4.13 million diesel engines will be completed in 2023! Weichai leads the way with 720000 units, while Yunnei competes for the top three and Dongkang ranks ninth

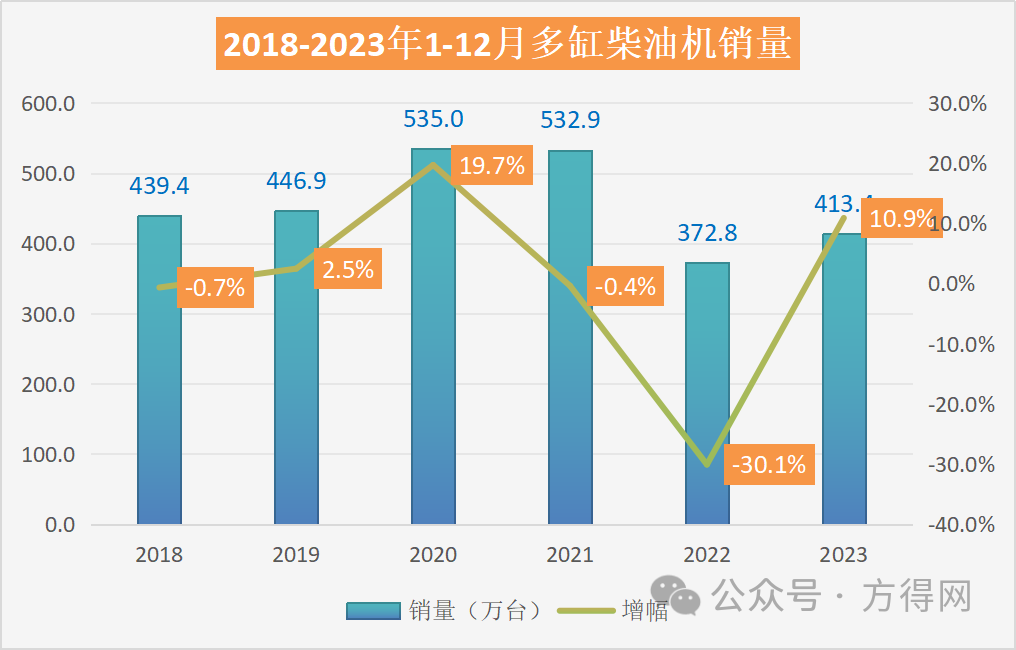

In 2023, multi cylinder diesel engines (hereinafter referred to as diesel engines) closed the year with 4.13 million units, a year-on-year increase of 22.66%.

In 2023, the domestic commercial vehicle market will return to 4 million units, a year-on-year increase of 20%. With the gradual recovery of the economy and the recovery of logistics market demand, various segmented markets of commercial vehicles have achieved varying degrees of growth; Among them, both the truck and bus markets achieved double-digit growth, and the heavy-duty truck market grew by 36%.

