Industry News | China National Heavy Duty Truck Group/Dongfeng Pinduoduo's top two major players enter the top ten. In April, commercial vehicle sales increased by 3% to 370000 units. Who won the championship?

In the first quarter of 2025, China's commercial vehicle market will follow a trend of decline increase decline, with cumulative sales exceeding 1 million units after March, a year-on-year increase of 2%.

Can the commercial vehicle market perform better in April, which is also considered the traditional peak sales season? Has there been any new change in the industry landscape?

➤ 370000 vehicles were sold in April, a month on month decrease of 18% and a year-on-year increase of 3%

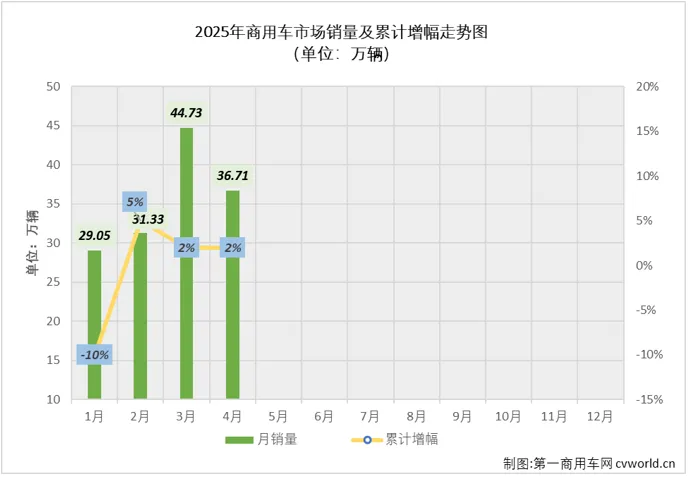

According to data from the China Association of Automobile Manufacturers (based on the number of invoices issued by enterprises and non terminal actual sales), in April 2025, the commercial vehicle market in China sold 367100 vehicles, a decrease of 18% compared to March this year and a year-on-year increase of 3%. The year-on-year growth rate has turned positive (the commercial vehicle market decreased by 2% year-on-year in March).

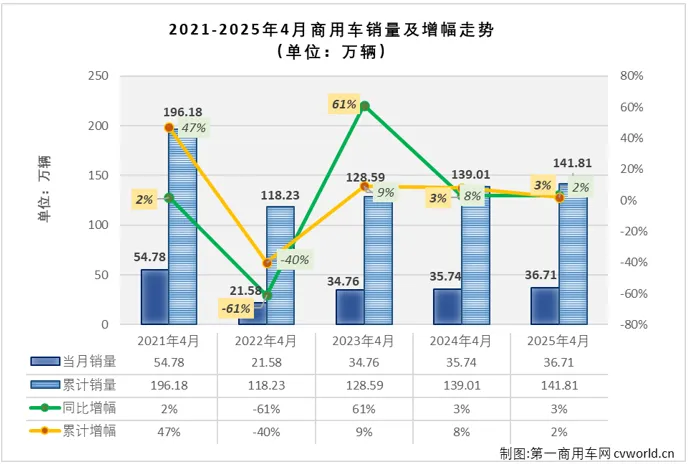

Looking at the sales and growth trend chart of commercial vehicles in April of the past five years, it can be seen that the commercial vehicle market has shown a trend of increasing decreasing increasing increasing increasing increasing. In April of the past five years, the commercial vehicle market has achieved growth for four years, with sales exceeding 500000 units in April 2021, reaching 547800 units. In April 2022, the year-on-year decline was 61%, falling to the level of 200000 units. In April of the past three years, the commercial vehicle market sold 347600, 357400, and 367100 vehicles respectively, with very small differences. The sales volume of 367100 vehicles in April this year ranked second in the past five years, which is a normal "performance".

From the perspective of cumulative sales, around 1.3 million vehicles is the normal level for the cumulative sales of commercial vehicles from January to April in recent years. The cumulative sales of commercial vehicles in the market from January to April this year were 1.4181 million vehicles, which is a relatively high level of the normal level. It has also ranked second in the past five years, but there is a gap of over 500000 vehicles compared to the highest period of January to April 2021. Compared to the first four months of last year, it has sold nearly 30000 more vehicles, with a cumulative growth rate of 2%.

➤ Foton's sales of over 50000 vehicles continue to top the monthly sales chart, with Dongfeng/Heavy Duty Truck competing in the top two

In April 2025, there were 11 companies in the commercial vehicle market with sales exceeding 10000 vehicles (Shaanxi Automobile, ranked 11th on the monthly list, also sold over 10000 vehicles), and the monthly sales of companies exceeding 10000 vehicles remained the same as in March. Foton won first place with 53900 vehicles, securing its fourth monthly ranking in the commercial vehicle market this year.

