales in the commercial vehicle diesel engine market.

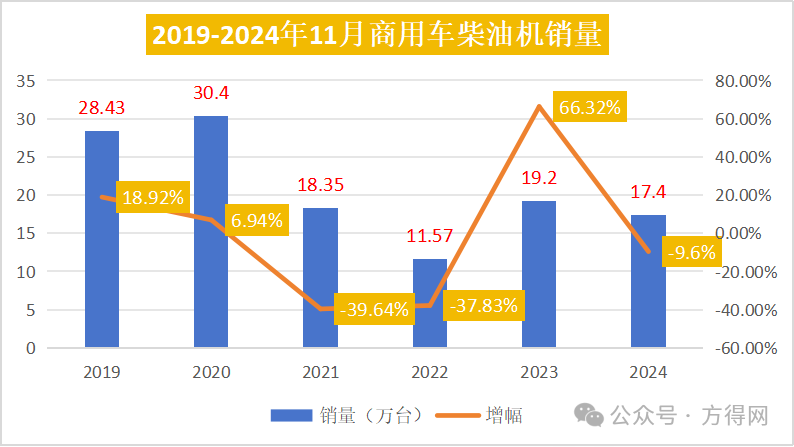

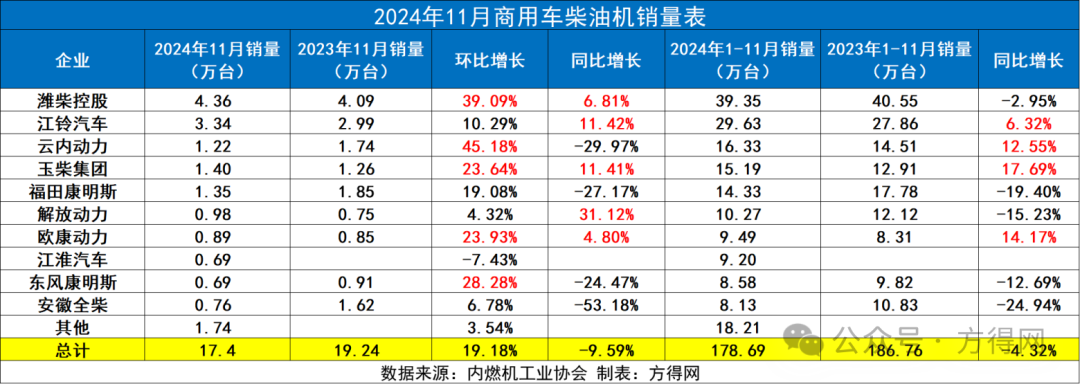

Similarly, the commercial vehicle diesel engine market has also declined year-on-year. In November, the monthly sales of commercial vehicle diesel engines were 174000 units, a year-on-year decrease of 9.6%, which is a relatively low level in six years.

From January to November 2024, the sales volume of commercial vehicles in the market was 3.505 million units, and the sales volume of commercial vehicle diesel engines was 1.7869 million units. From January to November 2023, the sales volume of commercial vehicles in the market was 3.666 million units, and the sales volume of commercial vehicle diesel engines was 1.866 million units, with a slight increase of 0.1% in assembly ratio.

This means that the share of commercial vehicles equipped with diesel engines remains unchanged compared to last year. Although sales of new energy vehicle models have increased and natural gas vehicle models have skyrocketed since 2024, the assembly of diesel engines in commercial vehicles is still mainstream.

In November 2024, all top ten companies in the commercial vehicle diesel engine market achieved positive growth month on month. Among them, Weichai, Yunnei, Yuchai, Oukang, and Dongkang outperformed the market, with Yunnei growing by 45%, ranking first in the industry.

In November 2024, Weichai had the highest sales volume in the commercial vehicle diesel engine market, with a monthly sales volume of 43600 units, ranking first in the industry. Jiangling sold 33400 units per month; Yuchai's monthly sales of 14000 units ranked third.

In November 2024, five of the top ten companies in the diesel engine market showed positive year-on-year growth, among which Weichai, Jiangling, Yuchai, Jiefang, and Oukang grew against the trend and outperformed the market. Among them, Jiefang Power grew by 31%, leading the industry.

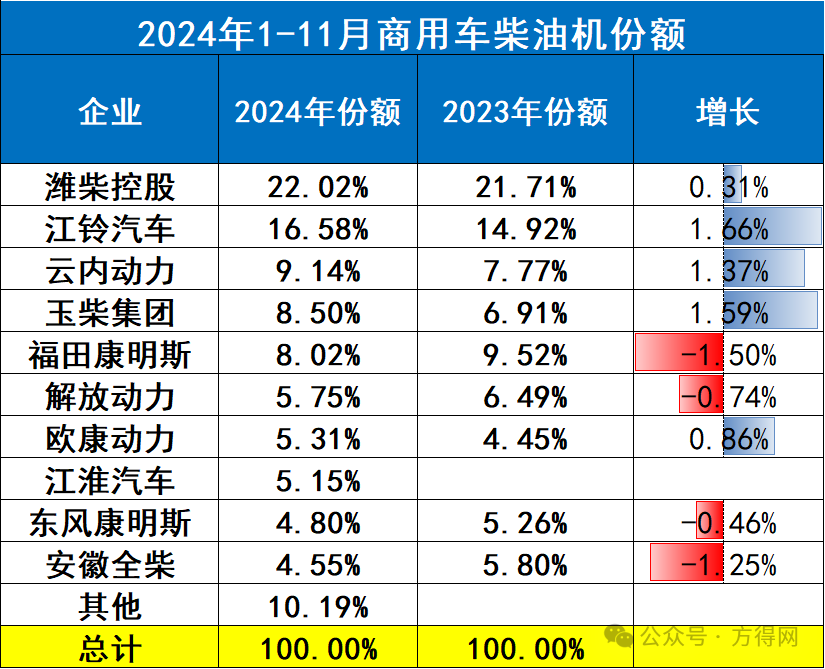

From the perspective of enterprise share, Weichai has been leading the industry from January to November 2024, accounting for 22% of the market share and the only company in the industry with a market share exceeding 20%.

In addition, Jiangling Motors' market share increased by 1.66% year-on-year, the highest in the industry. Yunnei, Yuchai, and Oukang have all achieved market share growth.

In November 2024, the top five commercial vehicle diesel engine companies had a market share of 64%, and in November 2023, the market share was 61%, a year-on-year increase of 3%. The top ten companies also have a higher share than in 2023, indicating that veteran diesel engine companies will make significant efforts in 2024, be very stable, and have stronger risk resistance capabilities.

As the last opportunity for growth at the end of the year, November 2024 was seized by all enterprises, achieving month on month growth. In December, there will not be much growth in the diesel engine market, and it is predicted that there will be around 4 million diesel engines by 2024. At the end of 2024, the annual meetings of various companies have also been held, and almost all of them have optimistic expectations for growth in 2025. Can we return to the level of 4.3 million units by 2025? Worth looking forward to.