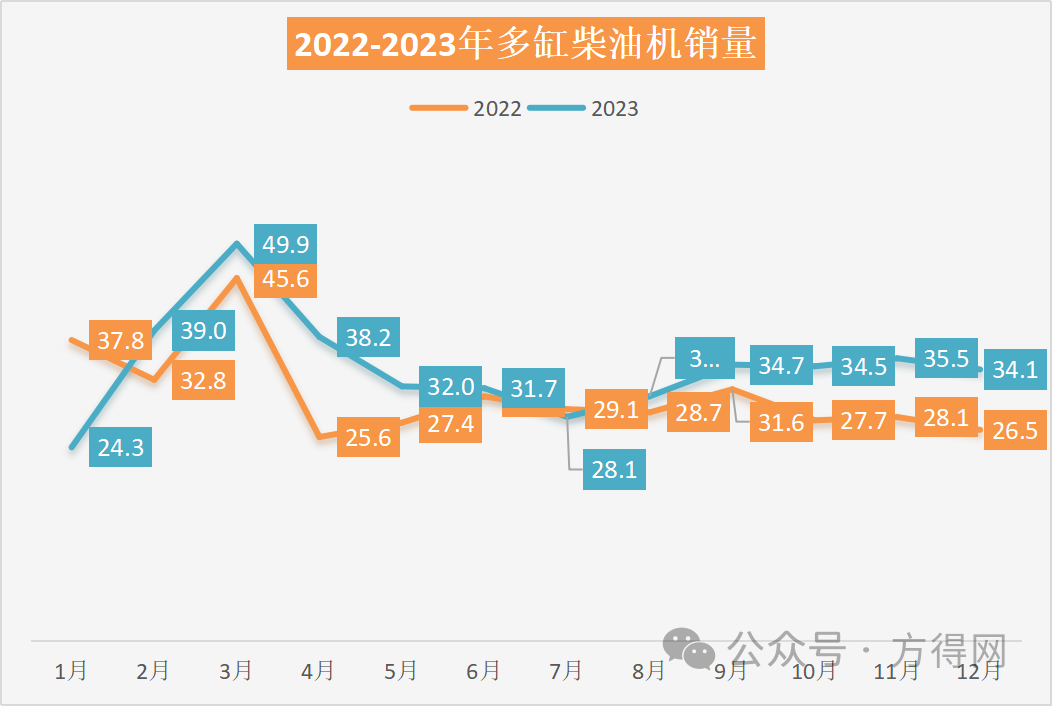

The diesel engine market has also risen along with commercial vehicles. According to the "China Internal Combustion Engine Industry Sales Monthly Report" by the Internal Combustion Engine Industry Association, in December 2023, the market sales of multi cylinder diesel engines (hereinafter referred to as diesel engines) reached 341000 units, a year-on-year increase of 28.6%. In the 12 months of 2023, only two months showed a year-on-year decline, while the rest of the months achieved positive growth.

How have companies performed in this context? What changes have occurred in the ranking of enterprises? Please refer to the analysis report provided by Fangde.com.

01Annual sales of 4.13 million units in 2023Year on year growth of 10.9%

In December 2023, the sales volume of the diesel engine market decreased by 4% month on month and increased by 28.6% year-on-year, marking the 10th month of positive growth in 2023. In 2023, diesel engines experienced a year-on-year decline in January, but sales began to grow from February, reaching a peak in March with monthly sales of nearly 500000 units. In April, the expected "recovery" did not come, and the market entered a cooling off period. It was not until July that all segmented markets of trucks and buses experienced a decline, and the monthly sales of diesel engines were lower than the same period in 2022, with a monthly sales volume of 281000 units. This was also the last time in 2023 that the monthly sales volume declined compared to the same period last year. From July to December, the monthly sales of diesel engines remained stable at around 340000, with continuous growth for five months.

It can be seen that the diesel engine market trend for the whole year of 2023 shows a trend of high, medium, and low, and then stable. In the first quarter, the diesel engine market continued the "residual heat" of last year, and major commercial vehicle manufacturers still have confidence in the market, with continuous good news and maintaining the final carnival. Calm down began in April, and from July to December, it exceeded 340000 units. This sales trend is consistent with the trend of the commercial vehicle market.

According to the analysis of Fangde.com, the sales growth of diesel engines in 2023 is due to two reasons: firstly, the base year of 2022 is relatively low, and the entire year of 2023 is experiencing "recovery" growth. From the overall sales perspective, 2023 has not yet recovered to the sales level of 2018-2019 before the epidemic. Secondly, the explosion of exports in 2023 has achieved the best level of exports for both commercial vehicles and components. Among them, Weichai, the leader in diesel engines, has achieved the best historical results in exports.

From the perspective of the commercial vehicle market, in 2023, the three major truck segments of heavy, medium, and light commercial vehicles saw a year-on-year growth of 36% for heavy trucks and 17% for light trucks. The overall commercial vehicle market grew by 20%, and the year-on-year growth of the diesel engine market was on par with that of commercial vehicles, lower than that of the heavy-duty truck market.

