Industry News | Understanding the Future Development Prospects and Trends of China's Horticultural Machinery Industry in 2025 in One Article

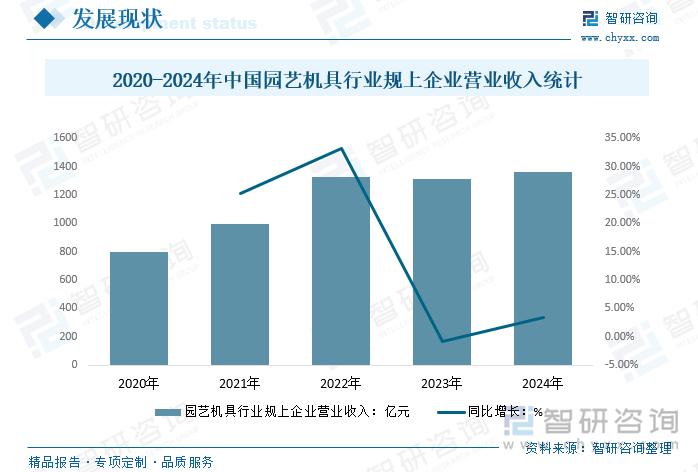

Content summary:From 2020 to 2022, the inventory scale of horticultural equipment products in downstream channels has been increasing year by year. In 2023, the sales of horticultural equipment in China mainly showed a destocking state. Therefore, the operating income of large-scale enterprises in China's horticultural equipment industry in 2023 decreased compared to 2022, about 131.4 billion yuan. With the decrease in inventory scale of downstream channels, the operating revenue of large-scale enterprises in China's horticultural machinery industry will be approximately 135.8 billion yuan in 2024.

Listed companies:Greebo (301260), Daye Co., Ltd. (300879), Zhongzhong Technology (002779), Quanfeng Holdings (02285), Sumeda (600710. SH), Shouhua Gas (300483.SZ), Liou Co., Ltd. (002131)

key word:Horticultural equipmentMarket sizeHorticultural equipmentMarket competition patternHorticultural equipmentIndustry development prospects

1Horticultural equipmentIndustry definition andclassification

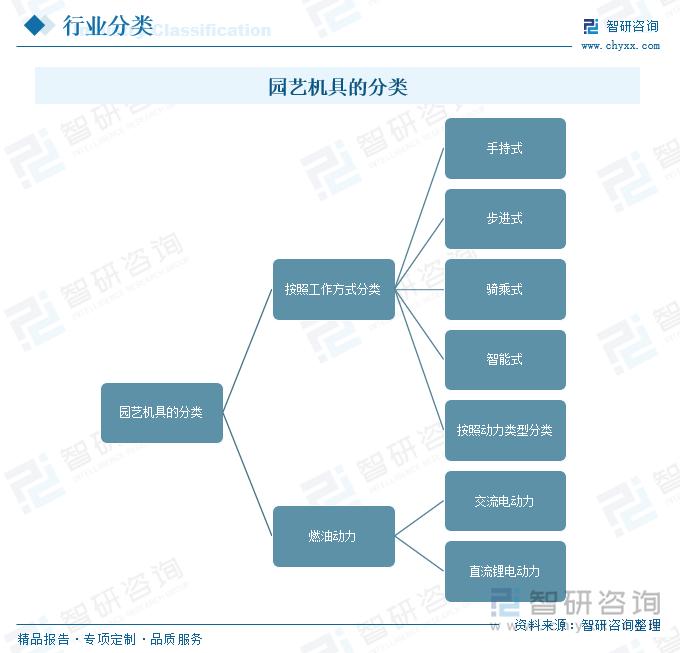

Horticultural equipment, also known as mechanical tools and devices for landscaping and maintenance, refers to the mechanical equipment used in the process of horticultural production and management to assist in soil treatment, planting, fertilization, irrigation, pruning, weeding, harvesting, and other work. They are commonly used in fields such as home gardens, landscape greening, agricultural production, etc., with the aim of improving the efficiency of horticultural operations, reducing labor intensity, and ensuring the healthy growth of crops or plants. Common gardening tools include lawn mowers, cultivators, trimmers, irrigation systems, planting equipment, weed killers, snow sweepers, and so on. Horticultural equipment can be classified according to their working mode and power, as follows:

From the comparison of various types of horticultural machinery products in China, AC power garden machinery products use external power sources as the power source, while DC lithium power garden machinery products use portable batteries as the power source. At present, the portable batteries for DC lithium-ion garden machinery products are mainly lithium batteries.

