Industry data | New energy heavy-duty trucks sold 15000 units in March, skyrocketing 1.8 times! Penetration rate exceeds 20%, Sany/XCMG compete for the championship, liberation increases by 6 times

In March, the sales volume of domestic heavy-duty truck terminals decreased slightly by 4% year-on-year, and many segmented markets will not have the "Golden Three" peak season in 2025. Or in other words, if there is a "golden three" peak season in the heavy-duty truck industry in 2025, then the peak season will only be concentrated in this niche market - new energy heavy-duty trucks.

In March, 15000 vehicles were sold, a year-on-year increase of 183%, and it achieved a "26 consecutive increases"

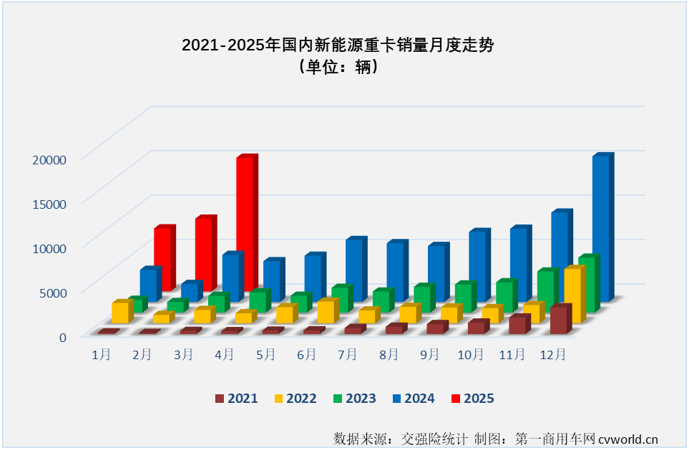

According to the latest data obtained by the First Commercial Vehicle Network, in March 2025, a total of 15000 new energy heavy-duty trucks were sold in the domestic market (note: the data in this article is based on the actual sales of compulsory traffic insurance, excluding exports and military vehicles, the same below), an increase of 84% compared to February this year and a year-on-year increase of 183%. From a numerical perspective, the sales volume of 15000 new energy heavy-duty trucks in March this year was not only the highest in history, but also a high-level performance in the entire history of new energy heavy-duty truck development (the second highest in history, as shown in the figure below, as of March 2025, the months with new energy heavy-duty truck sales exceeding 15000 were only December 2024 and March this year).

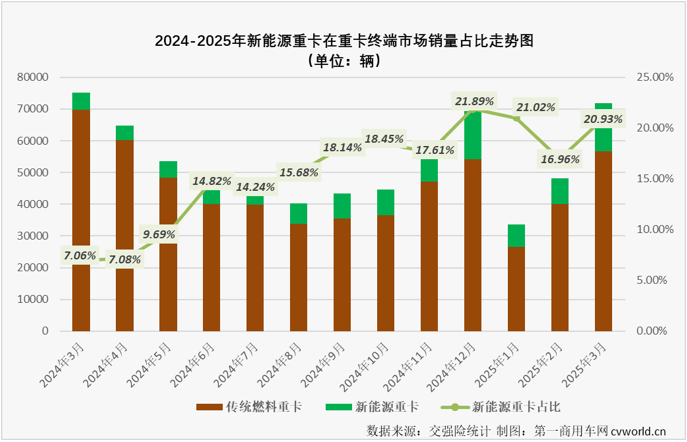

As shown in the above figure, based on the performance of the first quarter and three months, the new energy heavy-duty truck market is continuing the hot state of 2024 in 2025. In March 2025, the domestic demand for heavy-duty truck terminals has rebounded compared to the previous two months, with an overall sales of 71800 heavy-duty trucks, a month on month increase of 49% and a year-on-year decrease of 4%. The year-on-year growth rate of 183% for new energy heavy-duty trucks in March continued to significantly outperform the overall growth rate of the heavy-duty truck market. According to data from the First Commercial Vehicle Network, as of March 2025, new energy heavy-duty trucks have outperformed the industry for 22 consecutive months, and the year-on-year growth trend of the new energy heavy-duty truck market has expanded to an astonishing "26 consecutive increases".