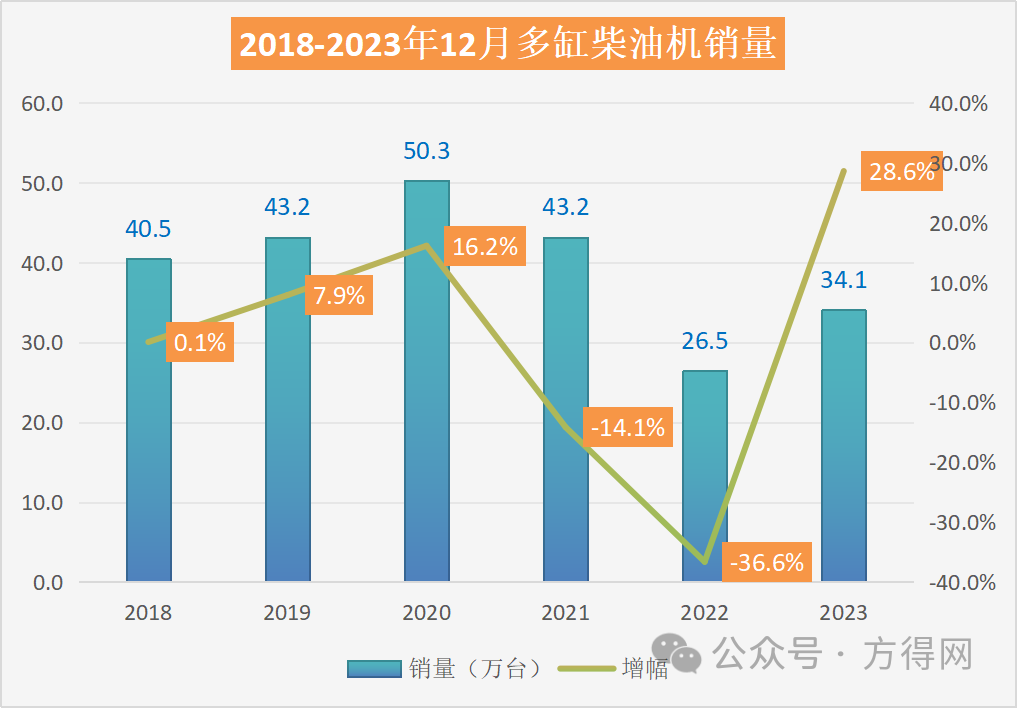

Looking at the sales and growth trend chart of diesel engines in December over the past five years, it can be seen that the average monthly sales volume in December was around 400000 units. The highest year was in 2020, with sales of 503000 units. In December 2023, it was 341000 units, which is relatively low compared to previous years.

From various segmented markets, related markets such as construction machinery and agricultural machinery have achieved significant growth. In December, the sales volume of multi cylinder diesel engines for construction machinery was 68900 units, a month on month increase of -8.25% and a year-on-year increase of 15.51%; The annual sales volume was 866700 units, a year-on-year increase of 4.04%. The top ten sellers are Xinchai, Quanchai, Yunnei, Weichai, Yuchai, Caterpillar, Dongkang, Jiefang Power, Guangkang, and Huafeng, accounting for 96.40% of their total sales.

From the perspective of cumulative sales, from 2018 to 2023, the average annual sales of diesel engines before the epidemic were around 4.4 million units. In 2023, the annual sales were 4.13 million units, a difference of over 1.1 million units compared to 5.329 million units in 2021, and a difference of nearly 200000 units compared to 2018-2019 before the epidemic.

The growth in 2023 is expected, and many diesel engine companies have made predictions about the market situation in 2024 at their annual meetings.

For the truck market in 2024, various companies in the commercial vehicle industry have made predictions, and the heavy truck market is expected to be between 700000 and 1.05 million units, with a year-on-year growth of less than 10%. The export market will continue to rise in 2024, and the light truck industry will usher in new opportunities.

In 2024, the diesel engine market will enter the era of stock, undergo cyclical adjustments, continuously upgrade policies and regulations, rapidly iterate new technologies, and develop new energy markets. Under multiple factors, opportunities and challenges coexist.