Sales Table of Commercial Vehicle Market in April 2025 (Unit: Vehicles)

As shown in the table above, in April 2025, the commercial vehicle market grew by 3% year-on-year, and the year-on-year growth rate turned positive from the previous month (-2%). In the context of a slight year-on-year increase in overall sales in the market, mainstream enterprises have experienced both growth and decline. In April, the top ten companies in terms of sales saw 5 increases and 5 decreases: Foton, Dongfeng, Heavy Duty Truck, Jiangling Motors, and Datong's sales in April increased by 20%, 24%, 12%, 9%, and 28% year-on-year, respectively. The year-on-year growth rates of several companies that achieved growth were higher than the overall market growth rate; At the same time, two of the declining companies experienced a decline of over 30%, and the company with the most severe decline saw a 37% year-on-year decrease in sales in April.

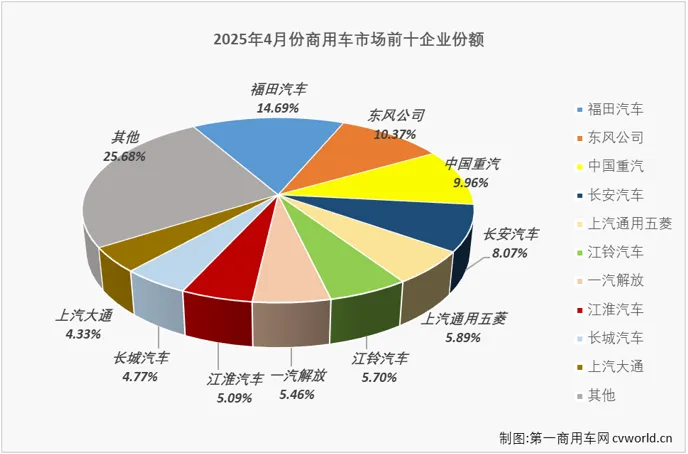

In terms of market share, the top ten companies in April all sold over 15000 vehicles, with a total share of 74.32%. Among them, the top five companies had a total share of nearly 50%, reaching 48.96%. In April, only two companies had a market share of over 10% in the commercial vehicle market, with Foton, ranked first on the monthly chart, grabbing 14.69% of the market share in April; Dongfeng ranks second with a share of 10.37%; The monthly share of Heavy Duty Truck, ranked third, is also close to 10%, reaching 9.96%; Changan and Wuling, ranked 4th and 5th respectively, had a market share of 8.07% and 5.89% in April.

Jiangling Motors and Jiefang, ranked 6th and 7th on the April monthly list, have a share of 5.70% and 5.46% respectively, with a monthly share gap of only 0.24% between the two companies; Jianghuai, ranked 8th on the monthly chart, has a monthly share of 5.09%, which is less than 0.7% lower than Jiangling Motors and Jiefang, ranked 6th and 7th respectively. It leads Shaanxi Automobile, ranked 9th, by less than 0.5%; The smallest gap in April appeared between Wuling and Jiangling, which ranked 5th and 6th on the monthly chart. The two companies had a market share difference of only 0.19% and sales difference of only over 600 vehicles in April. The competition for seats in the commercial vehicle market is exciting every month.

From the perspective of the industry landscape, the top ten members and rankings of commercial vehicle sales in April have changed: Datong has returned to the top ten of the monthly chart and ranked 10th in April (Datong ranked 11th in March); Wuling rose 3 places to 5th place on the monthly chart (Wuling ranked 8th in March); The Great Wall rose one place to 9th place on the monthly chart (it ranked 10th in March). Correspondingly, more than one company has experienced a decline in ranking. The monthly ranking remains consistent with March, with Foton, Dongfeng, Heavy Duty Truck, and Great Wall ranking 1-4, as well as Jiangling Motors ranking 6th.

➤ Accumulated sales of 1.42 million vehicles from January to April, a year-on-year increase of 2%, with Foton and other companies increasing their market share

In terms of cumulative sales, from January to April 2025, the commercial vehicle market sold a total of 1.4181 million vehicles, a year-on-year increase of 2%. The cumulative sales growth rate remained the same as after March, with 28100 vehicles sold more than the same period last year.