In March 2025, the proportion of new energy heavy-duty trucks in the terminal sales of the heavy-duty truck market reached 20.93%, an increase from the previous month's proportion (16.96%), higher than the full year proportion of 2024 (13.61%), and almost doubled from the same period last year's 7.06%. As shown in the above figure, since August 2024, the penetration rate of new energy in the heavy-duty truck market has exceeded 15% for eight consecutive months (as shown in the above figure), and the continuous improvement of China's new energy heavy-duty truck market is visible to the naked eye.

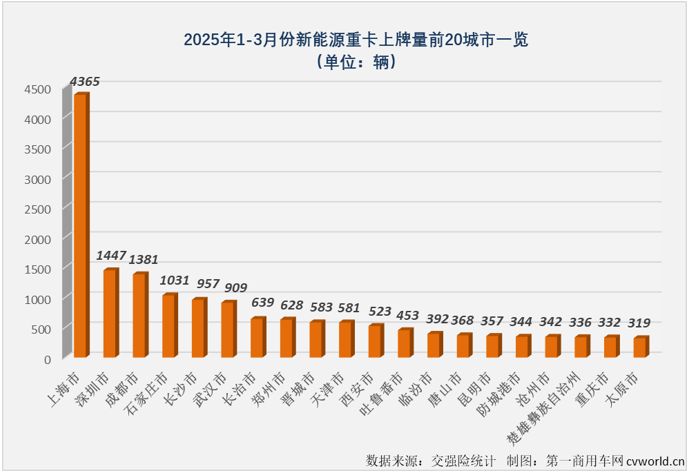

From January to March 2025, all 31 provinces (cities, districts) in China will have new energy heavy-duty trucks registered. In terms of cities, as of March this year, 275 cities in China have registered new energy heavy trucks (43 new cities added in March), among which 4 cities including Shanghai, Shenzhen, Chengdu, and Shijiazhuang have registered more than 1000 vehicles, and 11 cities have registered more than 500 vehicles.

Sany/XCMG/Jiefang/Heavy Duty Truck over 2000 vehicles compete for the top spot on the monthly list, with multiple companies setting records

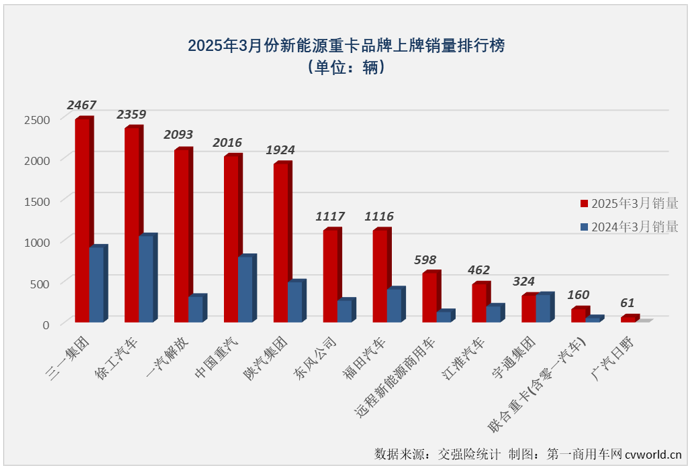

In March 2025, there were 11 companies in the new energy heavy-duty truck market that sold over 100 vehicles, of which 10 companies sold over 300 vehicles. For the first time, 7 companies sold over 1000 vehicles per month, and 4 companies sold over 2000 vehicles per month. Overall, the market looks very hot.

(Note: The above figure shows the sales volume of new energy heavy-duty truck chassis manufacturers, and the sales volume of modification manufacturers is not separately listed. The same applies below. Among them, the sales volume of United Heavy Truck in March was 40 Jingzhe pure electric tractors from Zero One Automobile.)