02Weichai leads with 720000 unitsQuanchai/Yunnei compete for the top three

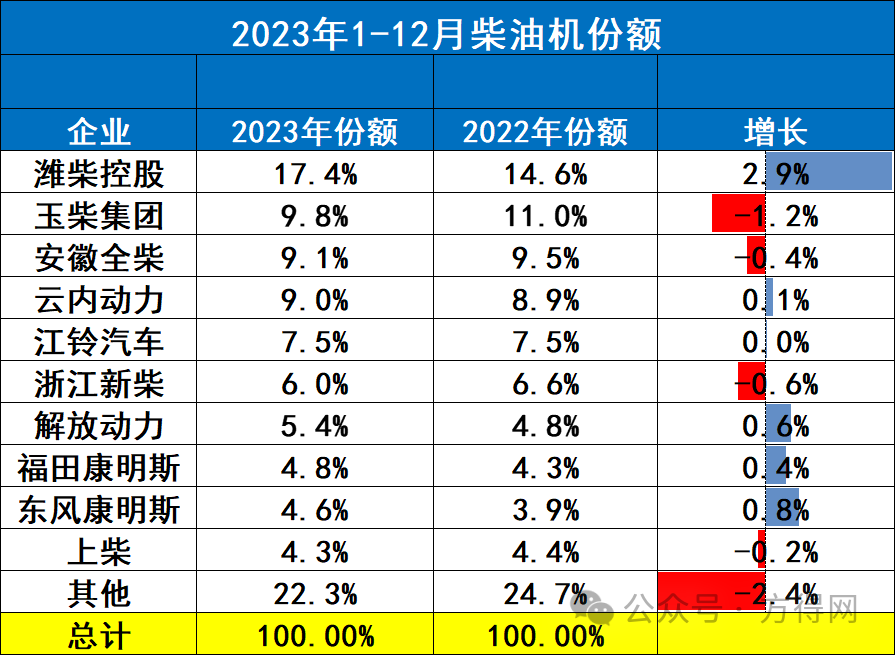

In 2023, there will be little change in the competitive landscape of the top five diesel engine markets.

From the perspective of the competitive landscape in the diesel engine market, the top five diesel engine companies in 2022 are Weichai, Yuchai, Quanchai, Yunnei, and Jiangling. In 2023, the top five diesel engine companies are also targeted at Weichai, Yuchai, Quanchai, Yunnei, and Jiangling.

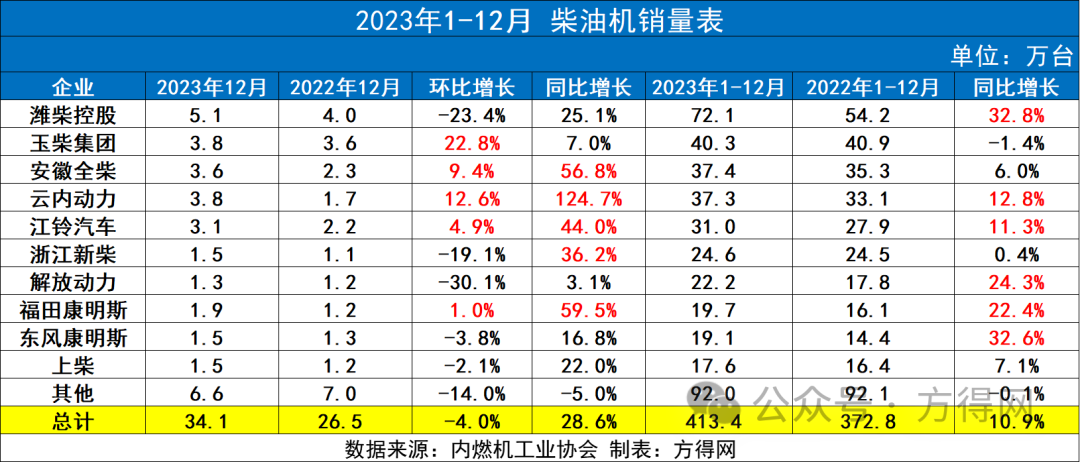

In terms of sales, in December 2023, all of the top ten companies in the diesel engine market saw year-on-year growth. Among them, Quanchai, Yunnei, Jiangling, Xinchai, and Foton Cummins had higher growth rates than the industry, outperforming the overall market. Due to the highest growth rate of heavy trucks and the largest volume of light trucks in the commercial vehicle market, diesel engine companies that mainly assemble these models have seen significant growth.