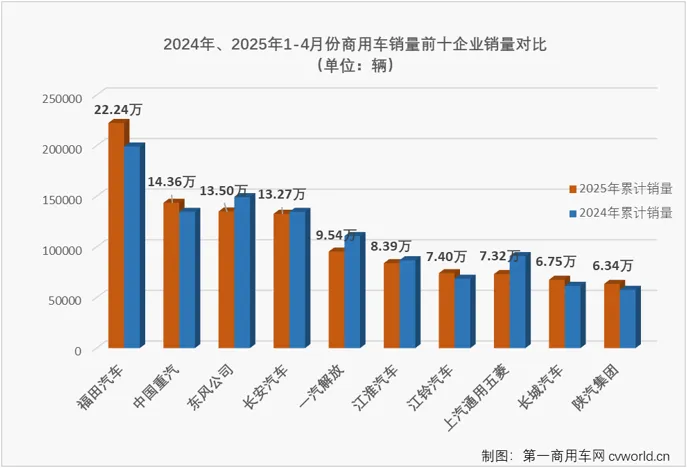

Looking at the top ten companies in terms of cumulative sales, Foton, Heavy Duty Truck, Dongfeng, and Changan have accumulated sales of over 100000 vehicles, reaching 222400 vehicles, 143600 vehicles, 135000 vehicles, and 132700 vehicles respectively; Jiefang and Jianghuai are also very close in terms of cumulative sales of 100000 vehicles, with cumulative sales of 95400 and 83900 vehicles respectively; Jiangling Motors, Wuling Motors, Great Wall Motors, and Shaanxi Automobile have all sold over 60000 vehicles, reaching 74000, 73200, 67500, and 63400 vehicles respectively.

From the perspective of cumulative sales growth, mainstream enterprises have both increased and decreased (with the top 15 cumulative sales increasing and 5 decreasing). From January to April, the cumulative sales of five companies including Foton, Heavy Duty Truck Group, Jiangling Motors, Great Wall Motors, and Shaanxi Automobile Group increased by 12%, 7%, 8%, 10%, and 10% year-on-year, respectively, all of which were higher than the overall market growth rate. While achieving growth, they also outperformed the overall growth rate of the commercial vehicle market. At the same time, three of the declining companies have accumulated double-digit declines, and the company with the most severe decline saw a 20% year-on-year decrease in cumulative sales from January to April this year.

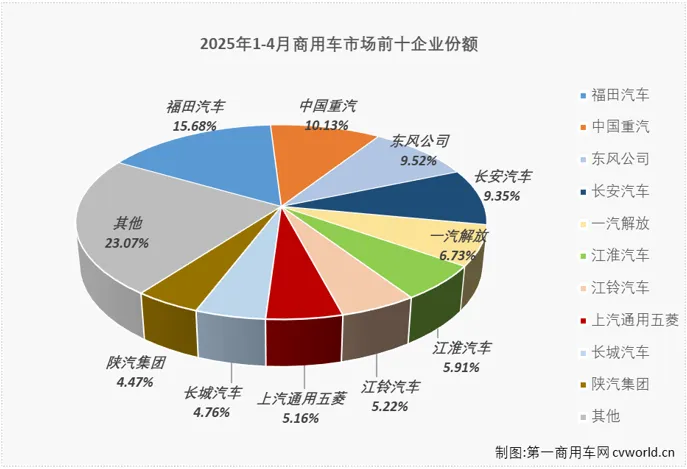

From the perspective of cumulative share, the top ten companies in terms of cumulative sales have a total share of 76.93%, and the top five companies in the industry have a total share of 51.41%. Currently, only two companies have a cumulative share of over 10%, and the difference between adjacent companies is not significant. The difference in share among multiple groups of "neighbors" is less than 0.5%. Compared with the same period last year, companies such as Foton, China National Heavy Duty Truck Group, Jiangling Motors, Great Wall Motors, and Shaanxi Automobile Group have achieved an increase in market share, with Foton showing the most significant improvement, increasing by 1.36 percentage points.

From the perspective of the industry landscape, after April 2025, the top ten members of the commercial vehicle market will remain consistent compared to the top ten at the end of last year, but there will be a slight change in ranking: China National Heavy Duty Truck Group has risen two places to temporarily rank second in the industry (China National Heavy Duty Truck Group ranked fourth at the end of last year), while companies such as Foton, Jiefang, Jianghuai, Jiangling, Wuling, Great Wall, and Shaanxi Automobile Group will maintain their year-end rankings unchanged from last year.

conclusion

In April, commercial vehicle sales increased by 3% year-on-year. In the first four months of this year, the commercial vehicle market showed a trend of decline increase decline increase. After April, cumulative sales increased by 2% year-on-year, with a net increase of about 28100 vehicles. The First Commercial Vehicle Network has noticed that in 2025, the commercial vehicle market will continue the fierce competition of the previous year, and the gap between "neighbors" is very small. After April, the cumulative share gap between Changan and Dongfeng, Wuling and Jiangling, and Shaanxi Automobile and Great Wall is less than 0.3%. The swap may occur next month. Please pay attention to subsequent reports.

Article source: Reprinted from First Commercial Vehicle Network