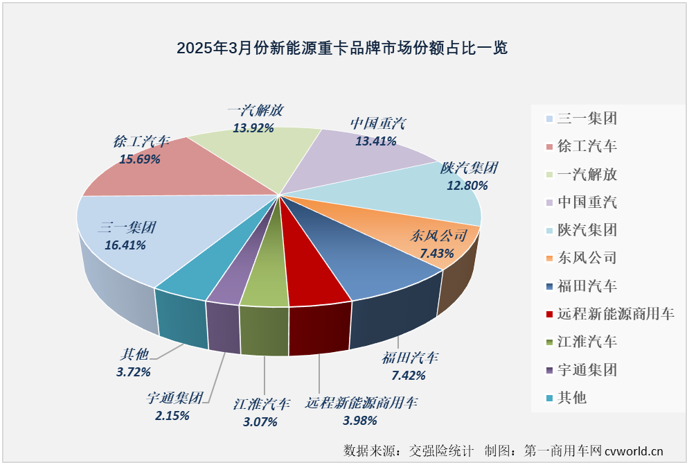

In the third round of the competition for the champion of the 2025 New Energy Heavy Truck Monthly List, Sany won the championship with 2467 vehicles, achieving the second sales champion of the 2025 New Energy Heavy Truck Monthly List; XCMG, Jiefang, and Heavy Duty Truck, ranked 2-4, all sold over 2000 vehicles in March, reaching 2359 vehicles, 2093 vehicles, and 2016 vehicles respectively; Shaanxi Automobile, Dongfeng, and Foton have also sold over a thousand units, ranking 5th to 7th on the monthly chart, with 1924 units sold, 1117 units sold, and 1116 units sold, respectively; Remote, Jianghuai, and Yutong, ranked 8-10 on the monthly chart, sold 598, 462, and 324 vehicles respectively. It is worth mentioning that many companies, including Liberation, Heavy Duty Truck, Shaanxi Automobile, Foton and others, have broken their records for the highest monthly sales volume in the new energy heavy-duty truck market.

As shown in the above figure, the sales of new energy heavy-duty trucks in March this year were higher than the same period last year, and the companies that achieved growth doubled. Among them, Liberation, Dongfeng, and Remote's sales in March increased by 575%, 325%, and 378% year-on-year respectively, making them the three leading companies in the market. Shaanxi Automobile and United Heavy Truck also had a year-on-year growth rate higher than the overall growth rate of 183% in the new energy heavy truck market, outperforming the market "overall".

In March 2025, there were 5 companies in the new energy heavy-duty truck market with a market share of over 10% (as shown in the above figure). With the overall sales of the market increasing, the competition in the new energy heavy-duty truck industry is becoming increasingly fierce. Except for Sany and XCMG, more companies have achieved a breakthrough of monthly sales exceeding 2000 vehicles. As of March 2025, there are 4 companies that have experienced monthly sales exceeding 2000 vehicles, and 8 companies that have experienced monthly sales exceeding 1000 vehicles (remote companies have also experienced monthly sales exceeding 1000 vehicles).

Accumulated sales exceeded 30000 in the first quarter, with XCMG/Sany accumulating sales of nearly 5000, leading to a significant increase in Liberation's market share

In 2024, there are a total of 10 players in the new energy heavy-duty truck market who have accumulated sales of over 1000 vehicles. After March 2025, the number of players who have accumulated sales of over 1000 vehicles has reached 9.

Sales Table of New Energy Heavy Truck Enterprises from January to March 2025 (Unit: Vehicles)

As shown in the table above, from January to March 2025, the cumulative sales of new energy heavy-duty trucks reached 30300 units, a year-on-year increase of 177%. The cumulative growth rate increased by 7 percentage points compared to after February (+170%). Looking specifically at new energy heavy-duty truck production enterprises, most of them have achieved doubled growth. Among them, companies such as Jiefang, Shaanxi Automobile, Dongfeng, and United Heavy Truck saw a year-on-year increase in cumulative sales of 551%, 331%, 249%, and 251% from January to March, respectively. While achieving double growth, they also outperformed the "big market" of the new energy heavy truck market from January to March.