Compared to last month, five out of ten companies achieved positive growth month on month, namely Yuchai, Quanchai, Yunnei, Jiangling, and Foton Cummins. Among them, Yuchai saw a month on month growth of 22.8%, making it the company with the highest monthly industry growth rate, while Yunnei also achieved a month on month growth of 12.6%.

In 2023, the sales of various companies in the diesel engine market have shown significant differences compared to last year. Only Weichai has over 700000 units in the industry; The only enterprise that has surpassed 400000 units is Yuchai; More than 300000 units are from Quanchai, Yunnei, and Jiangling, one more than last year; Enterprises with around 200000 units include Xinchai and Jiefang, which are two fewer than last year; The last three companies, Foton Cummins, Dongfeng Cummins, and Shangchai, all have nearly 200000 units.

From the perspective of enterprise share, in 2023, Weichai will dominate the industry with a share of 17.4%, making it the company with the highest share growth in the industry. Among them, Quanchai and Yunnei share equally, and the competition is fierce. Jiefang, Fukuda Cummins, and Dongfeng Cummins saw year-on-year growth.

Quanchai Q25

In 2023, the proportion of the top ten companies in the industry (77.74%) increased compared to last year. Similarly, the share of the top five diesel engine companies (52.77%) also increased compared to last year (51.34%), which means that the strong in the top five companies will always be strong, and the top ten companies will have stronger control over the industry.

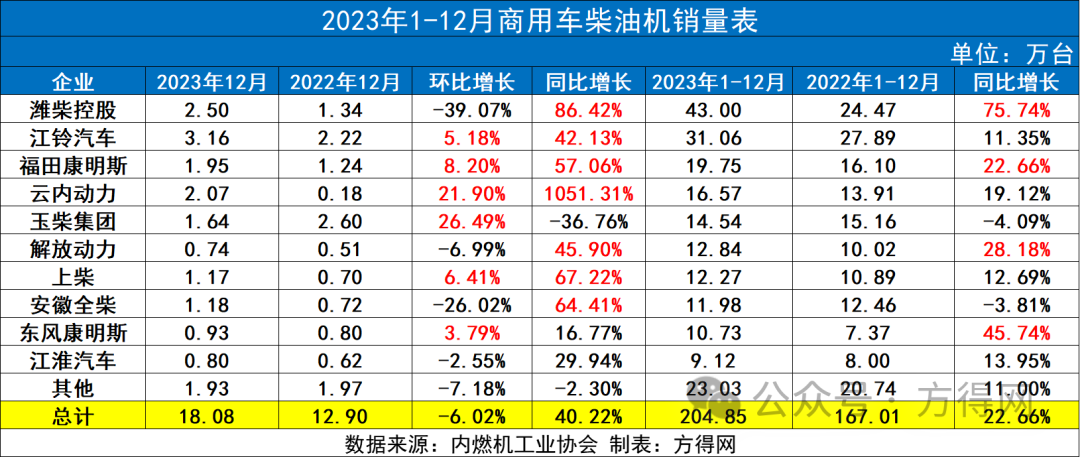

03Commercial vehicle diesel engines grow by 22.66%, freeing up the ranking and increasing by 2 places

In 2023, the growth rate of the commercial vehicle diesel engine market will be even greater, with sales increasing by 22.66%.

With the continuous recovery of the commercial vehicle market, the growth of multi cylinder diesel engines in commercial vehicles has become more significant. In December 2023, almost all of the top ten companies in the commercial vehicle diesel engine market achieved positive growth. Among them, Yunnei Power increased by 1051% year-on-year, which is the highest growth rate in the industry. Other companies have also achieved growth rates exceeding the industry.

From a month on month perspective, six companies including Jiangling Motors, Fukang, Yunnei, Yuchai, Shangchai, and Dongfeng Cummins achieved positive growth, with Yuchai experiencing a month on month increase of 26.49%, the highest in the industry.

In 2023, the ranking of the commercial vehicle diesel engine market will not change significantly. In 2022, the top five commercial vehicle diesel engine companies are Weichai, Jiangling, Fukang, Yuchai, and Yunnei. And in 2023, the top five will also target these five companies.