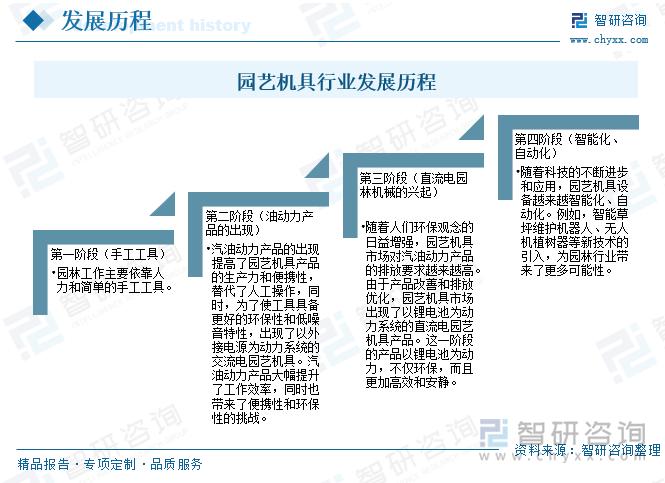

Landscape machinery not only shapes the green space around us, but is also an important component of modern horticultural culture. With the continuous advancement of technology, the garden machinery industry is undergoing a transformation from traditional manual tools to intelligent and oil powered products, the rise of DC garden machinery, and now the evolution of automation equipment.

IIHorticultural equipmentIndustry Development Status

The use of gardening equipment not only helps gardening enthusiasts improve work efficiency, but also makes gardening work easier and more professional. Thanks to the development of the world economy, the popularization of horticultural culture, and the promotion of new products, the demand for horticultural machinery in China's market continues to increase, with a particularly significant demand for electric garden machinery. Since the reform and opening up, China has relied on its labor cost advantage to attract a large number of world-class manufacturing enterprises to invest in China, gradually becoming the industrial base for global garden machinery products. In 2023, there will be approximately 690 large-scale horticultural machinery industry enterprises in China, and by 2024, there will be around 735.

From 2020 to 2022, the inventory scale of horticultural equipment products in downstream channels has been increasing year by year. In 2023, the demand for horticultural equipment in China's market will continue to increase with the development of urbanization. However, the sales of horticultural equipment mainly show a destocking state. Therefore, the operating income of large-scale enterprises in China's horticultural equipment industry in 2023 will decrease compared to 2022, about 131.4 billion yuan. With the decrease in inventory in downstream channels, the operating income of large-scale enterprises in China's horticultural machinery industry will increase by approximately 135.8 billion yuan in 2024 compared to 2023.

With the development and transformation of China's horticultural machinery industry, the product structure of Chinese horticultural machinery has undergone significant changes, with features such as intelligence and specialization, continuous improvement in quality, and increasing international competitiveness. The export value of horticultural machinery in China in 2023 is 3.124 billion US dollars; From January to May 2024, the export value of Chinese horticultural machinery was 1.62 billion US dollars, a year-on-year increase of 18.1%.

Related report: "China Horticultural Machinery Industry Market Panorama Research and Prospect Strategy Analysis Report" released by Zhiyan Consulting

IIIHorticultural equipmentIndustry Chain

oneTheHorticultural equipmentIndustry Chain Structure

The upstream of the horticultural machinery industry chain mainly includes raw materials such as steel, aluminum alloy, copper, plastic, rubber, as well as components such as engines and electric motors; The midstream of the industry is the production and manufacturing of horticultural machinery; The downstream of the industry is mainly applied in fields such as home gardens, landscape greening, garden engineering, agricultural production, and flower planting.

twoTheHorticultural equipmentUpstream of the industry chain-steels

As a key tool in horticultural operations, the choice of material for gardening equipment has a decisive impact on the durability, effectiveness, and applicable scenarios of the tool. Steel, as a widely used material, plays a crucial role in the manufacturing of horticultural machinery.