The top two companies, XCMG and Sany, saw their cumulative sales increase by 146% and 166% year-on-year from January to March this year, respectively. Both companies achieved a growth of about 1.5 times compared to the same period in 2024 when their sales were already high, indicating a high value for their growth. XCMG and Sany both contributed nearly 3000 units to the new energy heavy-duty truck market in the first quarter of 2025.

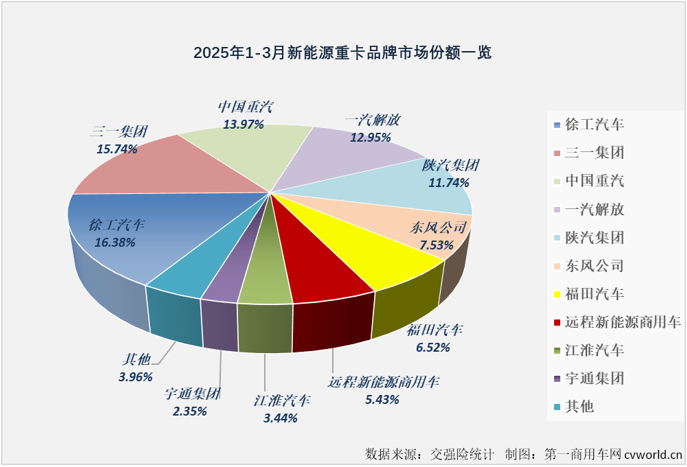

In terms of market share, from January to March 2025, XCMG's new energy heavy-duty truck sales totaled 4961 units, temporarily ranking first in the industry, with a cumulative share of 16.38%; Sany New Energy Heavy Truck has sold 4767 vehicles, ranking second in the industry with a cumulative share of 15.74%; Heavy Duty Truck Group, Liberation Automobile Group, and Shaanxi Automobile Group ranked 3-5, with cumulative sales of 4231, 3923, and 3555 vehicles, respectively, and cumulative market shares of 13.97%, 12.95%, and 11.74%, respectively. They are among the other companies with cumulative market shares exceeding 10%. The market shares of the three companies have all increased compared to the same period last year, with Liberation Automobile Group increasing by 7.45 percentage points, the most rapid increase. Shaanxi Automobile Group's market share increased by 4.20 percentage points compared to the same period last year, second only to Liberation Automobile Group.

Dongfeng, currently ranked sixth in the industry, has accumulated sales of over 2000 vehicles from January to March this year, grabbing a 7.53% share of the new energy heavy-duty truck market in the first quarter with 2282 vehicles, an increase of 1.57 percentage points compared to the same period last year; From January to March this year, the cumulative sales of Foton, Remote, and Jianghuai have successfully exceeded 1000 vehicles, reaching 1974 vehicles, 1645 vehicles, and 1042 vehicles respectively, with cumulative market shares of 6.52%, 5.43%, and 3.44%, respectively. The market shares of the three companies have all declined compared to the same period last year; Yutong ranks 10th on the cumulative sales list, with a market share of 2.35% from January to March. Other companies have accumulated sales of less than 300 vehicles and a market share of less than 1%.

Conclusion

In March 2025, the overall sales volume of new energy heavy-duty trucks reached the second highest in history, reaching 15000 units, with a year-on-year increase of 183%. Several heavy-duty truck manufacturers set their own records for the highest monthly sales volume in the new energy heavy-duty truck market. From the industry to the enterprise, the "Golden Three" peak season of the new energy heavy-duty truck market in 2025 is sufficiently prosperous. What kind of scene does it look like when it comes to each segmented market? Which segmented market is the most prosperous? What new records have been created?

Article source: Reprinted from First Commercial Vehicle Network