By 2023, Weichai's commercial vehicle diesel engine market will exceed 400000 units; More than 200000 units are from Jiangling Motors; Fukuda Kangming and Yunnei Power have sold over 150000 units; There are five companies with more than 100000 yuan, including Yuchai, Jiefang Power, Shangchai, Quanchai, and Dongfeng Cummins. Among them, Jiefang Power's ranking has risen by 2 places in 2023.

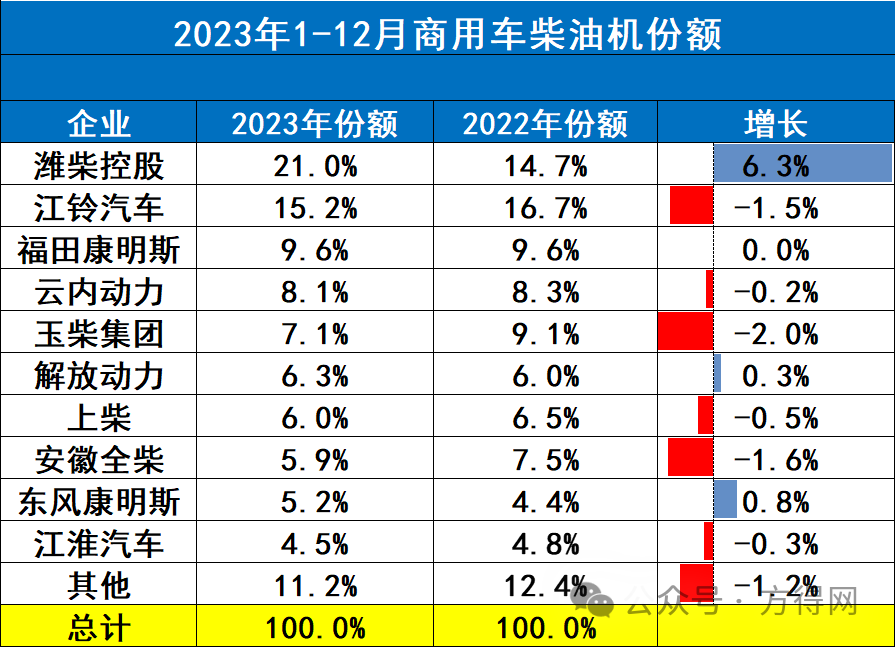

In terms of market share, the top ten sellers are Weichai, Jiangling, Fukang, Yunnei, Yuchai, Jiefang Power, Shangchai, Quanchai, Dongkang, and Jianghuai, accounting for 88.76% of the total sales; Weichai holds a leading market share of 20.99%, Jiangling 15.16%, Fukang 9.64%, Yunnei 8.09%, Yuchai 7.10%, Jiefang Power 6.27%, Shangchai 5.99%, Quanchai 5.85%, Dongkang 5.24%, and Jianghuai 4.45% in the commercial vehicle multi cylinder diesel engine market. Among them, three companies achieved an increase in market share, with Weichai experiencing the highest growth rate of 6.3%.

In 2023, the top five commercial vehicle diesel engine companies accounted for 61% of the market share, and in 2022, the top five companies accounted for 58%, a year-on-year increase of 3%. The top ten companies also had a higher market share than in 2022, indicating an increase in their control over the industry. It is worth mentioning that Dongfeng Cummins returned to the top ten in the industry in 2023 and remained in ninth place, thanks to its continuous expansion of market territory, layout of new tracks, continuous polishing of product technology, and improvement of user reputation, ultimately achieving both sales and reputation enhancement.

Many diesel engine companies have predicted that the commercial vehicle market will grow by around 5-10% in 2024. Among them, in 2024, the acceleration of the phase out process of National IV diesel vehicles is an opportunity for the growth of the diesel engine market.

In the face of the energy revolution, in 2024, the diesel engine market is a competition of technology and marketing, as well as a competition of foresight and supply chain.

Who can break through? Who can laugh until the end? Worth looking forward to.

Article source: Reprinted from Fangde.com