The steel industry is a pillar industry in the national economy. The construction and manufacturing industries, as the main areas of steel consumption, have emerged as an important driving force to support steel demand in the context of economic downturn and weakened demand in the real estate industry. In 2023, China's crude steel production was 1.029 billion tons, an increase of 11 million tons year-on-year; The steel production was 1.384 billion tons, a year-on-year increase of 43 million tons. In 2024, the Chinese steel industry will show a positive development trend in export, overseas factory construction, patent innovation, talent attraction, industrial chain extension, intelligent transformation, capacity reduction, steel enterprise restructuring, as well as market demand and capacity changes. From January to November 2024, China's crude steel production was 929 million tons, a year-on-year decrease of 2.7%, while steel production was 1.283 billion tons, a year-on-year increase of 0.9%. In 2024, China's crude steel production will be approximately 1.013 billion tons, and steel production will be approximately 1.4 billion tons.

threeTheHorticultural equipmentDownstream of the industry chain-Flower planting

Flower planting is one of the main applications of horticultural machines. In recent years, with the development of the economy and the improvement of people's living standards, people's pursuit of urban living quality has been constantly increasing. Flowers, as a beautiful form of greening, are gradually receiving widespread attention. According to statistics, in 2023, the actual planting area of flowers in China will be about 1.5 million hectares, and in 2024, the actual planting area of flowers in China will be about 1.58 million hectares. With the increase of flower planting area, the demand for efficient and intelligent gardening equipment has also increased.

4Horticultural equipmentIndustry development environment-policy

Horticultural equipment belongs to agricultural machinery and equipment. Agricultural mechanization is an important characteristic of the development level of agricultural productivity, the foundation for comprehensively realizing agricultural modernization, and the basis for increasing farmers' income and ensuring national food security. The vigorous development of agricultural mechanization can improve farmers' labor productivity and reduce the labor intensity of agricultural machinery workers. The development status of agricultural machinery is directly related to the production efficiency and competitiveness of China's agriculture. With the high attention paid by the country to agricultural modernization and the introduction of a series of policies, the agricultural machinery market will usher in more development opportunities. At present, the country's policies mainly include accelerating the research and development of large-scale intelligent agricultural machinery and equipment, developing small machinery suitable for hilly and mountainous areas, and promoting the intelligent development of horticultural machinery.

5Horticultural equipmentIndustry competition pattern

oneMajor enterprisesOverview

At present, important enterprises in China's horticultural machinery industry include Greebo, Daye Co., Ltd., Zhongjian Technology, Quanfeng Holdings, Sumeda, Shouhua Gas, and Leo Group.

twoRepresenting enterprises-Greebo

Greebo has been engaged in the research and development, design, production, and sales of new energy garden machinery since 2007, and is one of the leading enterprises in the global new energy garden machinery industry. The company mainly sells its own brand products, which can be divided into lawn mowers, lawn mowers, cleaning machines, hair dryers, pruning machines, chainsaws, intelligent lawn mowing robots, intelligent mounted lawn mowing carts, etc. according to their uses.

Greebo attaches great importance to technology research and development. In 2023, it will carry out more than 70 research and development projects, and add 221 patents, including 97 invention patents. In 2023, Greebo launched the lithium commercial lawn mower OptimusZ around commercial products, and further launched a full range of commercial products through continuous high-level research and development investment, covering handheld, manual push, and mount types. It also launched a mobile energy storage device to support commercial products, in order to solve the "mileage anxiety" of green landscaping companies. According to company announcement data, the R&D investment of Greebo in 2023 was 273 million yuan, an increase of 60 million yuan from 2022.

VIHorticultural equipmentIndustry Development Trends

With the continuous advancement of automation technology, intelligent technology, Internet of Things, and robotics technology, the horticultural machinery industry will continue to develop towards intelligence, efficiency, and environmental protection, meeting the needs of different levels and scales of horticultural operations. New energy horticultural machinery has become a new direction for industrial development. Driven by the trends of home gardening, intelligence, and environmental protection, it is expected that the demand for gardening equipment will continue to grow in the coming years. North America and Europe are the main markets for electric gardening equipment. The future development prospects of horticultural equipment products are broad.